Mizuho Financial Group (TSE:8411): Evaluating Valuation Following Strong Earnings, Dividend Hike, and Share Buyback News

Reviewed by Simply Wall St

Mizuho Financial Group (TSE:8411) made headlines with a series of announcements reflecting management’s confidence. The group reported strong half-year earnings, raised profit forecasts, increased its interim dividend, and introduced a sizable share buyback program.

See our latest analysis for Mizuho Financial Group.

Mizuho’s recent surge in announcements seems to have struck a chord with investors, as positive momentum builds. The stock’s share price has climbed 32.9% year-to-date, with a total return of 38.9% over the past year and a remarkable 362.9% five-year total shareholder return. With management doubling down on shareholder rewards and signaling ongoing optimism, it is no surprise that sentiment and performance are both on the rise.

If you’re curious what other stocks are catching investors’ attention, this could be the perfect time to broaden your outlook and discover fast growing stocks with high insider ownership

Yet with such strong gains and a slew of positive news driving recent momentum, investors may be wondering whether Mizuho Financial Group is still trading at a discount or if the market has already priced in future growth potential.

Most Popular Narrative: 1% Undervalued

With Mizuho Financial Group’s fair value estimate at ¥5,231.82 and the last close at ¥5,163, analysts see only a slight discount, setting up an intriguing case for long-term value and stability.

The diversification of revenue sources beyond traditional banking operations to include sales and trading, alongside developments in the overseas market, is intended to stabilize and grow revenues, reducing dependency on interest income and improving earnings predictability.

What did analysts factor in to arrive at this razor-thin undervaluation? The most closely watched assumptions touch on bold margin improvements and future earnings forecasts, as well as some controversial revenue projections. There is more to this delicate valuation balance than meets the eye. Find out exactly why the consensus is barely tipping toward undervalued.

Result: Fair Value of ¥5,231.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, operational costs and integration hurdles could challenge margin growth. As a result, actual performance may fall short of analyst expectations.

Find out about the key risks to this Mizuho Financial Group narrative.

Another View: What Do Earnings Ratios Say?

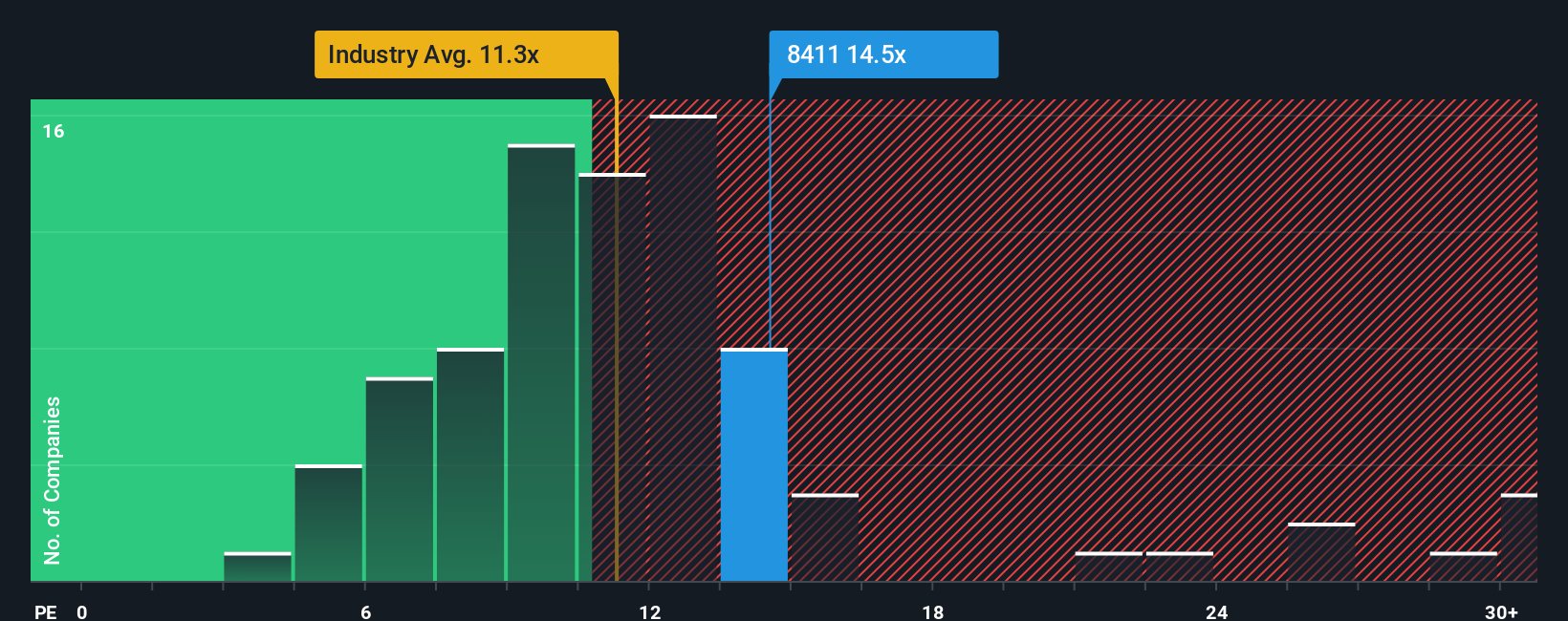

Looking at earnings ratios instead, Mizuho trades at 12.7x, which is higher than the Japanese banks industry average of 10.6x but lower than the peer average at 17.7x. Interestingly, this is still below the fair ratio of 15.6x, which suggests some value remains but also signals higher valuation risk if market expectations change. Could this premium be sustained, or are investors overpaying for stability?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mizuho Financial Group Narrative

If you reach a different conclusion after reviewing the numbers, or simply enjoy charting your own path, you can easily build your own perspective on Mizuho Financial Group in just a few minutes. Do it your way

A great starting point for your Mizuho Financial Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Keep your edge in today's fast-moving markets by checking out investment opportunities that suit your strategy. Don’t let smarter moves pass you by.

- Capture powerful income potential and steady cash flow through these 17 dividend stocks with yields > 3% which delivers compelling yields above 3%.

- Uncover cutting-edge technology innovators with these 25 AI penny stocks that lead advancements in artificial intelligence and reshape industry landscapes.

- Tap into tomorrow’s tech with these 26 quantum computing stocks positioned at the forefront of quantum computing breakthroughs and next-level performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8411

Mizuho Financial Group

Engages in banking, trust banking, securities, and other businesses related to financial services in Japan, the Americas, Europe, Asia/Oceania, and internationally.

Good value with proven track record and pays a dividend.

Market Insights

Community Narratives