- Japan

- /

- Healthcare Services

- /

- TSE:4671

3 Top Japanese Dividend Stocks Yielding Up To 6.1%

Reviewed by Simply Wall St

Japan's stock markets have experienced notable fluctuations recently, influenced by political changes and a shift in monetary policy expectations. Despite these challenges, dividend stocks remain an attractive option for investors seeking stable income amid market volatility. A good dividend stock typically offers a reliable yield and demonstrates resilience in uncertain economic conditions, making them particularly appealing during times of market instability.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.12% | ★★★★★★ |

| Globeride (TSE:7990) | 4.16% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.95% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.09% | ★★★★★★ |

| Innotech (TSE:9880) | 4.79% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.19% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.12% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

Click here to see the full list of 442 stocks from our Top Japanese Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Takachiho KohekiLtd (TSE:2676)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Takachiho Koheki Co., Ltd. is an electronics technology trading company in Japan with a market cap of ¥38.54 billion.

Operations: Takachiho Koheki Co., Ltd. generates its revenue through various segments within the electronics technology trading sector in Japan.

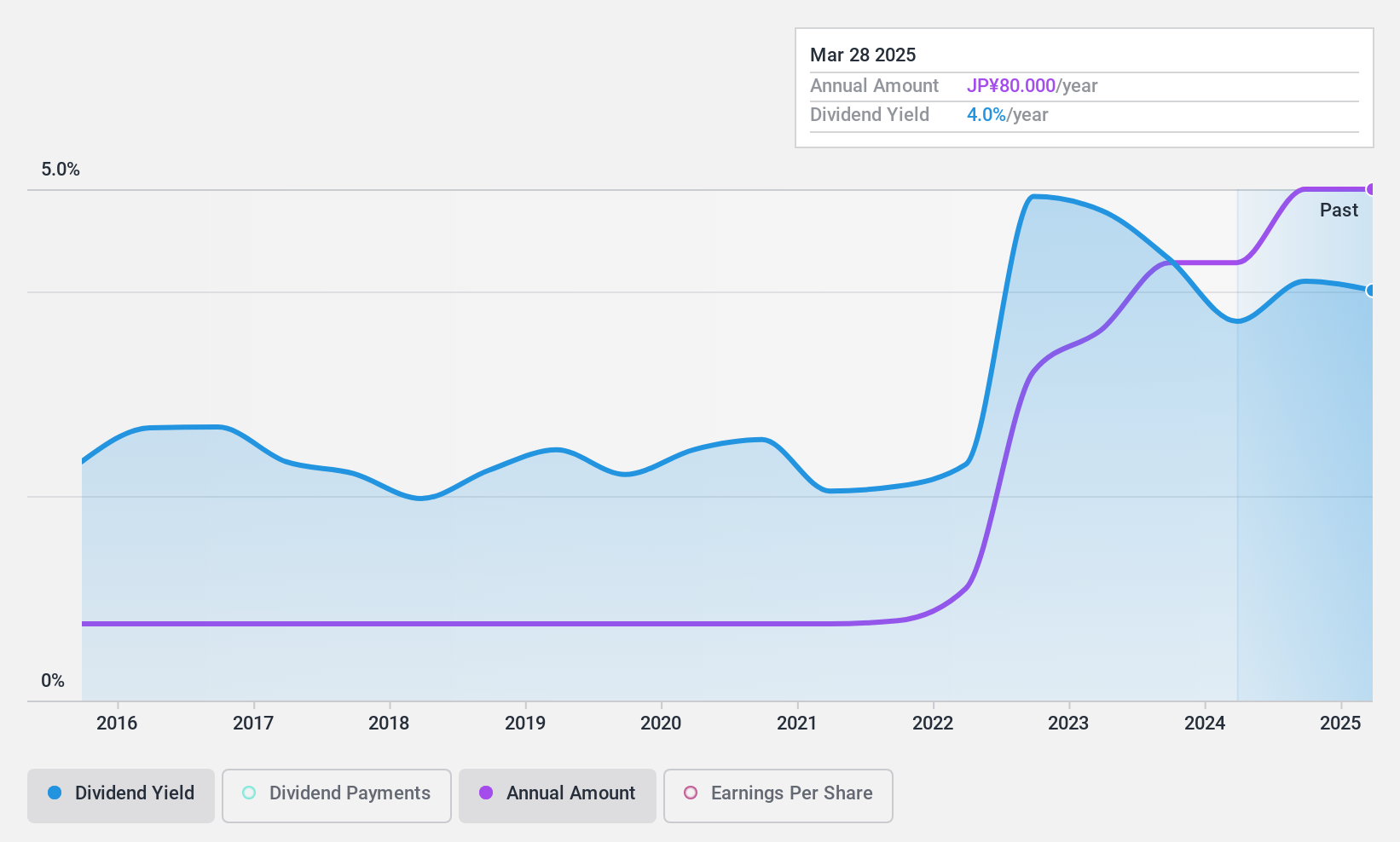

Dividend Yield: 3.8%

Takachiho Koheki Ltd.'s dividend yield of 3.77% ranks in the top 25% among Japanese dividend payers, but it is not well-supported by earnings or free cash flows, with a high payout ratio of 95.5%. Despite this, dividends have been stable and growing over the past decade. Recent board discussions about treasury stock disposal to fund scholarships may impact future financial flexibility for dividends. Earnings growth of 17.3% last year provides some positive outlook amidst these challenges.

- Click here and access our complete dividend analysis report to understand the dynamics of Takachiho KohekiLtd.

- The analysis detailed in our Takachiho KohekiLtd valuation report hints at an inflated share price compared to its estimated value.

FALCO HOLDINGS (TSE:4671)

Simply Wall St Dividend Rating: ★★★★★★

Overview: FALCO HOLDINGS Co., Ltd. is a medical service company in Japan that offers clinical testing and dispensing pharmacy services to medical institutions and companies, with a market cap of approximately ¥27.03 billion.

Operations: FALCO HOLDINGS Co., Ltd. generates revenue through its Clinical Tests segment, contributing ¥26.01 billion, and its Dispensing Pharmacy Business, which adds ¥15.92 billion, along with a smaller contribution from the ICT Business at ¥1.16 billion.

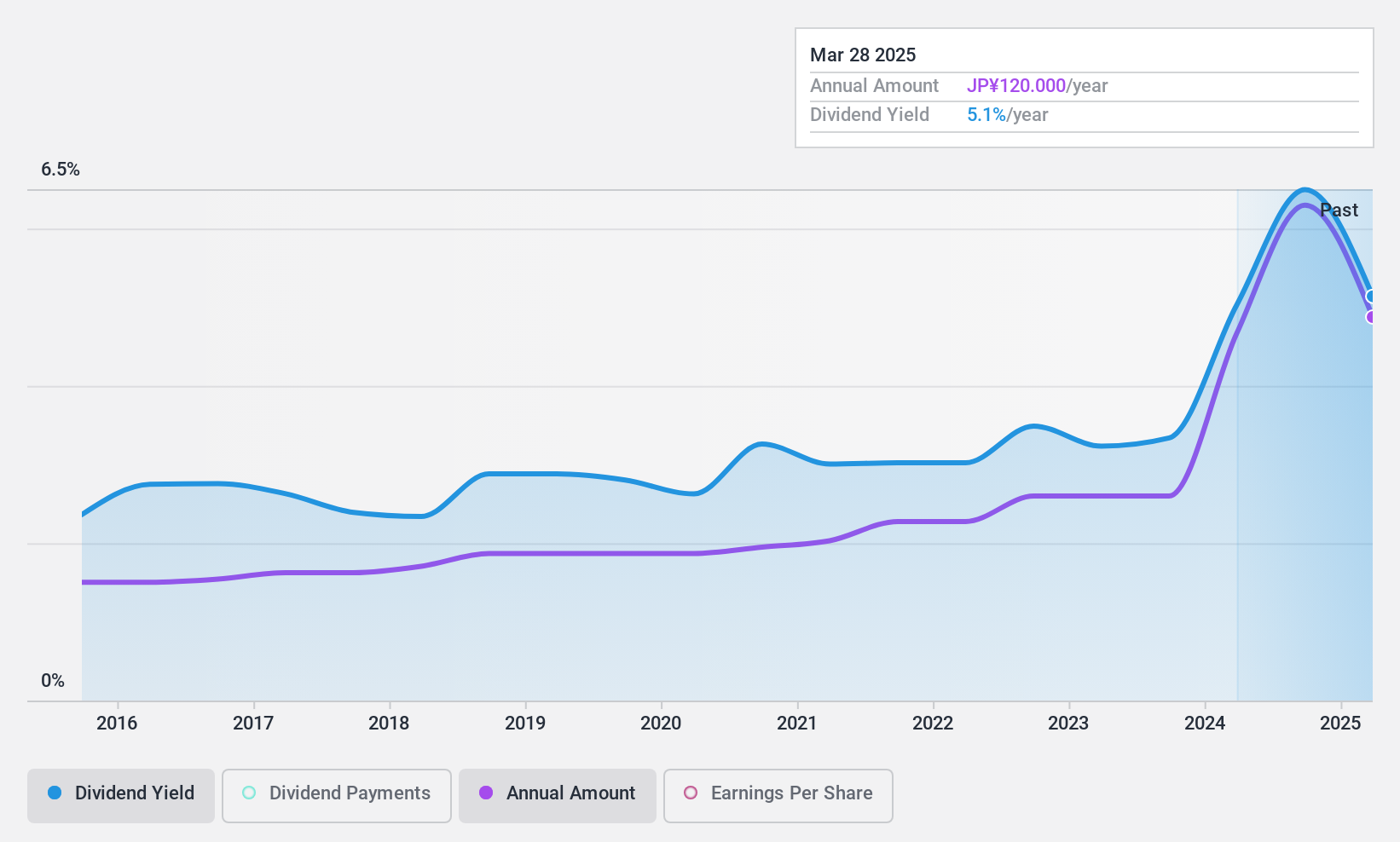

Dividend Yield: 6.1%

FALCO HOLDINGS offers an attractive dividend yield of 6.12%, placing it in the top 25% of Japanese dividend payers. The dividends are well-supported by a payout ratio of 48.1% and covered by free cash flows at a cash payout ratio of 75.5%. Over the past decade, dividends have been stable and growing, indicating reliability. Additionally, the stock trades at 50% below its estimated fair value, suggesting potential undervaluation for investors seeking income stability.

- Get an in-depth perspective on FALCO HOLDINGS' performance by reading our dividend report here.

- The analysis detailed in our FALCO HOLDINGS valuation report hints at an deflated share price compared to its estimated value.

Seven Bank (TSE:8410)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Seven Bank, Ltd. offers a range of banking products and services to both individual and corporate clients in Japan and abroad, with a market capitalization of ¥352.26 billion.

Operations: Seven Bank, Ltd.'s revenue segments include various banking products and services catering to both individual and corporate customers within Japan and internationally.

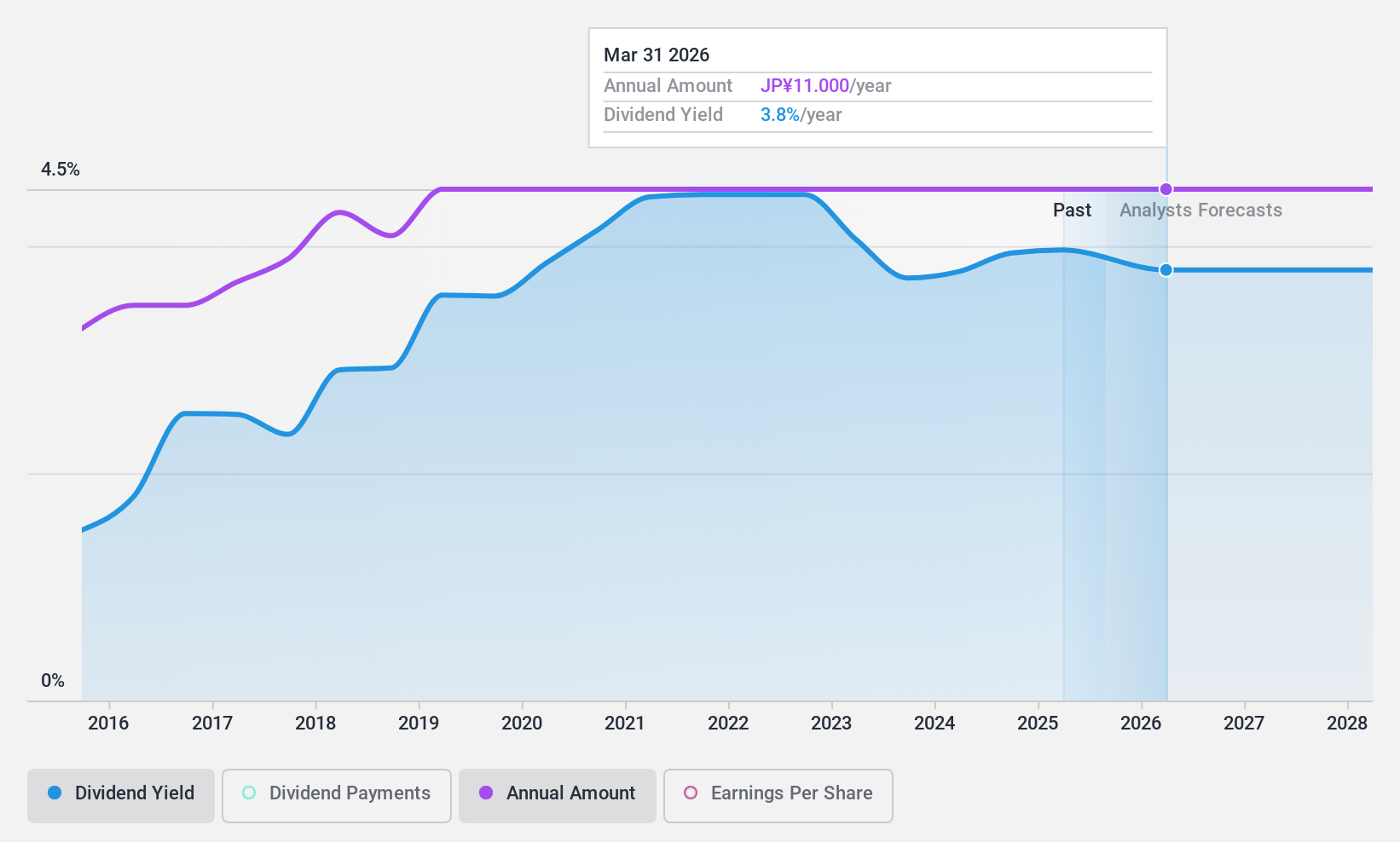

Dividend Yield: 3.7%

Seven Bank provides a stable dividend, with recent payments of ¥5.50 per share for the fiscal year 2024 and expected to continue at this level. Despite earnings growth of 63.3% last year, future earnings are forecasted to decline by an average of 5.5% annually over the next three years, raising concerns about long-term sustainability. The dividend yield stands at 3.65%, slightly below Japan's top quartile payers but is supported by a low payout ratio of 41.2%.

- Click to explore a detailed breakdown of our findings in Seven Bank's dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Seven Bank shares in the market.

Key Takeaways

- Click this link to deep-dive into the 442 companies within our Top Japanese Dividend Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4671

FALCO HOLDINGS

A medical service company, provides clinical testing and dispensing pharmacy services to medical institutions and companies in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives