- Japan

- /

- Medical Equipment

- /

- TSE:7575

Discovering Undiscovered Gems on None Exchange January 2025

Reviewed by Simply Wall St

As global markets experience a surge toward record highs, fueled by optimism surrounding potential trade deals and advancements in artificial intelligence, small-cap stocks have faced challenges in keeping pace with their larger counterparts. Despite this disparity, the current economic landscape—characterized by rebounding manufacturing activity and evolving political developments—presents unique opportunities for discerning investors to identify promising small-cap companies that may be overlooked. In this environment, a good stock is often one that demonstrates resilience through innovation or niche market positioning amidst broader market shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| ONEJOON | 9.85% | 24.95% | 4.85% | ★★★★★☆ |

| Giant Heavy Machinery Service | 17.81% | 21.88% | 48.77% | ★★★★★☆ |

| PAN Group | 143.29% | 15.75% | 23.10% | ★★★★☆☆ |

| Petrolimex Insurance | 32.25% | 4.46% | 7.91% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Saudi Azm for Communication and Information Technology (SASE:9534)

Simply Wall St Value Rating: ★★★★★☆

Overview: Saudi Azm for Communication and Information Technology Company, with a market cap of SAR1.74 billion, offers business and digital technology solutions in the Kingdom of Saudi Arabia through its various subsidiaries.

Operations: The company's revenue streams include Advisory (SAR24.61 million), Enterprise Services (SAR116.12 million), Proprietary Technologies (SAR58.94 million), and Platforms for Third Parties (SAR17.97 million).

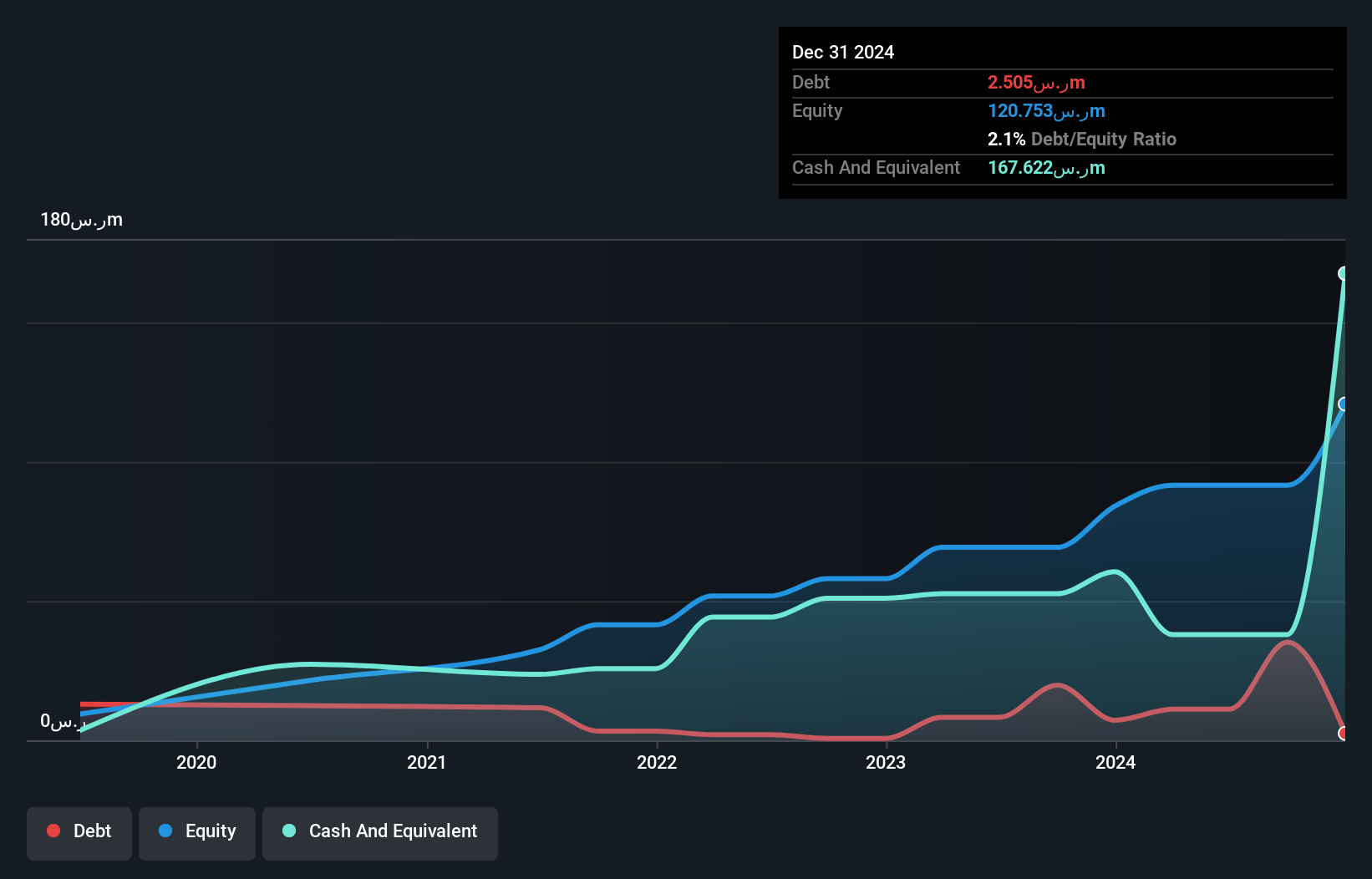

Saudi Azm for Communication and Information Technology stands out with its impressive earnings growth of 21.1% over the past year, surpassing the IT industry's 18.9%. The company has successfully reduced its debt to equity ratio from 137.7% to a mere 12.2% in five years, indicating strong financial management. Despite recent share price volatility, Saudi Azm's interest payments are well-covered by EBIT at a robust 24.1x coverage level, showcasing financial stability. However, it's important to note that free cash flow isn't positive currently, which might impact short-term liquidity strategies despite having more cash than total debt on hand.

Japan Lifeline (TSE:7575)

Simply Wall St Value Rating: ★★★★★★

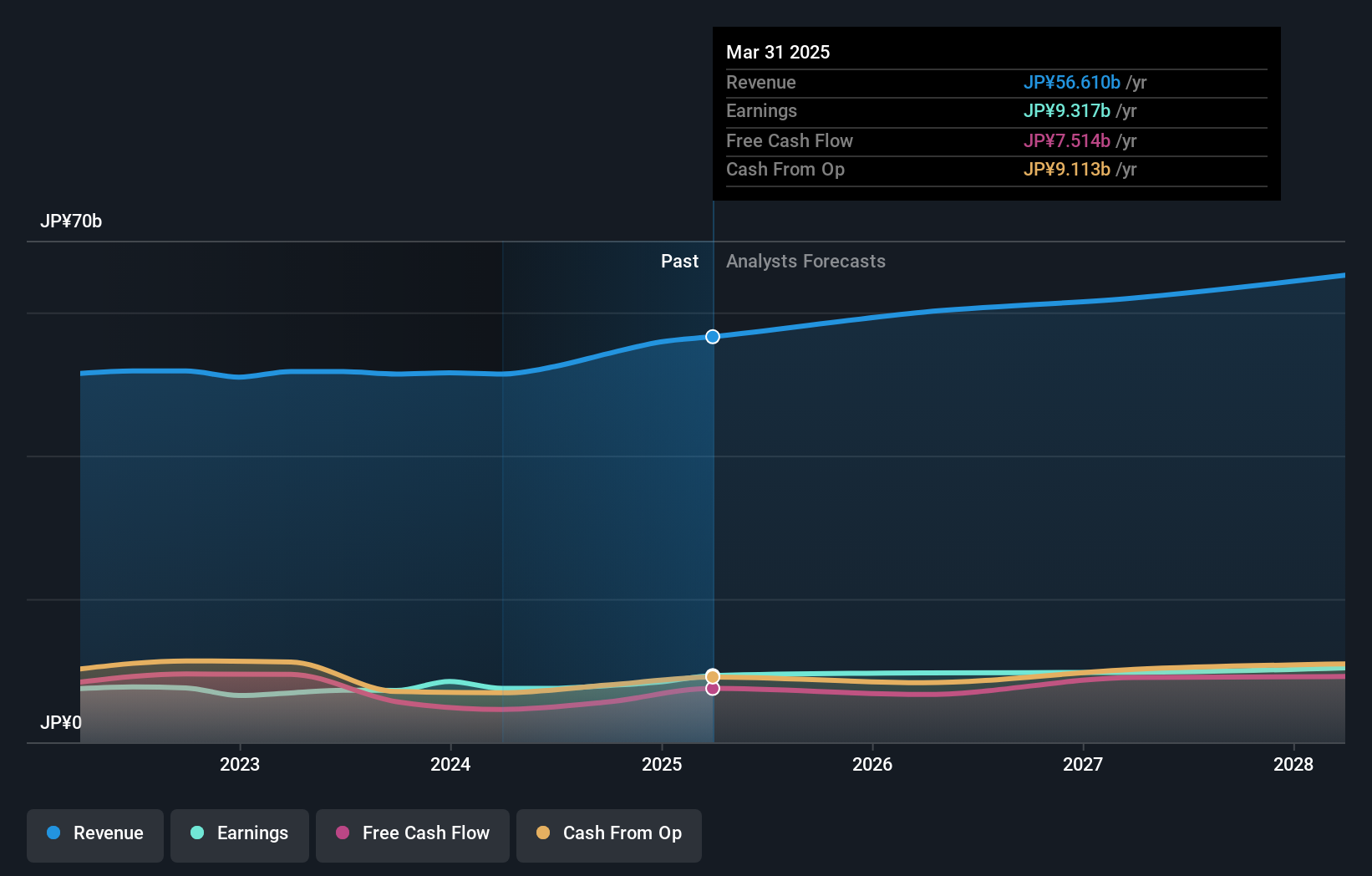

Overview: Japan Lifeline Co., Ltd. is a medical device company that develops, produces, imports, distributes, and trades cardiovascular-related medical devices in Japan with a market cap of ¥99.75 billion.

Operations: The primary revenue stream for Japan Lifeline comes from the manufacture and sale of medical devices, amounting to ¥54.24 billion. The company's financial performance is highlighted by its gross profit margin, which reflects its efficiency in managing production costs relative to sales revenue.

Japan Lifeline, a promising player in the medical equipment sector, has demonstrated robust earnings growth of 9.6% over the past year, outpacing the industry's 1.3%. The company's debt-to-equity ratio improved significantly from 21.4% to 9.7% over five years, indicating prudent financial management. Trading at an attractive valuation—41.8% below estimated fair value—it also boasts high-quality earnings and positive free cash flow. Recent developments include a dividend increase to ¥46 per share and a strategic partnership with Terumo Corporation for liver cancer treatment technology, suggesting potential for sustained growth and enhanced market presence in Japan's healthcare landscape.

- Take a closer look at Japan Lifeline's potential here in our health report.

Evaluate Japan Lifeline's historical performance by accessing our past performance report.

Awa Bank (TSE:8388)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Awa Bank, Ltd. offers a range of banking products and services to individual and corporate clients in Japan with a market capitalization of ¥110.78 billion.

Operations: Awa Bank generates revenue primarily from its Banking segment, which contributes ¥49.59 billion, and its Leasing segment, which adds ¥16.39 billion.

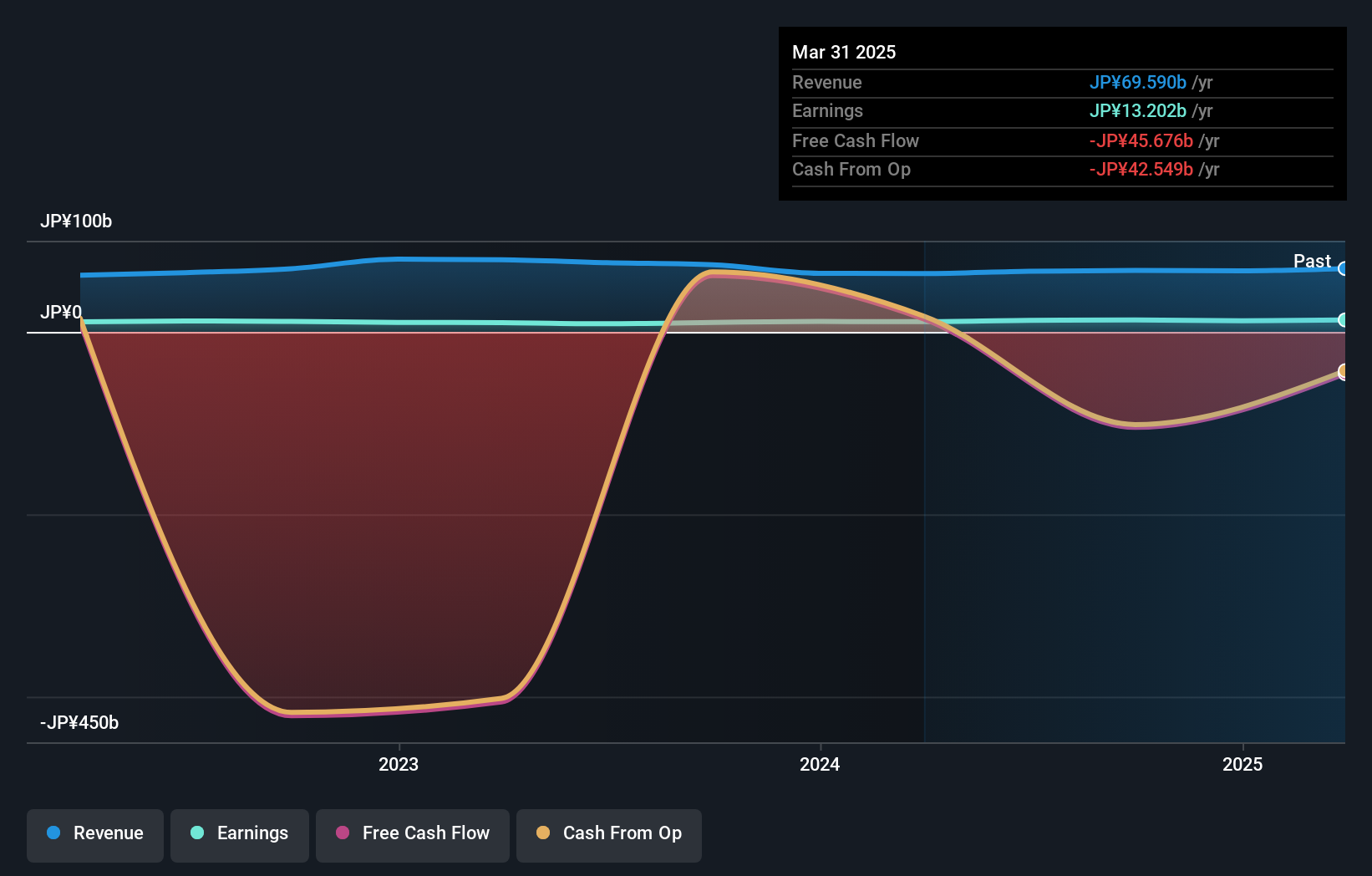

Awa Bank, with assets totaling ¥3,893.4 billion and equity of ¥345.1 billion, is a notable player in the financial sector. It boasts a solid deposit base of ¥3,320.9 billion against loans amounting to ¥2,341.5 billion but faces challenges with bad loans at 2.1% and an allowance for these at just 39%. Despite high-quality past earnings and impressive earnings growth of 26% over the past year—outpacing the industry average—the bank's low-risk funding structure primarily from customer deposits adds stability to its operations. Recently, Awa Bank completed a share buyback program repurchasing 176,300 shares for ¥499.81 million as part of its capital strategy.

Summing It All Up

- Embark on your investment journey to our 4664 Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7575

Japan Lifeline

A medical device company, develops, produces, imports, distributes, and trades in cardiovascular related medical devices in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives