As Japan's stock markets experienced significant declines in September 2024, driven by a U.S.-led sell-off in semiconductor stocks and a stronger yen impacting export-oriented companies, investors are increasingly on the lookout for resilient opportunities. In this environment, identifying promising stocks often involves looking for companies with strong fundamentals that can weather market volatility and capitalize on unique growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NCD | 11.89% | 8.95% | 25.43% | ★★★★★★ |

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| Intelligent Wave | NA | 6.92% | 15.18% | ★★★★★★ |

| Totech | 16.86% | 5.13% | 11.52% | ★★★★★★ |

| Poppins | 39.80% | 8.36% | -7.40% | ★★★★★★ |

| Otec | 9.81% | 2.32% | -1.39% | ★★★★★★ |

| Techno Quartz | 18.64% | 16.15% | 22.17% | ★★★★★★ |

| Icom | NA | 4.68% | 14.92% | ★★★★★★ |

| Denyo | 3.49% | 4.30% | 3.66% | ★★★★★☆ |

| Yukiguni Maitake | 170.63% | -6.51% | -39.66% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Nittetsu Mining (TSE:1515)

Simply Wall St Value Rating: ★★★★★★

Overview: Nittetsu Mining Co., Ltd. engages in mining activities both in Japan and internationally, with a market cap of ¥67.21 billion.

Operations: Nittetsu Mining generates revenue primarily through its mining activities. The company has a market cap of ¥67.21 billion.

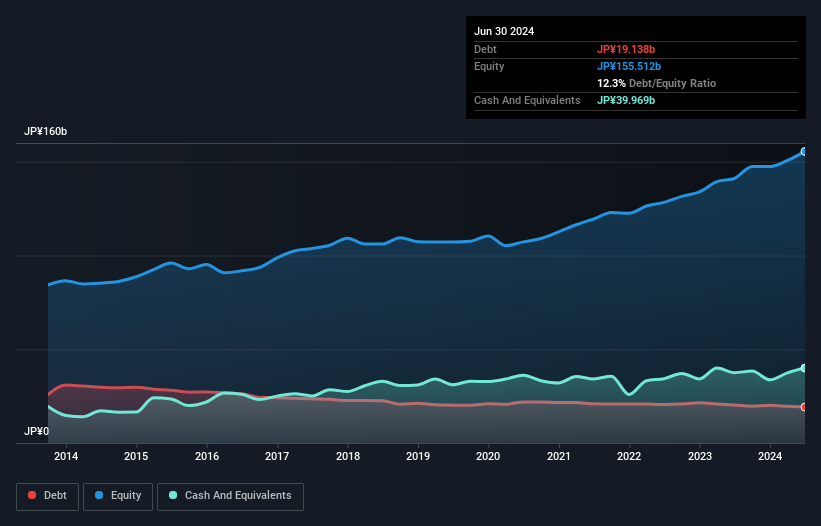

Nittetsu Mining, a notable player in Japan's mining sector, has demonstrated robust performance with a price-to-earnings ratio of 7.9x, notably lower than the JP market average of 13.3x. Over the past five years, its debt to equity ratio improved from 18.8% to 12.3%, showing prudent financial management. Additionally, Nittetsu’s earnings growth of 2.4% in the last year outpaced the industry average of -7%. The company recently partnered with Camino Minerals on a promising copper project in Chile, enhancing its strategic portfolio and operational synergies.

- Navigate through the intricacies of Nittetsu Mining with our comprehensive health report here.

Assess Nittetsu Mining's past performance with our detailed historical performance reports.

Toho Bank (TSE:8346)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Toho Bank, Ltd. operates as a provider of various banking products and services in Japan with a market cap of ¥61.13 billion.

Operations: Toho Bank generates revenue primarily from its banking segment, which contributed ¥51.59 billion, followed by leasing at ¥7.70 billion and credit guarantee services at ¥1.80 billion. The bank also incurs costs related to these operations, impacting its overall profitability.

Toho Bank, with total assets of ¥6,780.9B and equity of ¥202.5B, has deposits amounting to ¥6,304.2B and loans totaling ¥3,818.7B. The bank's net interest margin stands at 0.6%, alongside an appropriate bad loans ratio of 1.3%. Despite earnings growth averaging 22.8% annually over the past five years, Toho's recent performance did not outpace the industry’s 19% growth rate last year.

- Delve into the full analysis health report here for a deeper understanding of Toho Bank.

Gain insights into Toho Bank's past trends and performance with our Past report.

Ogaki Kyoritsu Bank (TSE:8361)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ogaki Kyoritsu Bank, Ltd. is a regional financial institution offering a range of banking products and services in Japan and internationally with a market cap of ¥75.38 billion.

Operations: Ogaki Kyoritsu Bank generates revenue primarily through its banking products and services. The company has a market cap of ¥75.38 billion.

Ogaki Kyoritsu Bank, with total assets of ¥6,787.3B and equity of ¥329.5B, has seen its earnings grow by 125.2% over the past year despite a 0.3% annual decline over five years. The bank's deposits stand at ¥5,881.1B while loans total ¥4,451.4B with a net interest margin of 0.7%. With an allowance for bad loans at 1.4%, it is trading at 49% below estimated fair value and primarily relies on low-risk funding sources for stability.

Key Takeaways

- Discover the full array of 754 Japanese Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8361

Ogaki Kyoritsu Bank

A regional financial institution, provides various banking products and services in Japan and internationally.

Proven track record with adequate balance sheet and pays a dividend.