As global markets navigate a busy earnings season and mixed economic signals, major indices like the Nasdaq Composite and S&P MidCap 400 have experienced volatility, with growth stocks lagging behind value shares. Meanwhile, economic uncertainties continue to influence investor sentiment across regions, highlighting the importance of stable investments such as dividend stocks. In this context, a good dividend stock is characterized by its ability to provide consistent income streams and potential for capital appreciation amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.85% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.16% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.87% | ★★★★★★ |

| Innotech (TSE:9880) | 4.76% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.97% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.00% | ★★★★★★ |

Click here to see the full list of 2002 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

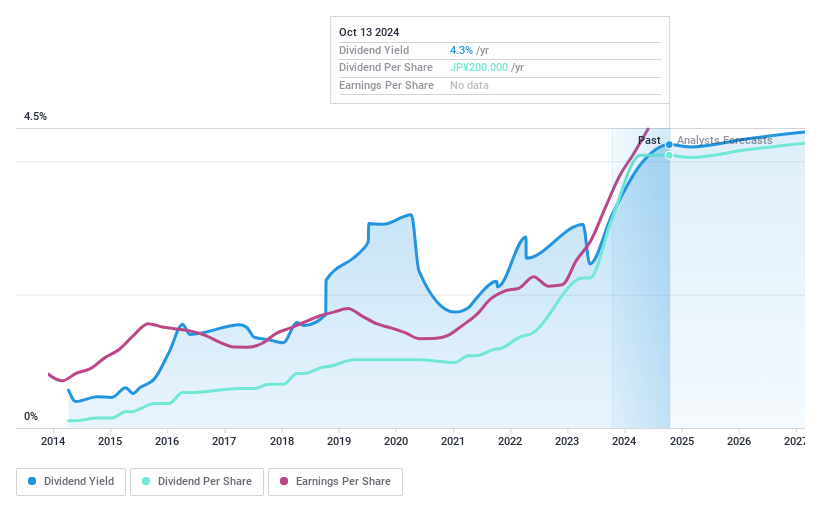

Takeuchi Mfg (TSE:6432)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Takeuchi Mfg. Co., Ltd. is a company that manufactures and sells construction machinery both in Japan and internationally, with a market cap of ¥228.09 billion.

Operations: Takeuchi Mfg. Co., Ltd.'s revenue segments primarily focus on the manufacturing and sales of construction machinery across domestic and international markets.

Dividend Yield: 3.9%

Takeuchi Mfg.'s dividend payments have been reliable and stable over the past decade, with a growing trend. However, the dividend is not well covered by cash flows, indicated by a high cash payout ratio of 363.2%, despite being well covered by earnings due to a low payout ratio of 24%. The stock trades at good value, significantly below its estimated fair value. A recent share repurchase program aims to enhance shareholder returns.

- Click here to discover the nuances of Takeuchi Mfg with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Takeuchi Mfg's current price could be quite moderate.

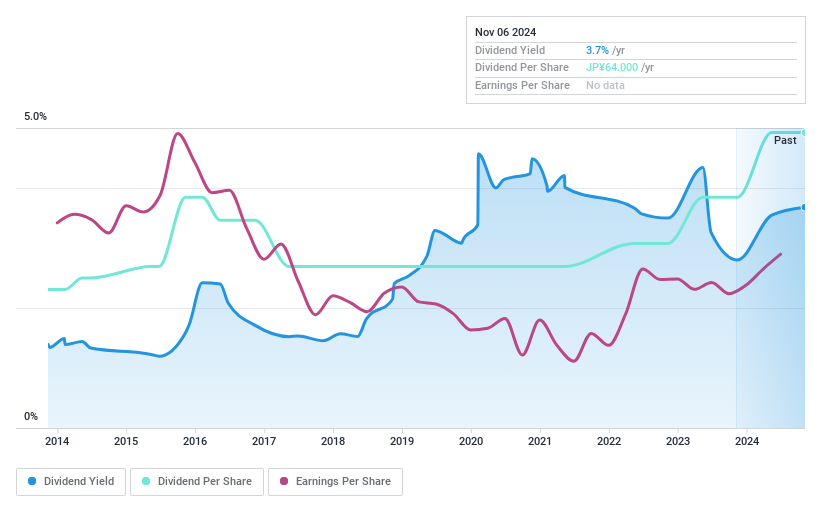

Yamanashi Chuo BankLtd (TSE:8360)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Yamanashi Chuo Bank, Ltd., along with its subsidiaries, offers a range of banking services to both individual and corporate clients in Japan, with a market cap of ¥50.65 billion.

Operations: The Yamanashi Chuo Bank, Ltd. generates revenue of ¥54.94 billion from its banking services segment.

Dividend Yield: 3.7%

Yamanashi Chuo Bank Ltd.'s dividend payments have grown over the past decade, although they have been volatile and unreliable. The current payout ratio of 27.6% suggests dividends are well covered by earnings, but future sustainability remains uncertain. With a dividend yield in the top quartile of JP market payers, it trades at 40.6% below estimated fair value, presenting a potential value opportunity despite concerns about its allowance for bad loans and unstable dividend history.

- Click here and access our complete dividend analysis report to understand the dynamics of Yamanashi Chuo BankLtd.

- The analysis detailed in our Yamanashi Chuo BankLtd valuation report hints at an deflated share price compared to its estimated value.

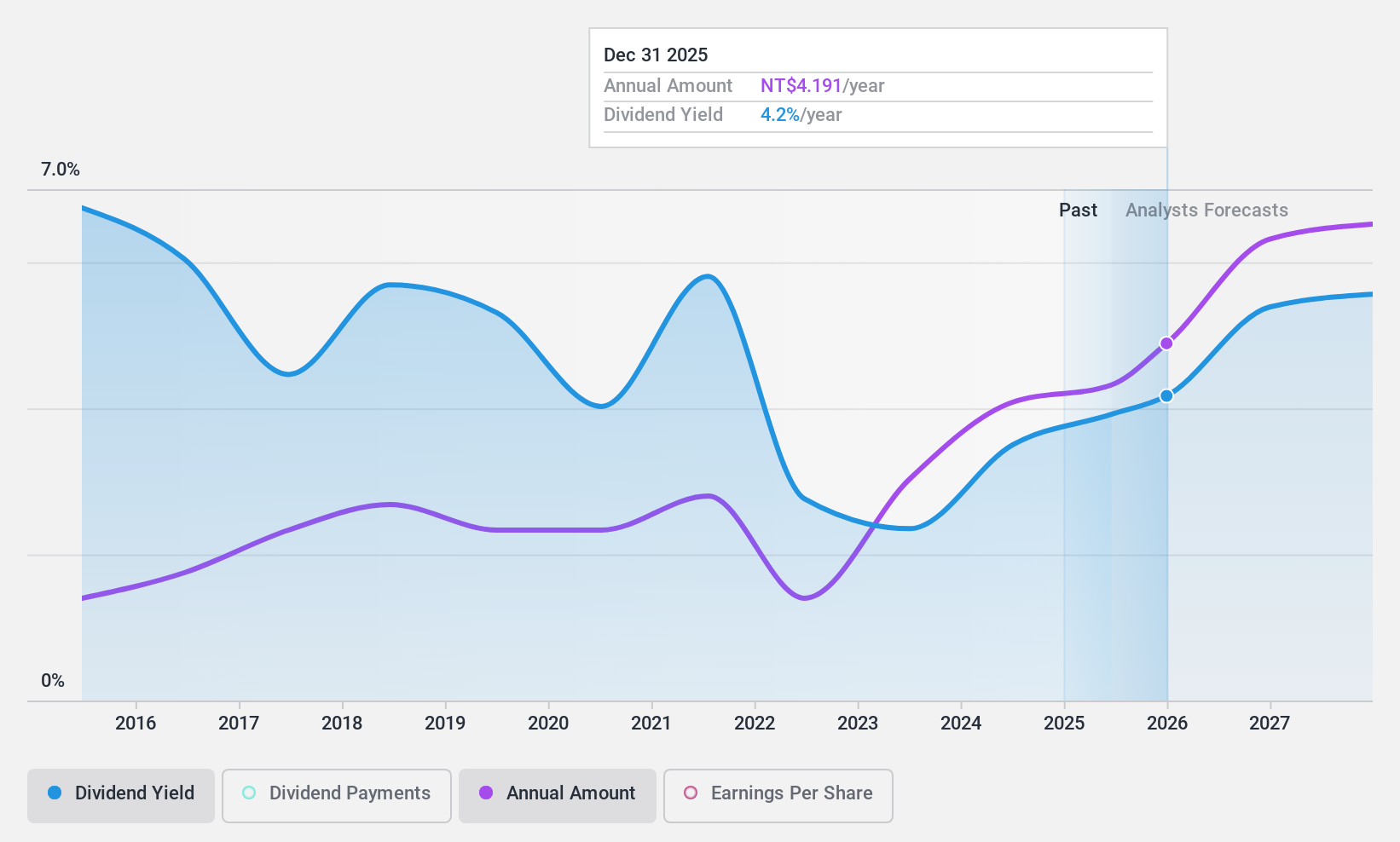

Sunonwealth Electric Machine Industry (TWSE:2421)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sunonwealth Electric Machine Industry Co., Ltd. and its subsidiaries specialize in manufacturing and selling precision motors and thermal solutions globally, with a market cap of NT$26.77 billion.

Operations: Sunonwealth Electric Machine Industry Co., Ltd.'s revenue segments are comprised of NT$21.88 billion from Greater China and NT$844.49 million from Europe and America.

Dividend Yield: 3.4%

Sunonwealth Electric's dividend payments have been volatile over the past decade, despite a payout ratio of 71% indicating coverage by earnings. The cash payout ratio of 42.7% also supports sustainability, yet the yield remains low compared to top TW market payers. Recent earnings showed a decline in net income despite increased sales, suggesting potential pressure on future dividends. Participation in innovative events like the OCP Global Summit highlights growth initiatives but doesn't directly impact dividend reliability.

- Click to explore a detailed breakdown of our findings in Sunonwealth Electric Machine Industry's dividend report.

- Our valuation report here indicates Sunonwealth Electric Machine Industry may be undervalued.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1999 Top Dividend Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takeuchi Mfg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6432

Takeuchi Mfg

Manufactures and sells construction machinery in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.