The Bull Case For Resona Holdings (TSE:8308) Could Change Following Major Buyback and Dividend Boost

Reviewed by Sasha Jovanovic

- On November 11, 2025, Resona Holdings announced a share repurchase program of up to 35 million shares for ¥35 billion, a dividend increase to ¥14.50 per share for the second quarter, and reported half-year earnings showing year-over-year growth in both net interest income and net income.

- The combination of a sizable buyback, higher dividend, and improved earnings highlights the company's commitment to capital efficiency and shareholder returns.

- We'll examine how the significant share repurchase plan strengthens Resona Holdings' investment narrative and outlook on capital management.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Resona Holdings Investment Narrative Recap

To be a shareholder in Resona Holdings, you need to believe in the company's ability to translate rising net interest income and shareholder-focused policies into sustainable growth, while managing the risks of rising costs and any disruptions linked to policy stock reductions. The latest share buyback and dividend increase underscore Resona's focus on capital returns, but this does not materially shift the main short-term catalysts, which remain tied to continued net interest income expansion and cost management, nor does it directly reduce the biggest risks such as expense growth or integration hurdles.

Of the recent announcements, the half-year earnings release is most relevant, as it highlights ongoing growth in net interest income and net income year over year. This strengthens the key catalyst of growing core earnings, reinforcing the importance of higher topline growth in offsetting risks related to cost and operational changes.

However, while capital returns are being ramped up, investors should remain aware of the margin pressures that could arise if operating expenses begin to outpace revenue growth...

Read the full narrative on Resona Holdings (it's free!)

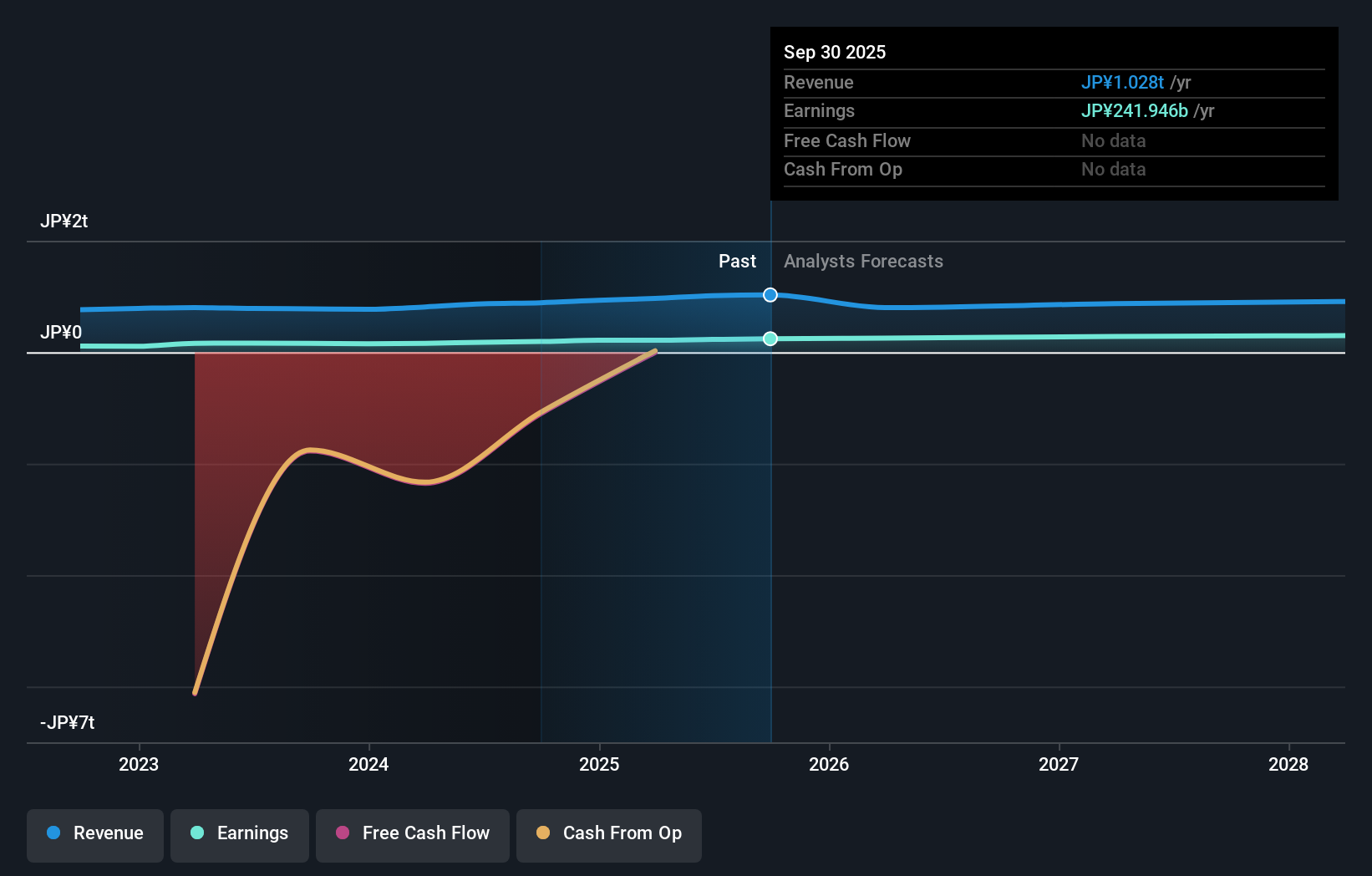

Resona Holdings' outlook anticipates ¥909.8 billion in revenue and ¥299.1 billion in earnings by 2028. This assumes revenues will decline at a rate of 3.6% per year, while earnings are expected to rise by about ¥70.6 billion from their current level of ¥228.5 billion.

Uncover how Resona Holdings' forecasts yield a ¥1458 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Community fair value estimates for Resona Holdings range from ¥1,458 to ¥2,232, based on two forecasts from the Simply Wall St Community. Some participants highlight expansion of net interest income as a catalyst, but you should explore other viewpoints to see how risks to margins might impact future performance.

Explore 2 other fair value estimates on Resona Holdings - why the stock might be worth 7% less than the current price!

Build Your Own Resona Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Resona Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Resona Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Resona Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8308

Resona Holdings

Through its subsidiaries, engages in the provision retail and commercial banking products and services in Japan and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success