Resona Holdings (TSE:8308): Evaluating Valuation After Buyback, Strong Results, and Dividend Hike

Reviewed by Simply Wall St

Resona Holdings (TSE:8308) has unveiled a new share repurchase program, coinciding with the announcement of robust half-year results. The company also raised its second-quarter dividend and outlined upbeat full-year earnings guidance.

See our latest analysis for Resona Holdings.

With upbeat half-year numbers and a fresh buyback announcement, Resona Holdings has kept its positive momentum rolling this year. The stock’s year-to-date share price return sits at a solid 36.8%, while three-year total shareholder return clocks in at an impressive 151%. Momentum remains in the company’s favor as the market responds to management’s confidence and improved earnings outlook.

If Resona’s recent moves have you looking for new opportunities, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

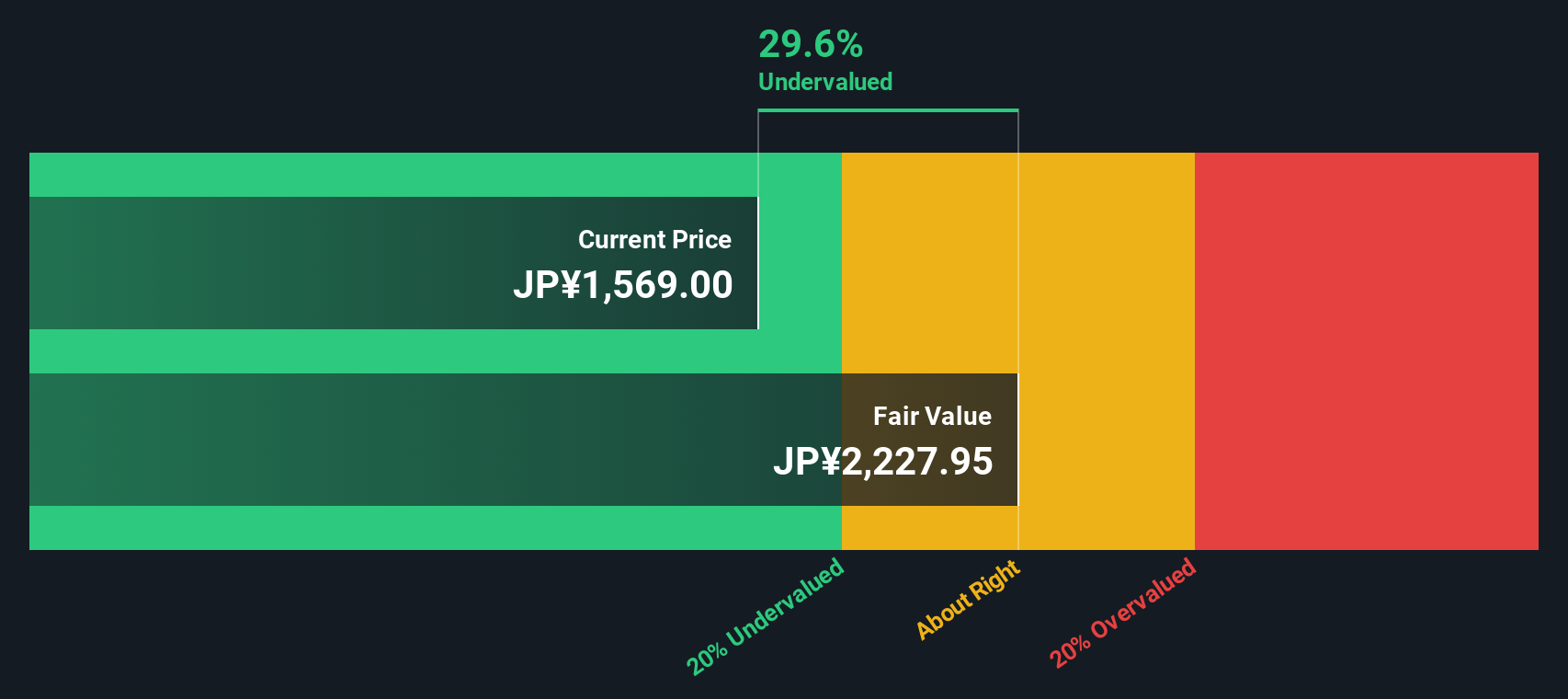

But after such a strong run and a series of upbeat announcements, does Resona Holdings remain undervalued, or has the market already priced in all the good news and future growth potential?

Most Popular Narrative: 7% Overvalued

With the narrative’s fair value at ¥1,458 and the last close at ¥1,565.5, the latest narrative signals that the market is pricing in more optimism than even the bullish forecasts suggest.

Efforts to enhance fee income, including strong performance in assets under management and settlement-related income, are supporting revenue growth and diversification. The strategic reduction of policy stock holdings and the expected increase in net gains from stocks may contribute to future earnings and improve capital utilization.

What is the catalyst behind the new fair value? The narrative hinges on a powerful shift in how the company grows profits and manages capital. Curious which financial levers and forecasts the narrative credits for this price? The key factors may be unexpected.

Result: Fair Value of ¥1,458 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising operating expenses or unexpected challenges from recent mergers could still strain margins and potentially disrupt the current narrative for Resona Holdings.

Find out about the key risks to this Resona Holdings narrative.

Another View: Discounted Cash Flow Paints a Different Picture

Looking at Resona Holdings through the SWS DCF model offers a sharp contrast. According to this approach, the estimated fair value stands much higher at ¥2,231.12 per share. This means the current price trades about 29.8% below this estimate. Could the longer-term outlook be more attractive than short-term multiples suggest?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Resona Holdings Narrative

If you have a different take or want to investigate the numbers firsthand, you can craft your own narrative in just a few minutes by using Do it your way

A great starting point for your Resona Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that every strong move creates new opportunities elsewhere. The next hot stock could be hiding in plain sight, but only if you look beyond the obvious.

- Unlock the potential of market mispricing when you analyze these 920 undervalued stocks based on cash flows that may see increased attention as the market catches up.

- Capture impressive yields while building a steady income stream by researching these 16 dividend stocks with yields > 3% offering attractive payouts above 3%.

- Get ahead of the curve in the next tech revolution by evaluating these 26 quantum computing stocks contributing to innovation in high-performance computing and emerging applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8308

Resona Holdings

Through its subsidiaries, engages in the provision retail and commercial banking products and services in Japan and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives