Mitsubishi UFJ (TSE:8306): How Does the Major Share Repurchase Impact Its Current Valuation?

Reviewed by Simply Wall St

Mitsubishi UFJ Financial Group (TSE:8306) has completed a major repurchase and cancellation of its common stock. This initiative is intended to optimize the company’s capital structure and demonstrates a proactive approach to supporting shareholder value. Investors are watching this move closely.

See our latest analysis for Mitsubishi UFJ Financial Group.

Mitsubishi UFJ Financial Group’s repurchase news comes amid a year of strong momentum, with the share price up 36% year-to-date and three-year total shareholder return soaring to nearly 272%. Recent gains have investors optimistic about the company’s outlook as it continues to make bold capital moves.

If this kind of renewed momentum has you searching for what else is on the move, now is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

But with Mitsubishi UFJ Financial Group’s shares rallying and excitement building around its capital moves, the key question for investors remains: is the stock still trading below its true value, or is all this growth already priced in?

Most Popular Narrative: 2.2% Overvalued

The consensus narrative places Mitsubishi UFJ Financial Group’s fair value just slightly below its last closing price, suggesting the market may be a little ahead of the fundamentals for now. Investors are considering whether further optimism is truly warranted, given how closely the narrative’s assumptions align with current valuations.

The bank's efforts to reduce low-profitability assets and transform into a more profitable entity through strategic asset replacement could enhance their net margins by optimizing the risk-reward ratio. The focus on customer segments and expanded contributions from deposit loan income and fee income indicate enhanced earnings power, potentially leading to robust revenue growth.

Want to know what’s fueling this aggressive valuation? The answer lies in how the narrative projects future earnings, margins, and ambitious efficiency targets. There’s a financial story here that challenges conventional expectations. The full narrative reveals which quantitative forecasts make this price tag possible—go see which number could change everything.

Result: Fair Value of ¥2,469 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected declines in net interest income or increased volatility in equity sales could quickly challenge the current optimism around Mitsubishi UFJ Financial Group’s outlook.

Find out about the key risks to this Mitsubishi UFJ Financial Group narrative.

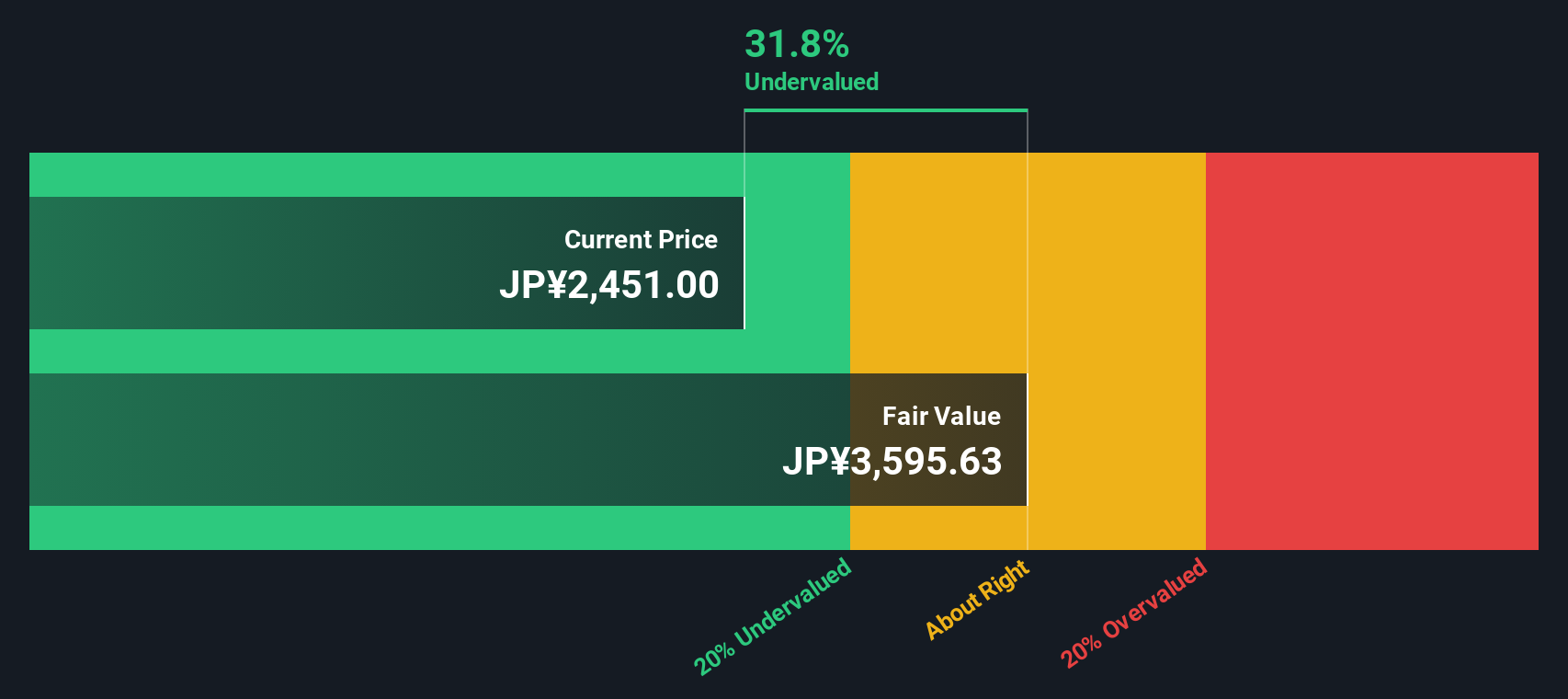

Another View: Discounted Cash Flow Suggests Undervaluation

Looking at Mitsubishi UFJ Financial Group through the lens of our DCF model, a different story emerges. The SWS DCF approach values shares at ¥3,666, making the current price appear significantly undervalued by over 30%. Is the market overlooking future cash flow potential, or does the consensus narrative capture all that is truly sustainable?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsubishi UFJ Financial Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsubishi UFJ Financial Group Narrative

If you’re the type to dig into the numbers yourself or question the consensus, you can quickly build your own story in just a few minutes. Do it your way

A great starting point for your Mitsubishi UFJ Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let today’s market movers pass you by. Let Simply Wall Street Screener help you discover hidden opportunities that could make all the difference in your portfolio.

- Spot overlooked value plays by checking out these 928 undervalued stocks based on cash flows and see which stocks are priced attractively based on their cash flows.

- Catch the income advantage with these 14 dividend stocks with yields > 3%, which guides you to companies boasting yields above 3% for steady returns.

- Experience the power of innovation and get a jump on the future by reviewing these 25 AI penny stocks as they make breakthroughs in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8306

Mitsubishi UFJ Financial Group

Operates as a bank holding company that engages in a range of financial businesses in Japan, the United States, Europe, Asia/Oceania, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026