Is Mitsubishi UFJ's Major Buyback and Dividend Hike Reshaping Its Investment Case (TSE:8306)?

Reviewed by Sasha Jovanovic

- Mitsubishi UFJ Financial Group recently announced an upward revision to its full-year profit guidance, a major share repurchase program of 130 million shares (1.14% of outstanding shares) for ¥250 billion, and an increased annual dividend forecast following robust financial results driven by net interest and fee income gains.

- This series of actions highlights the company's emphasis on returning value to shareholders through disciplined capital management, along with confidence in future earnings growth supported by ongoing strong performance, particularly from equity method investees linked to Morgan Stanley.

- We will examine how MUFG's higher dividend outlook and significant buyback initiative further support its investment narrative of capital discipline and shareholder focus.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Mitsubishi UFJ Financial Group Investment Narrative Recap

For investors considering Mitsubishi UFJ Financial Group, the key thesis centers on believing in the bank’s ability to grow profits through disciplined capital management, continued strength in customer segments, and resilience in net interest and fee income. Recent upward revisions in earnings guidance and shareholder return policies reinforce the view that dividend growth remains a prominent short-term catalyst, while ongoing reliance on equity security sales poses the biggest risk, these news events support the outlook for dividends, but do not materially reduce risk related to earnings volatility from equity sales.

Among the recent announcements, the major share buyback of 130 million shares stands out for its immediate impact on capital efficiency and earnings per share. As MUFG continues to emphasize capital returns, this buyback both complements the raised dividend outlook and ties closely to the current catalysts underpinning investor confidence in the company’s financial discipline.

However, investors should also be aware that despite these strong shareholder-focused actions, the continued dependence on equity gains as a profit driver means...

Read the full narrative on Mitsubishi UFJ Financial Group (it's free!)

Mitsubishi UFJ Financial Group is projected to reach ¥6,429.1 billion in revenue and ¥2,385.3 billion in earnings by 2028. This outlook assumes annual revenue growth of 5.7% and an earnings increase of about ¥1,128.2 billion from the current earnings of ¥1,257.1 billion.

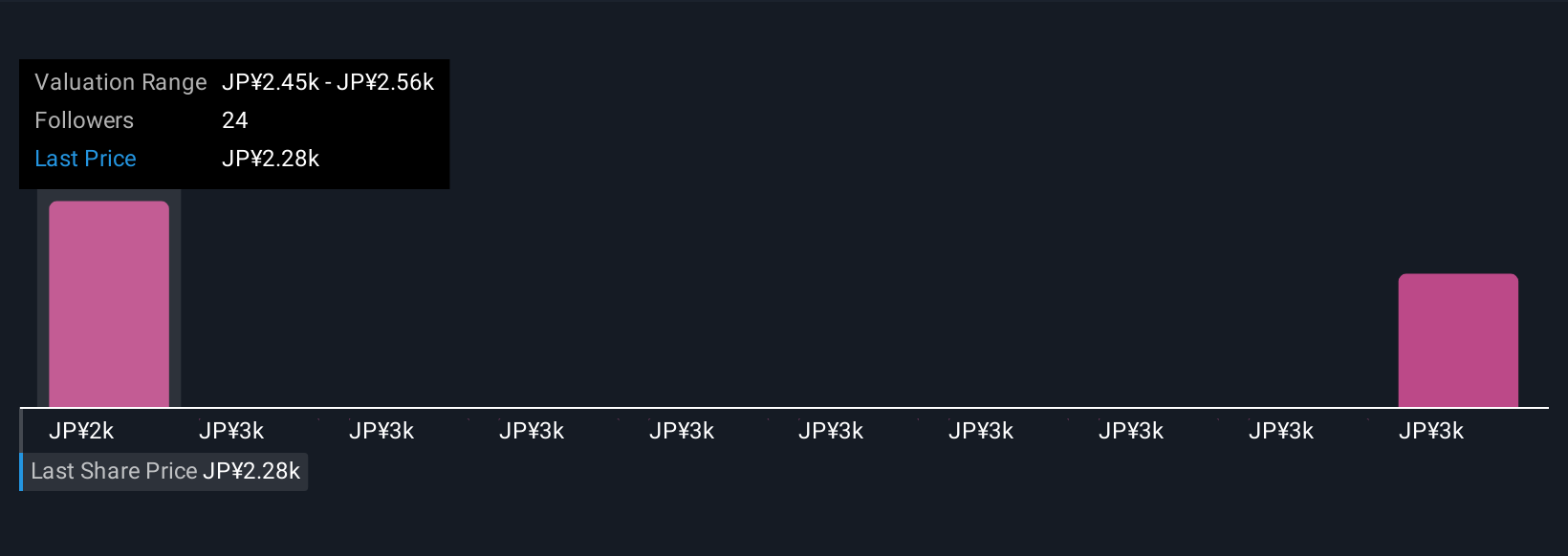

Uncover how Mitsubishi UFJ Financial Group's forecasts yield a ¥2453 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Fair value opinions from three Simply Wall St Community members range from ¥2,452.73 to ¥3,676.72 per share. While several believe MUFG offers upside, these valuations contrast against ongoing concerns that profits from equity sales may not be sustainable long term.

Explore 3 other fair value estimates on Mitsubishi UFJ Financial Group - why the stock might be worth as much as 54% more than the current price!

Build Your Own Mitsubishi UFJ Financial Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi UFJ Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mitsubishi UFJ Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi UFJ Financial Group's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8306

Mitsubishi UFJ Financial Group

Operates as a bank holding company that engages in a range of financial businesses in Japan, the United States, Europe, Asia/Oceania, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives