Exploring Mitsubishi UFJ Financial Group (TSE:8306) Valuation After Renewed Focus on BoJ Policy Shifts

Reviewed by Simply Wall St

Investor attention has sharpened on Mitsubishi UFJ Financial Group (TSE:8306) ahead of the Bank of Japan’s upcoming policy decision. Speculation over potential shifts in monetary stance is growing following comments from U.S. officials about the yen.

See our latest analysis for Mitsubishi UFJ Financial Group.

The focus on the Bank of Japan's next move has put Mitsubishi UFJ Financial Group in the spotlight, and investors have responded. The stock's current share price sits at ¥2,322, up 1.82% in the past day and 25% year-to-date. While some recent volatility reflects shifting expectations about monetary policy, the bigger story is an impressive long-term performance. Total shareholder return has reached 47% over the past year and more than 260% over three years, signaling momentum that is still building despite recent speculation.

If you're interested in finding more opportunities with strong momentum, now is the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With the stock riding high and investor optimism building, the key question is whether Mitsubishi UFJ Financial Group remains undervalued or if the market has already factored in all the potential upside, leaving little room for surprise gains.

Most Popular Narrative: 5.3% Undervalued

Mitsubishi UFJ Financial Group’s most widely followed valuation narrative puts fair value at ¥2,452.73, a modest premium to its last close of ¥2,322. Investors are weighing whether this gap signals more room to run or reflects a fully valued scenario.

The bank's efforts to reduce low-profitability assets and transform into a more profitable entity through strategic asset replacement could enhance their net margins by optimizing the risk-reward ratio. The focus on customer segments and expanded contributions from deposit loan income and fee income indicate enhanced earnings power, potentially leading to robust revenue growth.

Want to find out what powers this bullish price estimate? The narrative hinges on future profitability targets, margin expansion, and a sharper earnings trajectory than many expect. The secret sauce is in the numbers the narrative uses to justify this valuation: bold growth, leaner operations, and confidence in disciplined capital strategies. See what’s driving the consensus optimism below.

Result: Fair Value of ¥2,452.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in bond yields or a slowdown in equity sales could quickly challenge these upbeat forecasts and change the narrative surrounding Mitsubishi UFJ Financial Group.

Find out about the key risks to this Mitsubishi UFJ Financial Group narrative.

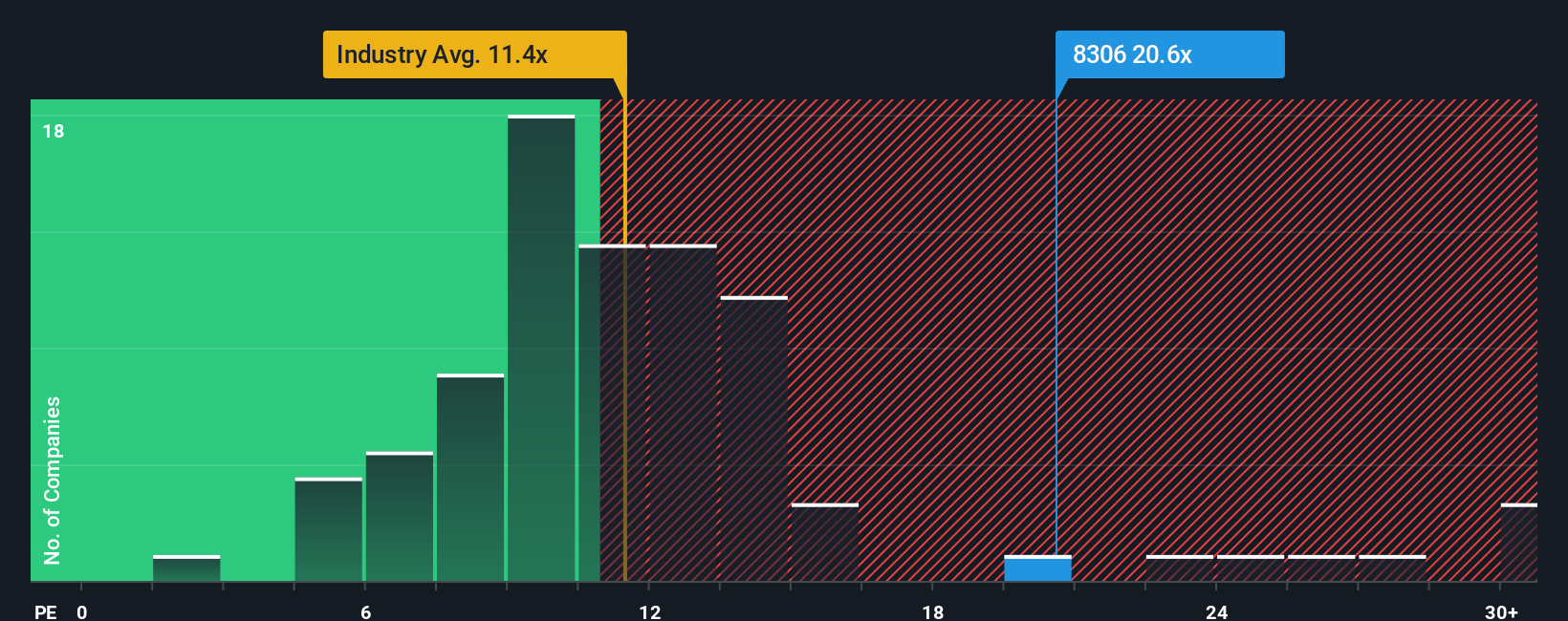

Another View: The Multiples Perspective

Looking at Mitsubishi UFJ Financial Group through the lens of its valuation ratio paints a more cautious picture. The company's ratio stands at 21x, which is notably higher than the Japanese banks industry average of 11.3x and even above the fair ratio of 18.2x. This means investors are paying a premium compared to both peers and what the numbers suggest is justified, raising the question: is momentum enough to support this price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsubishi UFJ Financial Group Narrative

If you see the story unfolding differently or want to dig deeper into the numbers on your own terms, take just a few minutes to craft your own perspective, your way. Do it your way

A great starting point for your Mitsubishi UFJ Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Unlock fresh opportunities for your portfolio by checking out other promising stocks tailored to your goals. Make sure you’re not missing out on some of the market’s hottest trends.

- Access high-yield potential by checking out these 24 dividend stocks with yields > 3%, which consistently outperform on income and stability.

- Get ahead of technological breakthroughs with these 28 quantum computing stocks, leading innovation in computing and industry change.

- Maximize value by scanning these 848 undervalued stocks based on cash flows, which are priced below their intrinsic worth to give you a true edge in the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8306

Mitsubishi UFJ Financial Group

Operates as a bank holding company that engages in a range of financial businesses in Japan, the United States, Europe, Asia/Oceania, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives