A Look at MUFG’s (TSE:8306) Valuation Following Earnings Upgrade, Dividend Hike, and Share Buyback

Reviewed by Simply Wall St

Mitsubishi UFJ Financial Group (TSE:8306) is making headlines after management raised earnings guidance for the year, announced higher dividends, and launched a substantial share buyback plan. Investors are taking note of the company’s latest moves.

See our latest analysis for Mitsubishi UFJ Financial Group.

The share price has responded positively to management’s series of shareholder-friendly moves, climbing 28.4% so far this year. That momentum is supported by a remarkable 35% total shareholder return over the past twelve months and more than fivefold gains over five years. This reflects both robust performance and growing investor confidence in the company’s outlook.

If the latest buyback and dividend boost have piqued your interest, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

Despite these headline-grabbing announcements and strong recent gains, analysts and investors are now weighing whether Mitsubishi UFJ Financial Group’s stock still offers room for upside or if the market has already factored in its growth story.

Most Popular Narrative: 3.4% Undervalued

Mitsubishi UFJ Financial Group’s analyst consensus fair value suggests a modest upside compared to its latest closing price, hinting at cautious but positive market sentiment. If you’re curious about the logic behind this narrative, a major driver stands out in the analysts’ assumptions.

The bank's efforts to reduce low-profitability assets and transform into a more profitable entity through strategic asset replacement could enhance their net margins by optimizing the risk-reward ratio.

What is giving analysts conviction in their price target? The answer lies in bold profit margin forecasts and the expectation that asset mix improvements will significantly reshape the group’s long-term earnings power. Discover exactly which future financial leaps the narrative is betting on. One key figure may surprise you.

Result: Fair Value of ¥2,469 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent uncertainty in global markets and the company’s reliance on equity sales for profit growth could weaken these optimistic analyst forecasts.

Find out about the key risks to this Mitsubishi UFJ Financial Group narrative.

Another View: The Multiples Perspective

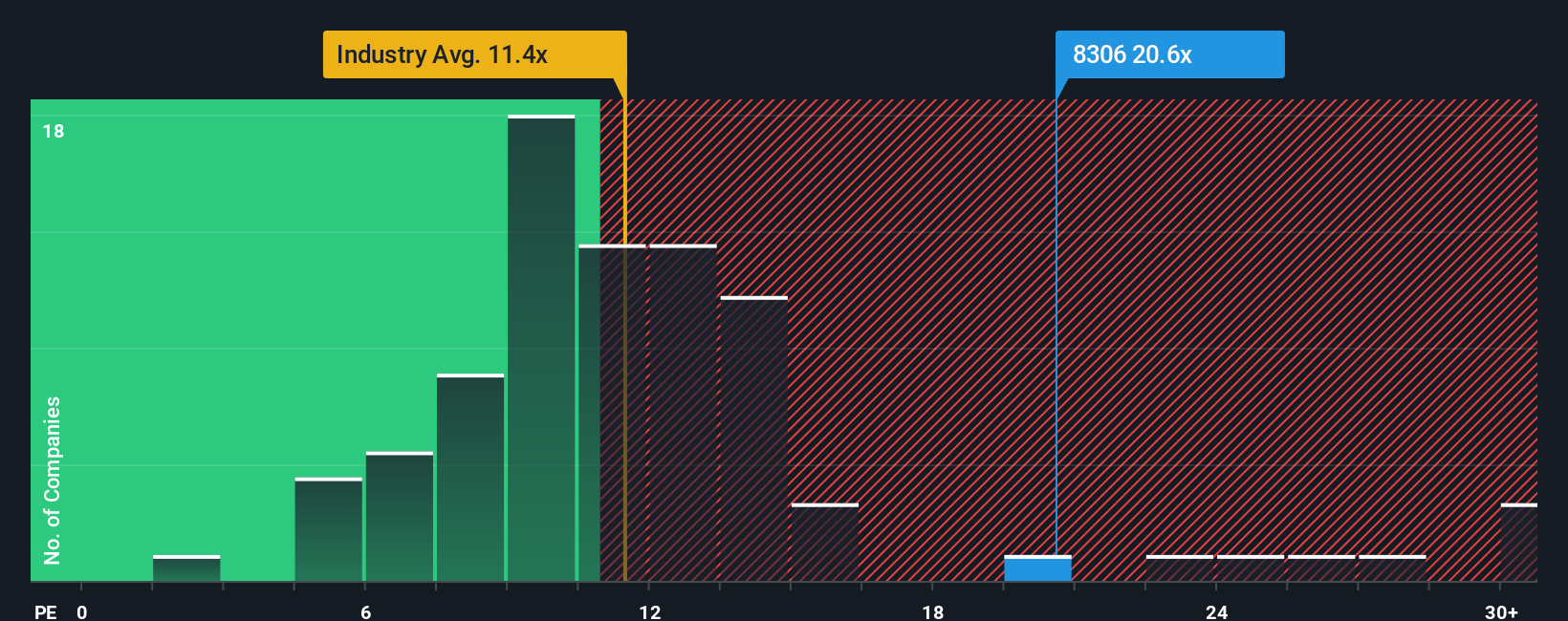

Looking beyond analyst fair value estimates, Mitsubishi UFJ Financial Group’s price-to-earnings ratio stands at 20.9x, which is noticeably above both its peer group average of 15.7x and the Japanese banks industry average of 10.8x. The fair ratio is calculated at 18.3x, indicating the current valuation might be demanding relative to benchmarks. Does this premium signal confidence in future growth, or are investors taking on greater risk at these levels?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsubishi UFJ Financial Group Narrative

If you see the story unfolding differently or want to dig into the numbers yourself, it takes just a few minutes to build your own perspective. Do it your way

A great starting point for your Mitsubishi UFJ Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Smart Move?

Meaningful opportunities are waiting for those who look beyond the obvious. Don’t let great potential slip through your fingers, when so many unique ideas are just a click away.

- Capitalize on market shifts by checking out these 922 undervalued stocks based on cash flows, featuring real upside supported by healthy cash flows and pricing power.

- Fuel your portfolio’s future by tapping into these 26 AI penny stocks, which lead AI innovation with rapid growth potential and sector-defining breakthroughs.

- Boost your income strategy with these 15 dividend stocks with yields > 3%, providing attractive yields and a track record of strong payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8306

Mitsubishi UFJ Financial Group

Operates as a bank holding company that engages in a range of financial businesses in Japan, the United States, Europe, Asia/Oceania, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives