Undiscovered Gems To Explore On None Exchange In February 2025

Reviewed by Simply Wall St

As global markets experience a mix of optimism and caution, with U.S. stock indexes nearing record highs despite rising inflation concerns, small-cap stocks have notably lagged behind their larger counterparts. In this environment, identifying potential opportunities among lesser-known stocks can be rewarding for investors seeking to diversify their portfolios with unique growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Jordanian Duty Free Shops | NA | 10.61% | -7.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine Société coopérative (ENXTPA:CCN)

Simply Wall St Value Rating: ★★★★★★

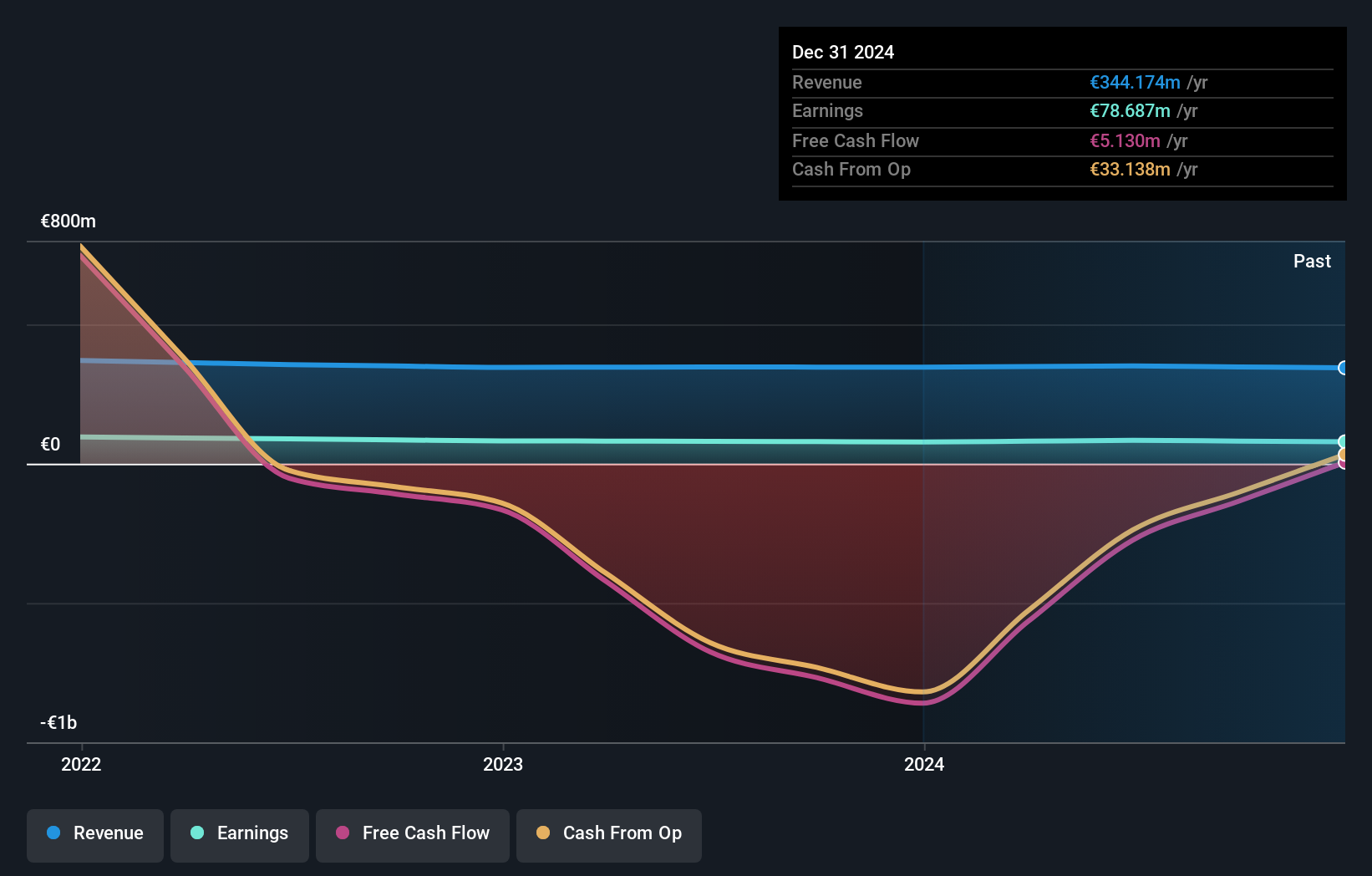

Overview: Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine Société coopérative provides a range of banking products and services to individuals, professionals, farmers, associations, and companies in France with a market capitalization of €553.61 million.

Operations: The cooperative generates revenue primarily from its retail banking segment, which accounts for €350.44 million.

Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine, a cooperative bank with €25.5 billion in assets and €3 billion in equity, stands out for its robust financial health. With total deposits of €20.7 billion and loans amounting to €21 billion, it efficiently manages its operations. The bank maintains a sufficient allowance for bad loans at 111% and keeps non-performing loans at an appropriate 1.1%. Primarily funded by low-risk customer deposits (92%), the bank trades at 20.7% below estimated fair value, suggesting potential undervaluation despite not outperforming industry growth rates recently.

Sri Trang Gloves (Thailand) (SET:STGT)

Simply Wall St Value Rating: ★★★★★★

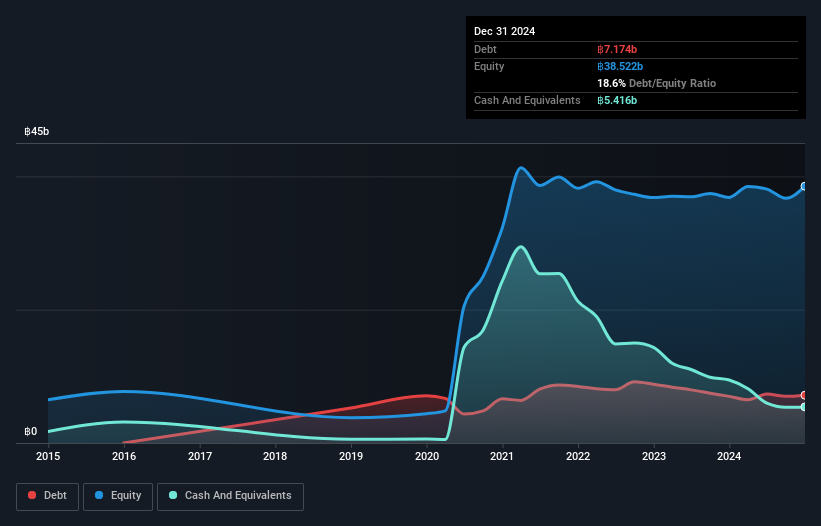

Overview: Sri Trang Gloves (Thailand) Public Company Limited is involved in the manufacture and distribution of rubber gloves across various international markets, with a market cap of approximately THB21.92 billion.

Operations: The primary revenue stream for Sri Trang Gloves comes from its gloves segment, generating THB23.30 billion. The company's financial performance is significantly influenced by this segment, reflecting its core business focus.

Sri Trang Gloves, a key player in the medical equipment sector, has shown remarkable growth with earnings soaring by 153% over the past year, outpacing the industry average. The company reported a substantial increase in net income to THB 995 million from THB 153 million last year. Basic and diluted earnings per share rose to THB 0.35 from THB 0.05 previously. Over five years, its debt to equity ratio impressively decreased from 156% to just over 19%, signaling stronger financial health. With high-quality earnings and satisfactory debt levels, Sri Trang Gloves seems well-positioned for continued growth and stability in its market niche.

- Get an in-depth perspective on Sri Trang Gloves (Thailand)'s performance by reading our health report here.

Understand Sri Trang Gloves (Thailand)'s track record by examining our Past report.

Aichi Financial Group (TSE:7389)

Simply Wall St Value Rating: ★★★★★☆

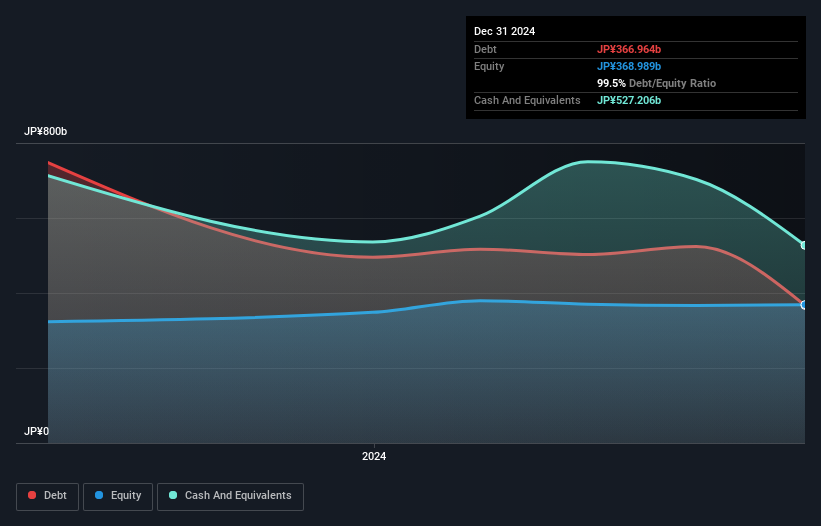

Overview: Aichi Financial Group, Inc. operates in Japan offering a range of banking products and services through its subsidiaries, with a market cap of ¥135.63 billion.

Operations: Aichi Financial Group generates revenue primarily from its banking products and services in Japan. The company has a market capitalization of ¥135.63 billion.

Aichi Financial Group, with total assets of ¥6,816.8 billion and equity at ¥369.0 billion, showcases a robust financial structure. The company has total deposits of ¥6,005.8 billion against loans amounting to ¥4,820.9 billion, indicating a solid deposit base supporting its lending activities. Its non-performing loans stand appropriately at 1.8%, yet the allowance for bad loans is low at 28%, hinting at potential risk management areas to address further. Despite these challenges, Aichi's earnings surged by an impressive 762% over the past year compared to the industry’s average growth of 21%, reflecting strong operational performance in a competitive sector.

Seize The Opportunity

- Gain an insight into the universe of 4716 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7389

Aichi Financial Group

Through with its subsidiaries, provides various banking products and services in Japan.

Excellent balance sheet with questionable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion