Nishi-Nippon Financial Holdings (TSE:7189): Assessing Valuation After Strong Earnings and Dividend Hike

Reviewed by Simply Wall St

Nishi-Nippon Financial Holdings (TSE:7189) just posted a meaningful jump in ordinary income and net profit for the half-year ended September 2025. Along with these results, the group also raised its dividend forecast for the year.

See our latest analysis for Nishi-Nippon Financial Holdings.

The upbeat half-year results and dividend hike appear to have reinvigorated investor confidence, as reflected in Nishi-Nippon Financial Holdings’ recent price action. The stock logged a robust 21.5% share price return over the past month and stands over 41% higher year-to-date. Its one-year total shareholder return is an impressive 53%. Over the longer run, momentum remains strong with a total return of nearly 291% in three years and 385% in five, suggesting sustained optimism around the bank’s growth story.

If recent gains have you curious about what else is catching investors’ attention, now is a smart time to discover fast growing stocks with high insider ownership

But after such a strong rally and a dividend boost, is Nishi-Nippon Financial Holdings still trading at an attractive price, or has the market already factored in all the good news and growth potential?

Price-to-Earnings of 11.1x: Is it justified?

Nishi-Nippon Financial Holdings is currently trading at a price-to-earnings ratio of 11.1x, just slightly below both the JP Banks industry average and its close peers. At its last close of ¥2,841.5, the market appears to be valuing the company's recent growth streak and profitability at a modest premium.

The price-to-earnings (P/E) ratio is a vital metric for banks, capturing what investors are willing to pay for each unit of earnings. For a bank like Nishi-Nippon, the P/E ratio reflects perceptions about its earnings quality, risk profile, and growth potential in the context of a regulated sector.

At 11.1x, Nishi-Nippon's P/E ratio is lower than the JP Banks industry average of 11.2x and just under the peer group average of 11.3x. This suggests that, despite strong recent earnings growth, the market is not assigning a substantial premium, possibly due to its low return on equity and modest board independence. If market participants re-rate the stock toward a higher multiple, it could materially affect its share price trajectory.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 11.1x (UNDERVALUED)

However, risks remain. These include the stock now trading slightly above analyst price targets and concerns around its relatively low board independence.

Find out about the key risks to this Nishi-Nippon Financial Holdings narrative.

Another View: What Does the DCF Model Say?

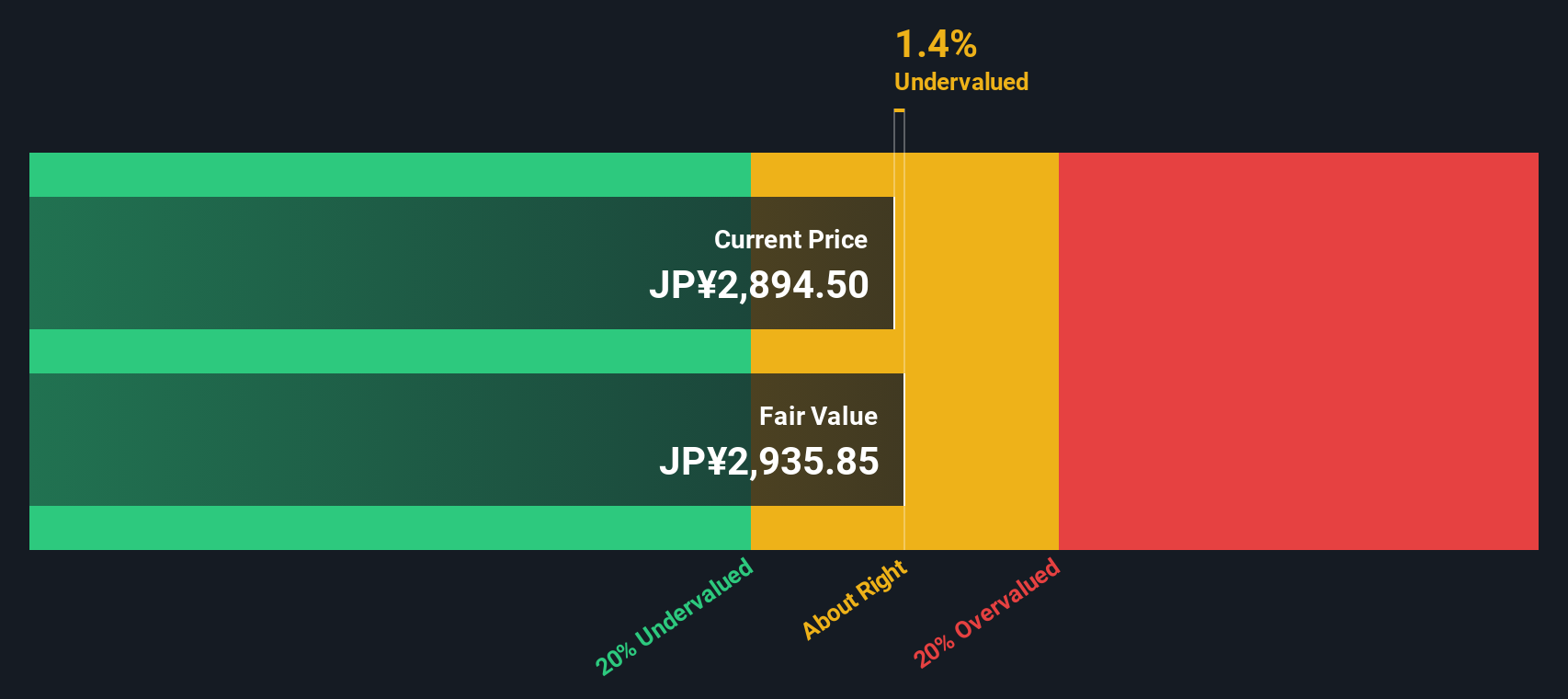

While the current price-to-earnings ratio suggests Nishi-Nippon Financial Holdings is undervalued compared to the industry and peers, our DCF model provides a second opinion. It values the shares at ¥2,934.28, so the stock is trading about 3% below the estimated fair value. There may still be a margin of safety, or upside could already be limited.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nishi-Nippon Financial Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nishi-Nippon Financial Holdings Narrative

If you have your own perspective or want to dig deeper into the numbers, you can develop your own take on Nishi-Nippon Financial Holdings in just a few minutes. Do it your way

A great starting point for your Nishi-Nippon Financial Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Moves?

Unlock opportunities the market can't ignore. With a world of stocks at your fingertips, now is the perfect moment to seize your next winning idea.

- Capture potential for strong yield growth as you check out these 14 dividend stocks with yields > 3%, which highlights companies with impressive dividend track records and sustainable payouts.

- Capitalize on the AI revolution by using these 27 AI penny stocks to find forward-thinking businesses transforming industries with advancements in artificial intelligence.

- Target value overlooked by the crowd through these 882 undervalued stocks based on cash flows, where fundamentally sound stocks may be trading at attractive prices right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nishi-Nippon Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7189

Nishi-Nippon Financial Holdings

Through its subsidiaries, provides financial and non-financial products and services in Japan, China, Hong Kong, and Singapore.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives