- Japan

- /

- Auto Components

- /

- TSE:7988

Nifco (TSE:7988) Valuation: Assessing the Impact After Completion of Share Buyback Program

Reviewed by Simply Wall St

Nifco (TSE:7988) wrapped up its latest share buyback plan on October 30, 2025, after acquiring just over 1.19 million shares, which is about 1.3% of its outstanding stock during the program.

See our latest analysis for Nifco.

Nifco wrapped up its share buyback program just as momentum has been building in the stock. The company saw a 19.8% share price return over the last 90 days and a one-year total shareholder return of nearly 30%. This solid run, helped by management’s recent move, suggests investors are viewing the company more favorably and could be reassessing its longer-term potential in the auto parts sector.

If you want to see what other auto stocks are catching investors’ attention, now’s a perfect time to explore See the full list for free.

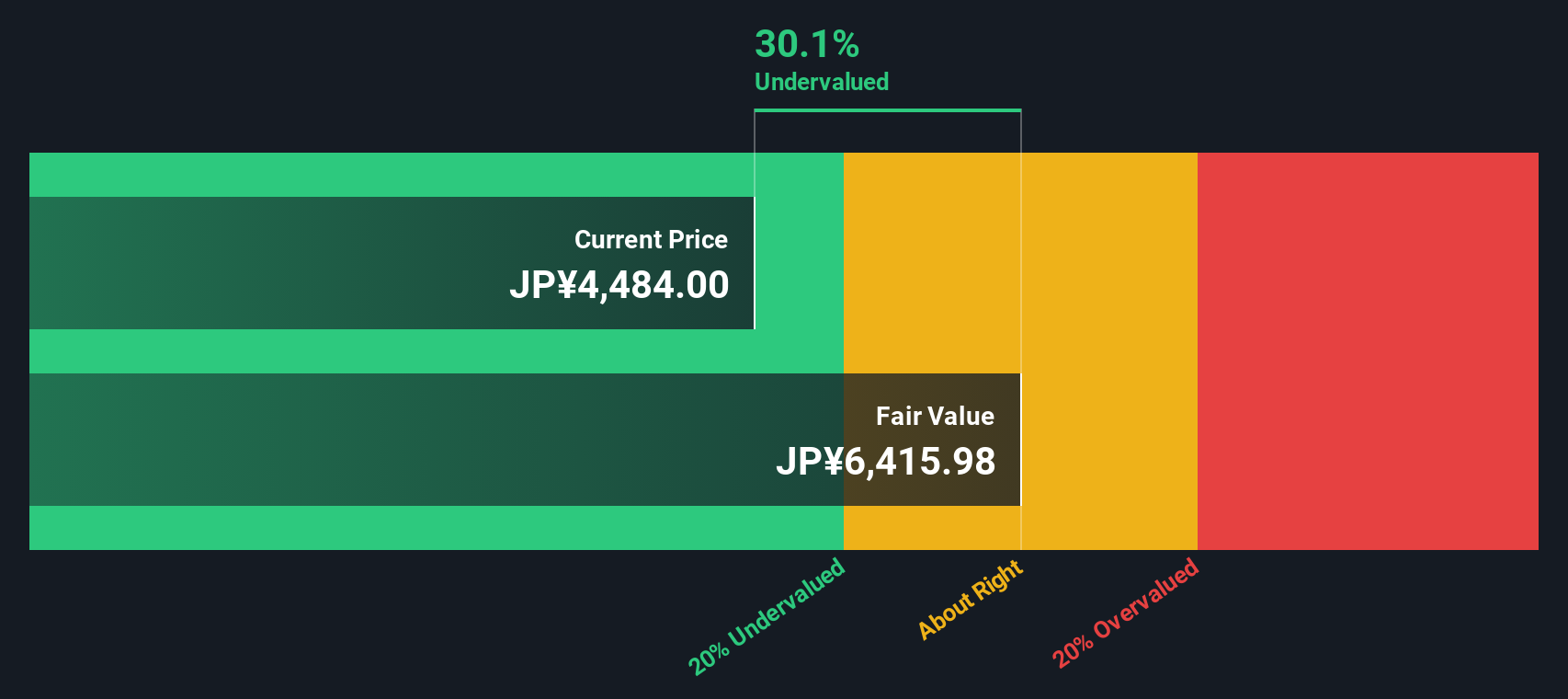

With shares up this year and buybacks complete, does Nifco still trade at a discount to its intrinsic worth, or is the recent optimism already reflected in the stock price, leaving little room for further upside?

Price-to-Earnings of 9.4x: Is it justified?

Nifco currently trades on a price-to-earnings (P/E) ratio of 9.4x, noticeably cheaper than peers and industry averages. With a last close price of ¥4,567, the market is valuing its earnings at a significant discount to both the broader market and its sector.

The price-to-earnings ratio measures how much investors are willing to pay today for a yen of current earnings. For established auto parts companies like Nifco, the P/E offers a clear lens into market expectations for future profit growth or risk.

Nifco’s low P/E suggests investors may be underappreciating its recent profit surge. While the stock sits well below the peer average of 16.4x and the Japanese auto components industry average of 11.6x, its trailing earnings growth has been impressive. However, forecasts point to less optimistic profit trends in coming years. This could be tempering the multiple assigned by the market.

It is helpful to compare this 9.4x P/E not only to competitors, but also to what analysts deem a “fair” multiple for Nifco. The estimated fair price-to-earnings ratio is 8.4x, indicating the stock looks a bit expensive on this metric. The market’s enthusiasm may be pushing it closer to, or slightly above, its justified level based on recent performance and expected outlook.

Explore the SWS fair ratio for Nifco

Result: Price-to-Earnings of 9.4x (UNDERVALUED)

However, slower net income growth and a smaller discount to analyst price targets could weigh on sentiment if profitability does not meet expectations.

Find out about the key risks to this Nifco narrative.

Another View: Discounted Cash Flow Says "Undervalued"

Looking at Nifco through the lens of our DCF model tells a different story. The analysis suggests shares are trading at a significant 33% discount to fair value, which means today's market price may understate the true worth of the business. Could this gap signal a bigger long-term opportunity, or is there more risk beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nifco for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 856 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nifco Narrative

If you want to dig into the numbers yourself or see things from a different angle, you can quickly craft your own narrative using our tools. Do it your way.

A great starting point for your Nifco research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Act now to get ahead of the market and turn market shifts into opportunities with smart strategies. Don’t let standout investment trends pass you by.

- Target impressive yields for your portfolio and tap into growth with these 21 dividend stocks with yields > 3%, which consistently outperform in both income and stability.

- Join the AI revolution and boost your edge by reviewing these 26 AI penny stocks, as they are redefining industry boundaries with transformative applications.

- Spot undervalued gems waiting for smart investors. Seize your chance now with these 856 undervalued stocks based on cash flows before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nifco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7988

Nifco

Manufactures and sells industrial plastic parts and components in Japan, Asia, North America, China, South Korea, the United States, and Europe.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives