- Japan

- /

- Auto Components

- /

- TSE:7318

Slammed 31% Serendip Holdings Co.,Ltd. (TSE:7318) Screens Well Here But There Might Be A Catch

The Serendip Holdings Co.,Ltd. (TSE:7318) share price has fared very poorly over the last month, falling by a substantial 31%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 37% share price drop.

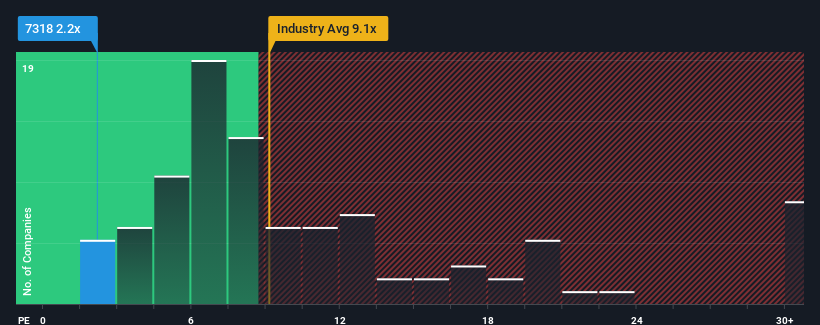

Even after such a large drop in price, Serendip HoldingsLtd's price-to-earnings (or "P/E") ratio of 2.2x might still make it look like a strong buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 13x and even P/E's above 19x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Serendip HoldingsLtd certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Serendip HoldingsLtd

Does Growth Match The Low P/E?

Serendip HoldingsLtd's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 228% last year. The strong recent performance means it was also able to grow EPS by 3,234% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 10% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Serendip HoldingsLtd is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Serendip HoldingsLtd's P/E?

Shares in Serendip HoldingsLtd have plummeted and its P/E is now low enough to touch the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Serendip HoldingsLtd currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Serendip HoldingsLtd (2 make us uncomfortable!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7318

Serendip HoldingsLtd

Operates business succession support, management consulting, M&A advisory, corporate revitalization support, corporate advisory, professional manager dispatch, and other incidental business in Japan.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026