- Japan

- /

- Auto Components

- /

- TSE:7280

Further Upside For Mitsuba Corporation (TSE:7280) Shares Could Introduce Price Risks After 26% Bounce

Despite an already strong run, Mitsuba Corporation (TSE:7280) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 161% following the latest surge, making investors sit up and take notice.

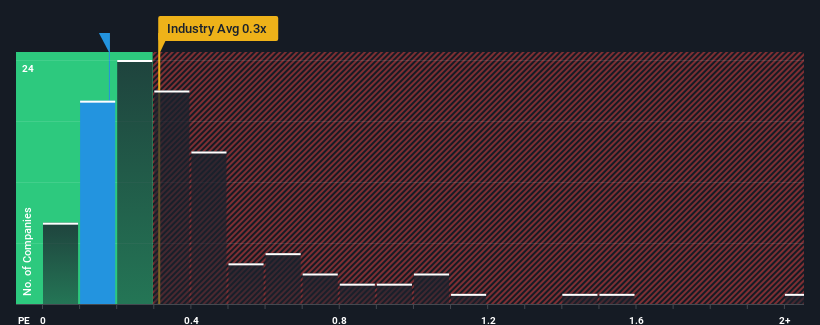

Although its price has surged higher, it's still not a stretch to say that Mitsuba's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Auto Components industry in Japan, where the median P/S ratio is around 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Mitsuba

How Has Mitsuba Performed Recently?

Mitsuba has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Mitsuba's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Mitsuba?

The only time you'd be comfortable seeing a P/S like Mitsuba's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 7.8% gain to the company's revenues. The latest three year period has also seen a 29% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 4.2% shows it's noticeably more attractive.

In light of this, it's curious that Mitsuba's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Mitsuba appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To our surprise, Mitsuba revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

You need to take note of risks, for example - Mitsuba has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7280

Mitsuba

Manufactures and sells automotive, motorcycle, and micro mobility products in Asia, the Americas, Europe, Africa, and China.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives