Yamaha Motor (TSE:7272) Valuation in Focus Following Launch of Premium Electric Scooters in India

Reviewed by Simply Wall St

Yamaha Motor (TSE:7272) has launched two new electric scooters, the AEROX E and EC-06, in India. The move highlights Yamaha’s push toward premium electric vehicles and its environmental targets for 2050.

See our latest analysis for Yamaha Motor.

Momentum around Yamaha Motor has been a bit mixed lately. While recent product launches could revive investor enthusiasm, the year-to-date share price return is down 16.85%. Even so, the long run remains impressive with a total shareholder return of over 100% across five years, showing Yamaha still knows how to deliver for committed shareholders.

Inspired by innovation in electric mobility? Now is a good moment to see what’s happening across automakers. Discover See the full list for free.

After a year marked by both innovation and subdued stock performance, the real question for investors is whether Yamaha Motor is now trading at an attractive valuation or if the market has already accounted for its future potential.

Most Popular Narrative: 2% Undervalued

With the latest closing price of ¥1,117.5, Yamaha Motor is currently seen as trading just below the narrative's fair value of ¥1,140. This puts it nearly in line with consensus and provides a timely checkpoint for those tracking the company's longer-term outlook.

The integration of the RV business with the golf car business to form the Outdoor Land Vehicle (OLV) business will focus on efficient operations and cost reductions. This positions the company for higher revenue and narrowing deficits, which could potentially improve operating income.

What game-changing assumptions are fueling this fair value? The narrative hints at ambitious profit margin gains and future earnings levels that could surprise the market. Which bold forecasts are behind these targets? Unlock the story that drives this valuation.

Result: Fair Value of ¥1,140 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising raw material and labor costs, as well as ongoing business restructuring, could challenge Yamaha Motor’s ability to deliver consistent margin improvements in the coming years.

Find out about the key risks to this Yamaha Motor narrative.

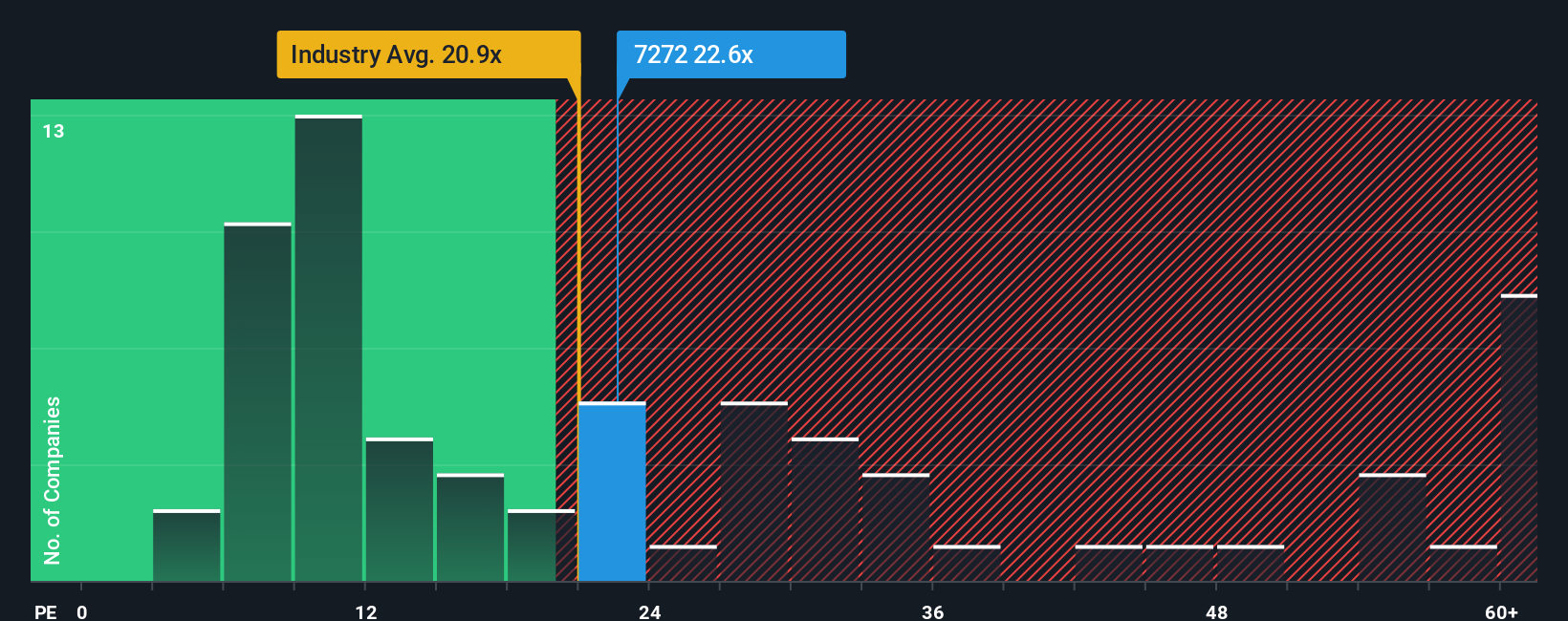

Another View: Multiples Tell a Cautionary Story

While the prevailing narrative sees Yamaha Motor as slightly undervalued, a closer look at earnings multiples sends a different signal. The company trades at a lofty 70.4 times earnings, well above the Asian auto industry average of 18.1 and the peer average of 13.9. Even compared to its fair ratio of 31.6, the stock looks unusually expensive. This gap suggests there could be more valuation risk than meets the eye. Is the market too optimistic about Yamaha’s future, or is the price justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yamaha Motor Narrative

If you think there’s another side to this story, or want a hands-on look at the numbers, crafting your own view takes just a few minutes. Do it your way

A great starting point for your Yamaha Motor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next move count with these powerful stock screens tailored for smarter investing. Don’t miss your chance to spot trends and uncover tomorrow’s winners today.

- Tap into tomorrow’s tech by checking out these 26 AI penny stocks that are set to transform everything from automation to algorithms.

- Supercharge your income with these 16 dividend stocks with yields > 3% featuring generous yields and the potential for consistent returns.

- Get ahead of the market by spotting value opportunities with these 926 undervalued stocks based on cash flows showing attractive prices based on strong cash flows and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7272

Yamaha Motor

Engages in the land mobility, marine products, robotics, financial services, and others businesses in Japan, North America, Europe, Asia, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives