Yamaha Motor (TSE:7272): Assessing Value as Share Price Moves Mirror Analyst Targets

Reviewed by Simply Wall St

See our latest analysis for Yamaha Motor.

This recent stretch of share price volatility sits against a longer backdrop of cooling investor sentiment, as Yamaha Motor’s 1-year total shareholder return now stands at -12.3%, despite a strong 168% gain over the past five years. Recent dips may reflect shifting expectations, but the company’s longer-term story shows the potential for resilient performance if market confidence returns.

If the turbulence in Yamaha’s stock has you thinking bigger, now is the perfect chance to broaden your search and discover See the full list for free.

With shares lagging this year despite strong profit growth, investors are left to wonder whether Yamaha Motor now offers genuine value or if the market is already pricing in renewed momentum for future growth.

Most Popular Narrative: Fairly Valued

With Yamaha Motor’s last close at ¥1,115 and the most widely followed narrative placing fair value at ¥1,140, there is minimal gap between these two figures. This highlights market and consensus alignment. The current price and consensus target suggest that, for now, analyst expectations are closely matched with market sentiment.

The integration of the RV business with the golf car business to form the Outdoor Land Vehicle (OLV) business will focus on efficient operations and cost reductions. This positions the company for higher revenue and narrowing deficits, thus potentially improving operating income.

You’ve seen the price, but do you know what’s powering that fair value? The answer: Quantitative upgrades and big operational changes. Discover which forecasted business levers and strategic pivots are at the heart of this narrative’s calculation. Ready for the numbers that could shape Yamaha’s next chapter?

Result: Fair Value of ¥1,140 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising raw material costs and persistent restructuring expenses could pressure margins and create challenges for the positive outlook currently supported by analysts.

Find out about the key risks to this Yamaha Motor narrative.

Another View: Comparing Market Ratios

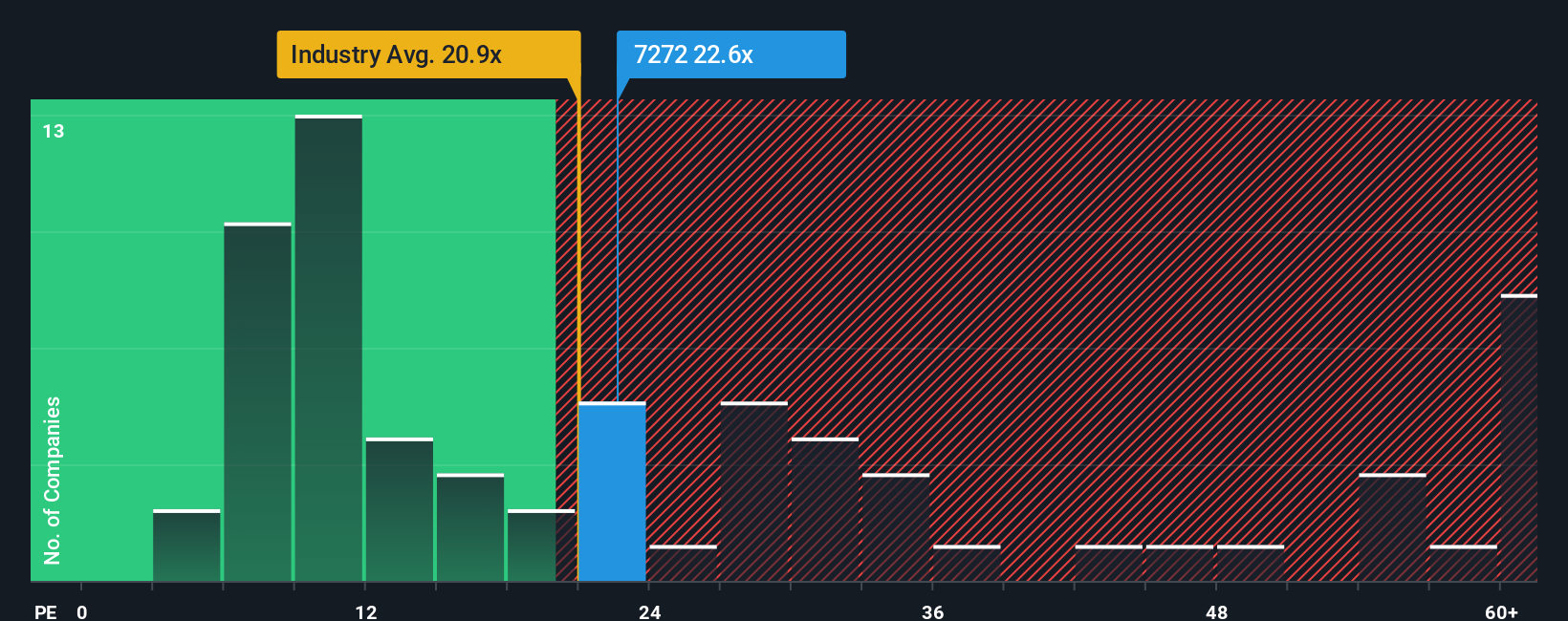

Looking at Yamaha Motor through the lens of its price-to-earnings ratio, the shares trade at 22.5 times earnings, which is not only higher than the estimated fair ratio of 20.6 but also above the Asian auto industry average of 22. This difference suggests the stock may carry more valuation risk. Will the market keep paying a premium, or could a rerating lie ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yamaha Motor Narrative

If you see the numbers differently or want to dig deeper into your own analysis, you can craft a personalized narrative in just a few minutes, your way with Do it your way.

A great starting point for your Yamaha Motor research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop at just one opportunity. Unlock your next move by targeting strategies that could boost your returns and broaden your portfolio.

- Tap into stable income streams and maximize your portfolio’s growth potential by focusing on stocks offering consistent yields with these 22 dividend stocks with yields > 3%.

- Seize opportunities others overlook and position yourself for future upside by going after these 840 undervalued stocks based on cash flows based on real cash flows.

- Ride the wave of artificial intelligence innovation and gain early access to tech leaders through these 26 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7272

Yamaha Motor

Engages in the land mobility, marine products, robotics, financial services, and others businesses in Japan, North America, Europe, Asia, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives