Did Profit Revision and Share Buybacks Just Shift Subaru's (TSE:7270) Investment Narrative?

Reviewed by Sasha Jovanovic

- Subaru Corporation recently announced a correction to its previously disclosed first-quarter financial results for the fiscal year ending 2026, reducing the profit attributable to owners, and provided an update on its ongoing share repurchase program, having bought back over 4.14 million shares out of a planned maximum of 20.84 million by December 23, 2025.

- This combination of financial reporting adjustments and capital allocation actions underscores how transparency and shareholder-focused initiatives can influence investor perceptions.

- We’ll examine how Subaru’s focus on shareholder value through its buyback program shapes its evolving investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is Subaru's Investment Narrative?

To believe in Subaru as a shareholder right now, you need confidence in the company’s ability to balance value-focused capital returns with operational challenges amid changing market expectations. The recent reduction in reported profit and the active continuation of the share buyback program highlight both Subaru’s willingness to own up to errors and its commitment to rewarding shareholders. While this financial restatement is a short-term knock to sentiment, early share price moves suggest its overall impact is not material to Subaru’s near-term catalysts, which remain tied to upcoming earnings announcements and vehicle launches. However, the adjustment may sharpen scrutiny of Subaru’s financial reporting ahead of the next results, and the risk of sustained earnings decline, already forecast by analysts, is brought further into focus. Board turnover and a less experienced leadership team are likely to remain under the microscope after these events.

But investors should not overlook concerns about the sustainability of profit growth and board stability. Subaru's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

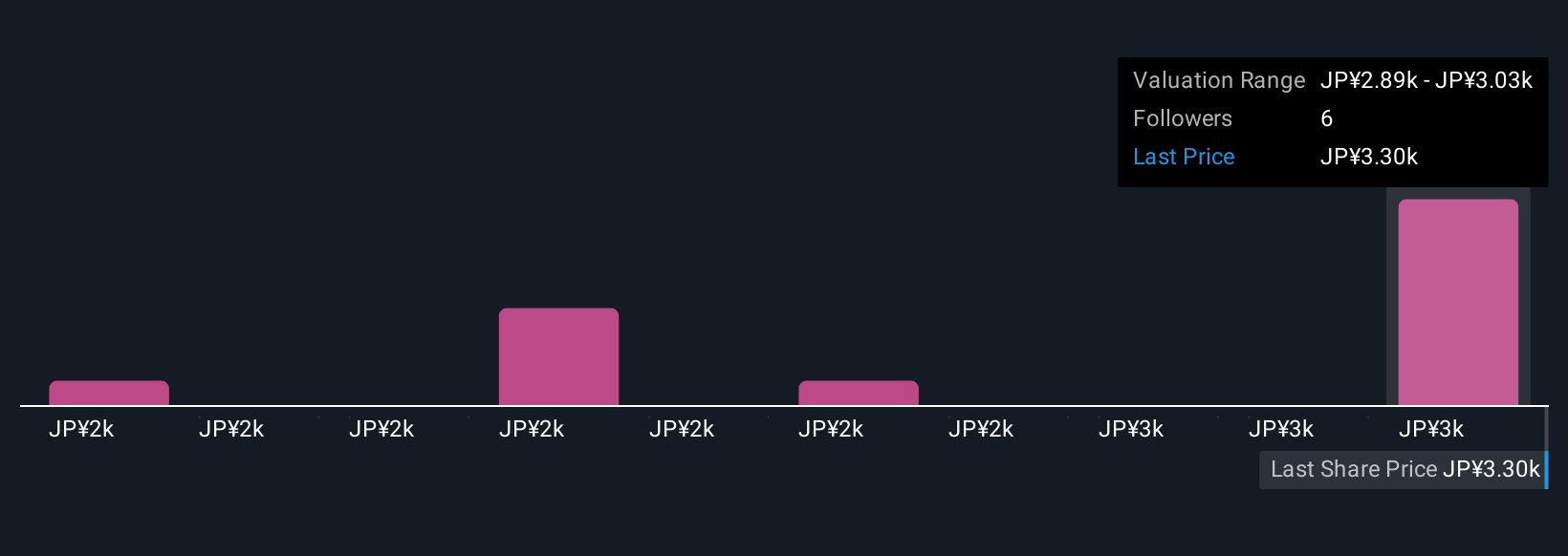

Explore 4 other fair value estimates on Subaru - why the stock might be worth as much as ¥3030!

Build Your Own Subaru Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Subaru research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Subaru research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Subaru's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7270

Subaru

Manufactures and sells automobiles and aerospace products in Japan, Rest of Asia, North America, Europe, and Internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives