Did Suzuki Motor's (TSE:7269) Dividend Hike Signal Evolving Capital Priorities for Shareholders?

Reviewed by Sasha Jovanovic

- Suzuki Motor Corporation recently announced a cash dividend of ¥22.00 per share for the second quarter ended September 30, 2025, up from ¥20.00 per share a year earlier, with payment starting on November 28, 2025.

- This dividend increase may reflect management’s confidence in Suzuki’s financial position and signals a willingness to reward shareholders.

- With a higher dividend payment, we'll explore how Suzuki Motor’s strengthened shareholder returns factor into its broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Suzuki Motor's Investment Narrative?

For a shareholder, Suzuki Motor presents a story of steady growth mixed with evolving returns. The newly announced dividend increase to ¥22.00 per share reinforces a pattern of consistent cash payouts and signals a confidence from management following a period of rising revenue and profit margins. While this bump in dividends is a positive step for shareholder returns, it doesn’t materially shift the near-term catalysts or big risks. The focus remains on new product launches like the e VITARA electric vehicle, software innovations out of India, and the company’s push for value versus its global auto peers. There’s also persistent attention on board independence and turnover, as well as executive compensation changes. The recent dividend news subtly boosts the investment narrative but doesn’t meaningfully change the balance of growth opportunities and governance concerns shaping Suzuki’s outlook.

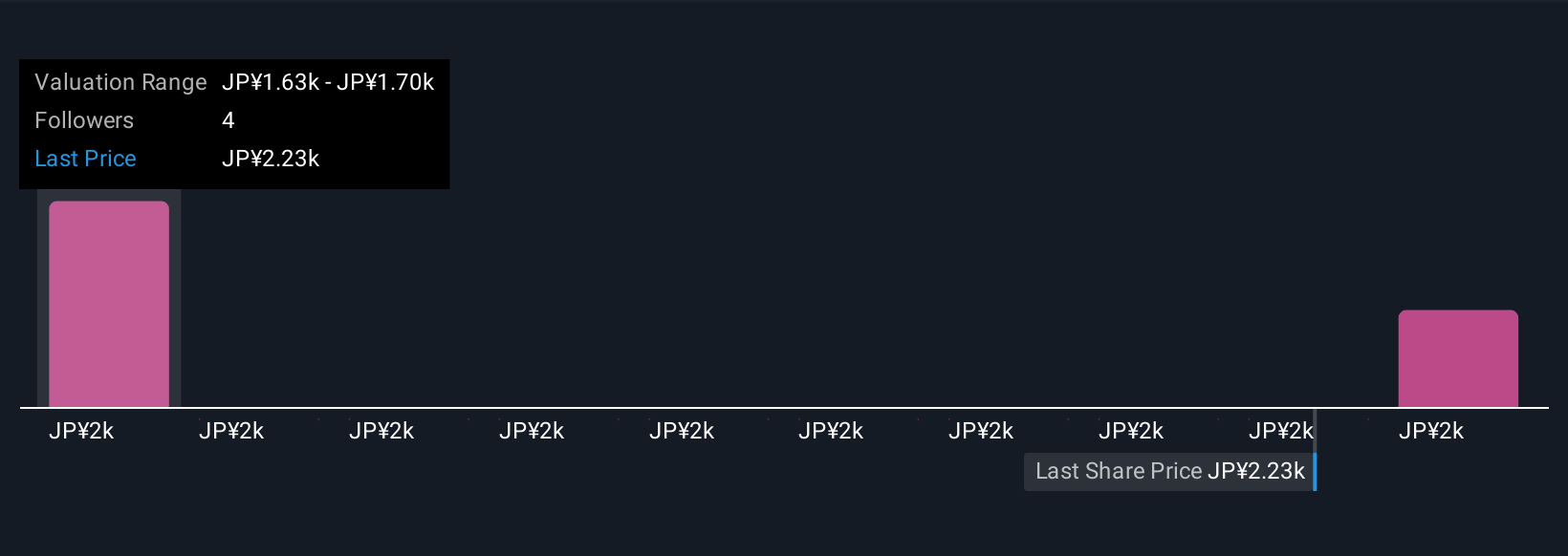

However, investors should pay special attention to the company’s board inexperience and its potential impact. Suzuki Motor's shares are on the way up, but they could be overextended by 27%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Suzuki Motor - why the stock might be worth as much as 12% more than the current price!

Build Your Own Suzuki Motor Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Suzuki Motor research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Suzuki Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Suzuki Motor's overall financial health at a glance.

No Opportunity In Suzuki Motor?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7269

Suzuki Motor

Engages in the manufacture and sale of automobiles, motorcycles, outboard motors, electric wheelchairs, and other products in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives