How Investors May Respond To Honda Motor (TSE:7267) Raising Dividends Despite Lower Earnings

Reviewed by Sasha Jovanovic

- Honda Motor Co., Ltd. recently reported half-year financial results, updated its full-year guidance, and announced a second-quarter dividend increase to ¥35.00 per share, with payment beginning December 5, 2025.

- Amidst earnings and profit declines, the company raised its interim dividend, highlighting its intent to maintain shareholder returns even as market conditions shift.

- We'll examine how Honda's decision to increase its interim dividend shapes the company's investment narrative and future prospects.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Honda Motor Investment Narrative Recap

To believe in Honda Motor as a shareholder, you need confidence in its ability to harness earnings from its motorcycle segment and pursue growth through localization and hybrid technology, despite sustained pressure from competitive and regulatory forces in the global auto industry. The recent interim dividend increase sends a positive signal on commitment to shareholder returns; nevertheless, it does not materially alter the near-term focus on execution of Honda’s electrification strategy, still the most important catalyst, or meaningfully reduce exposure to the key risk of market share erosion in core regions.

Among the latest announcements, Honda’s update to its full-year earnings guidance stands out. Lowered profit projections highlight the urgency around margin compression and competitive threats, reinforcing why stabilizing operating performance is closely watched by investors considering the company’s future trajectory.

Yet, while dividend increases can draw attention, investors should be aware that mounting competitive pressure in China and beyond puts Honda's long-term growth path at real risk if...

Read the full narrative on Honda Motor (it's free!)

Honda Motor's narrative projects ¥22,320.2 billion revenue and ¥855.5 billion earnings by 2028. This requires 1.1% yearly revenue growth and a ¥217.7 billion increase in earnings from ¥637.8 billion today.

Uncover how Honda Motor's forecasts yield a ¥1738 fair value, a 13% upside to its current price.

Exploring Other Perspectives

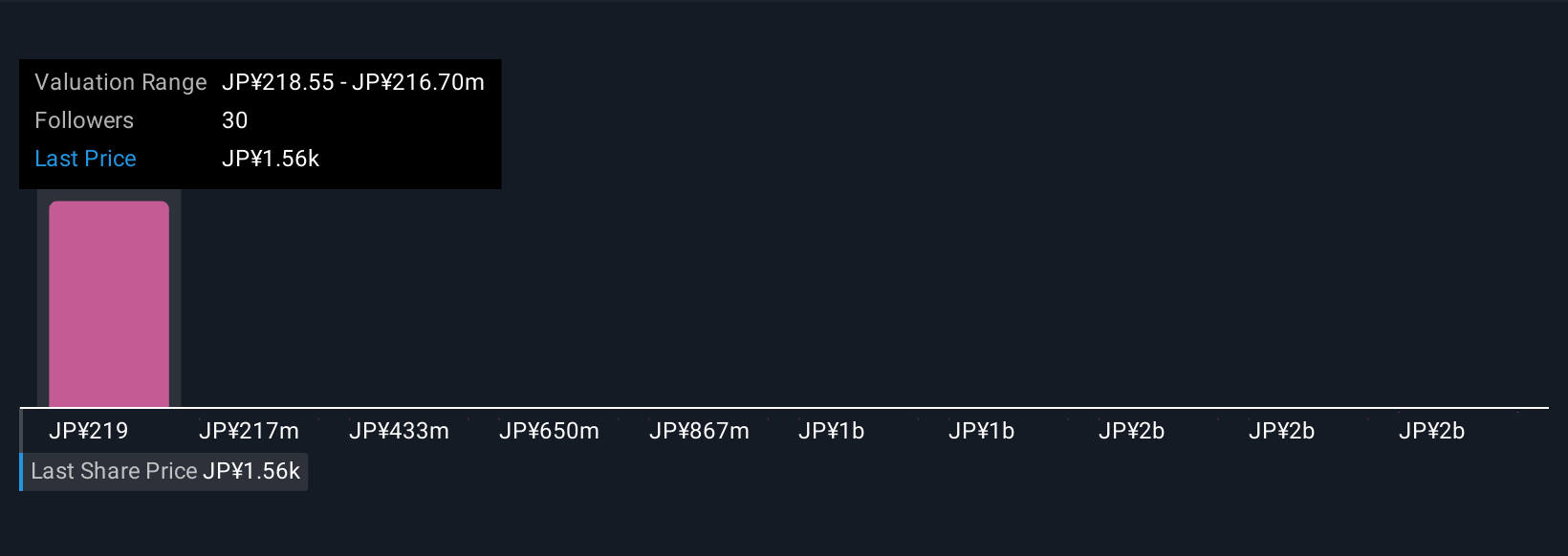

Four individual fair value estimates from the Simply Wall St Community span ¥218.55 to ¥1,845.13 per share, showing a broad range of outlooks. Lingering competitive risks in key markets may explain why opinions differ so sharply, it's worth exploring several alternative viewpoints to weigh these implications for Honda's future.

Explore 4 other fair value estimates on Honda Motor - why the stock might be worth as much as 20% more than the current price!

Build Your Own Honda Motor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Honda Motor research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Honda Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Honda Motor's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honda Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7267

Honda Motor

Develops, manufactures, and distributes motorcycles, automobiles, and power products in Japan, North America, Europe, Asia, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives