Honda (TSE:7267) Valuation: Is the Recent Share Price Drift a Potential Opportunity?

Reviewed by Simply Wall St

Honda Motor (TSE:7267) shares have edged down about 2% over the past week, even as recent trading volumes held steady. For investors, the stock’s mild drift may point to shifting sentiment after its positive growth over the past month.

See our latest analysis for Honda Motor.

Zooming out, Honda Motor’s current share price has dipped slightly from recent highs, but the bigger story is its long-haul resilience. While short-term share price returns have softened, the company’s one-year total shareholder return sits at 7.1%, and its five-year total return has climbed a remarkable 120.5%. These are clear signals that longer-term momentum remains intact despite near-term fluctuations.

If Honda’s steady upward trend makes you wonder about the rest of the sector, check out See the full list for free..

With such strong long-term returns and healthy fundamentals, is Honda Motor’s gradual pullback a rare opportunity to buy in at a discount, or is the market simply reflecting optimism for its future growth?

Most Popular Narrative: 10.6% Undervalued

Honda Motor’s most popular narrative suggests the stock is trading below its fair value estimate of ¥1,744.38, compared to a last close of ¥1,560. This gap points to optimism about Honda’s long-term growth drivers and profitability improvements that may not be fully captured in the current share price.

Ongoing cost optimization through price revisions, operational efficiencies, and expanding use of common platforms across models is improving cost structure and profitability. This is expected to support higher long-term net margins and earnings stability, even amidst short-term pressures from tariffs and currency fluctuations.

Want to know what the narrative is banking on for Honda’s next chapter? The real story centers on ambitious earnings upgrades, margin expansion and a future profit multiple well below the sector norm. Discover what sets these financial targets apart and why analyst calculations hint at greater upside.

Result: Fair Value of ¥1,744.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent EV business losses and declining auto sales in key Asian markets could challenge Honda's growth trajectory and put pressure on future earnings.

Find out about the key risks to this Honda Motor narrative.

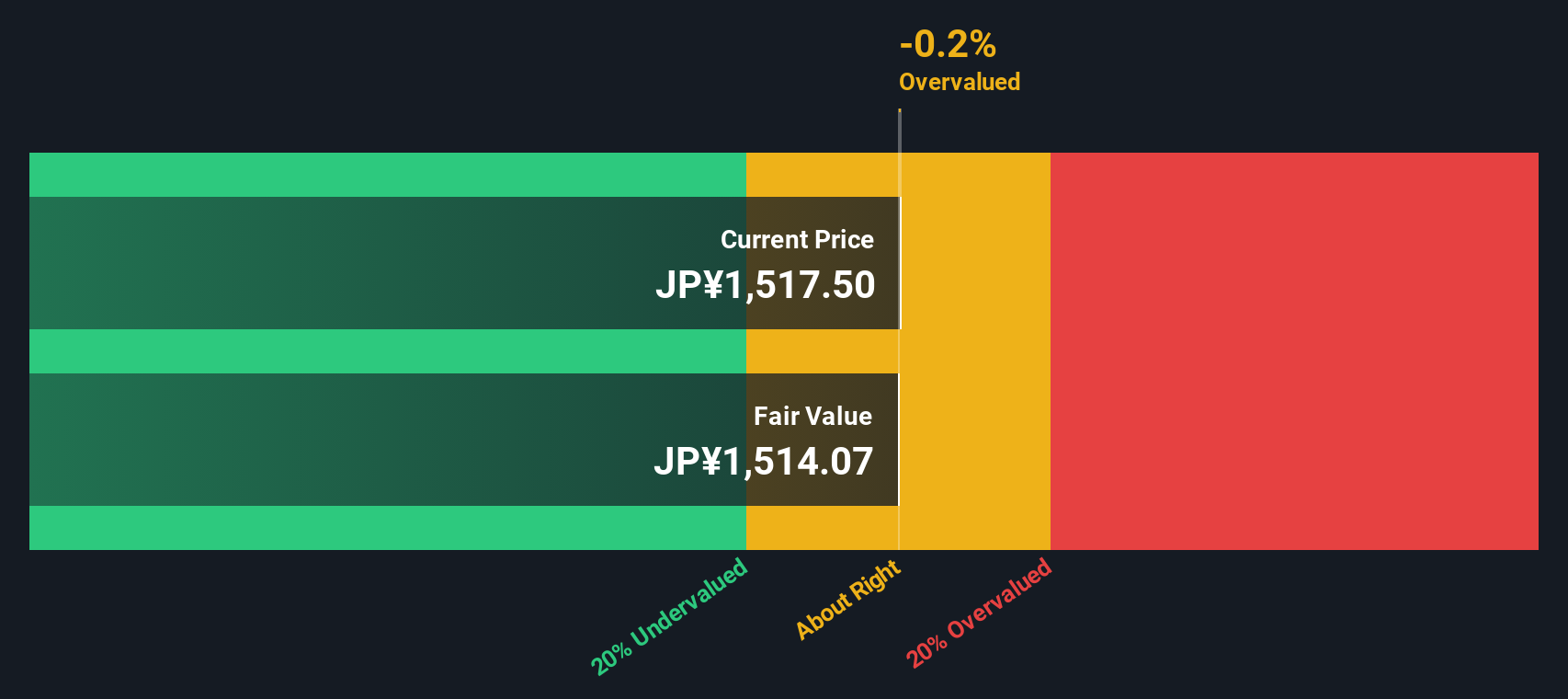

Another View: SWS DCF Model

While the consensus fair value estimate relies on analyst forecasts and multiples, our SWS DCF model takes a closer look at Honda Motor's expected future cash flows. According to this approach, Honda appears fairly valued at current levels. However, because models can differ, investors may need to consider whether to trust the market's outlook or the numbers behind the DCF.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Honda Motor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 839 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Honda Motor Narrative

If you think the story goes in a different direction, or you prefer to dig into the data yourself, you can have your say and craft a personal view in just a few minutes. Do it your way

A great starting point for your Honda Motor research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stand still. Expand your opportunities by checking out hand-picked stock ideas that fit a wide range of strategies and goals right now.

- Start earning more from your portfolio with higher-yield picks by tapping into these 22 dividend stocks with yields > 3% offering attractive returns above 3%.

- Capture the momentum of artificial intelligence by scanning these 26 AI penny stocks driving innovations across every sector.

- Get ahead of the market with great value opportunities among these 839 undervalued stocks based on cash flows based on robust cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honda Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7267

Honda Motor

Develops, manufactures, and distributes motorcycles, automobiles, and power products in Japan, North America, Europe, Asia, and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives