As global markets navigate the uncertainties surrounding the incoming Trump administration and fluctuating interest rate expectations, investors are keenly observing sector performances and economic indicators. Amidst this backdrop, dividend stocks continue to attract attention for their potential to provide steady income streams, particularly in times of market volatility. When considering dividend stocks, it's essential to focus on companies with a strong track record of consistent payouts and financial stability, which can offer some degree of resilience against broader market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.68% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.13% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.74% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.47% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.83% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.55% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

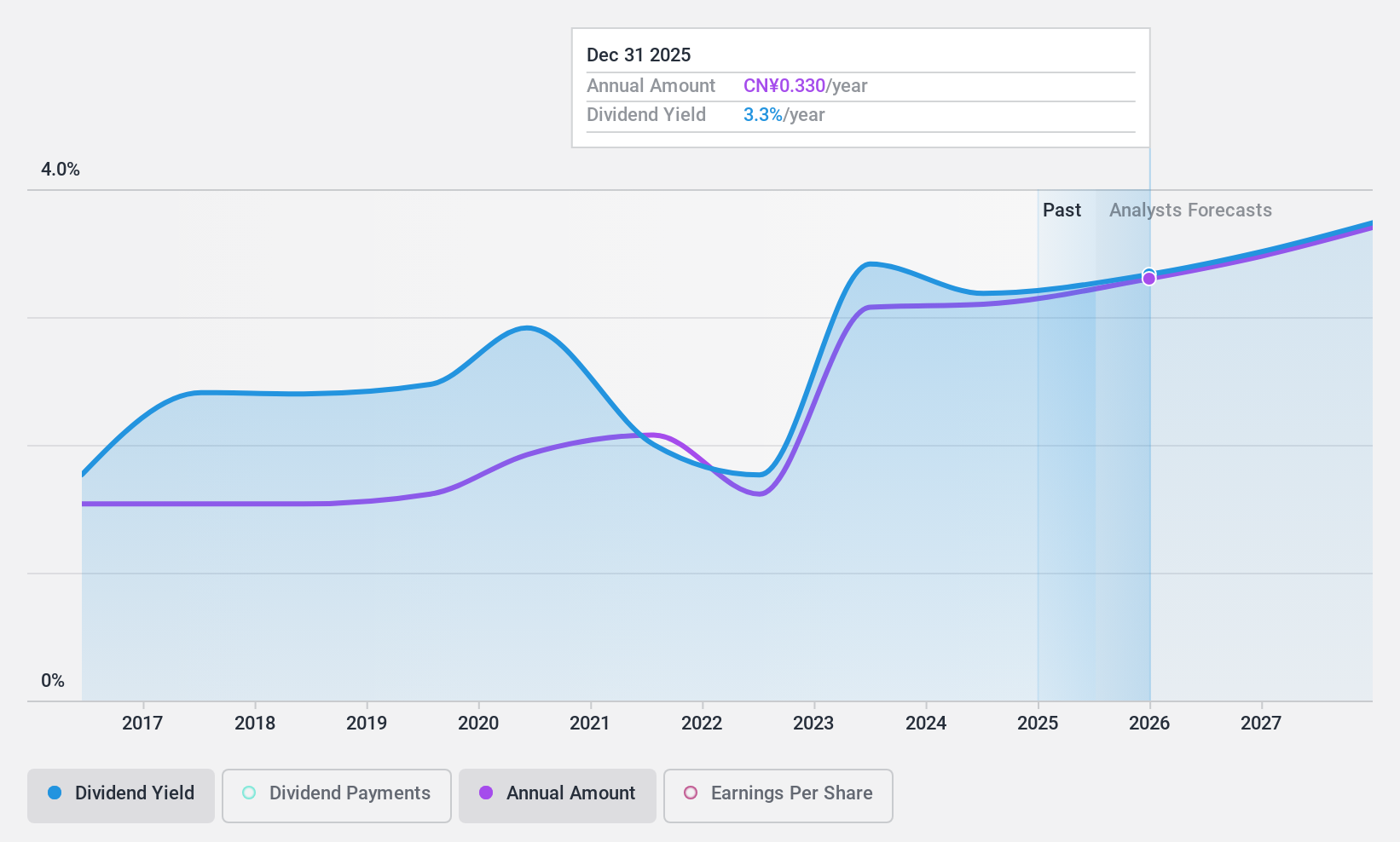

Fujian Funeng (SHSE:600483)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fujian Funeng Co., Ltd. operates in the power generation sector in China with a market capitalization of approximately CN¥26.51 billion.

Operations: Fujian Funeng Co., Ltd.'s revenue primarily comes from its power generation operations in China.

Dividend Yield: 3.1%

Fujian Funeng's dividend payments, though covered by earnings and cash flows with payout ratios of 28.7% and 35.6%, respectively, have been volatile over its nine-year history. The company reported CNY 1.77 billion in net income for the first nine months of 2024, indicating profitability but has a high debt level and diluted shareholders recently. Trading at a price-to-earnings ratio of 9.6x, it offers good value compared to peers with a top-tier dividend yield in the CN market at 3.11%.

- Delve into the full analysis dividend report here for a deeper understanding of Fujian Funeng.

- Insights from our recent valuation report point to the potential undervaluation of Fujian Funeng shares in the market.

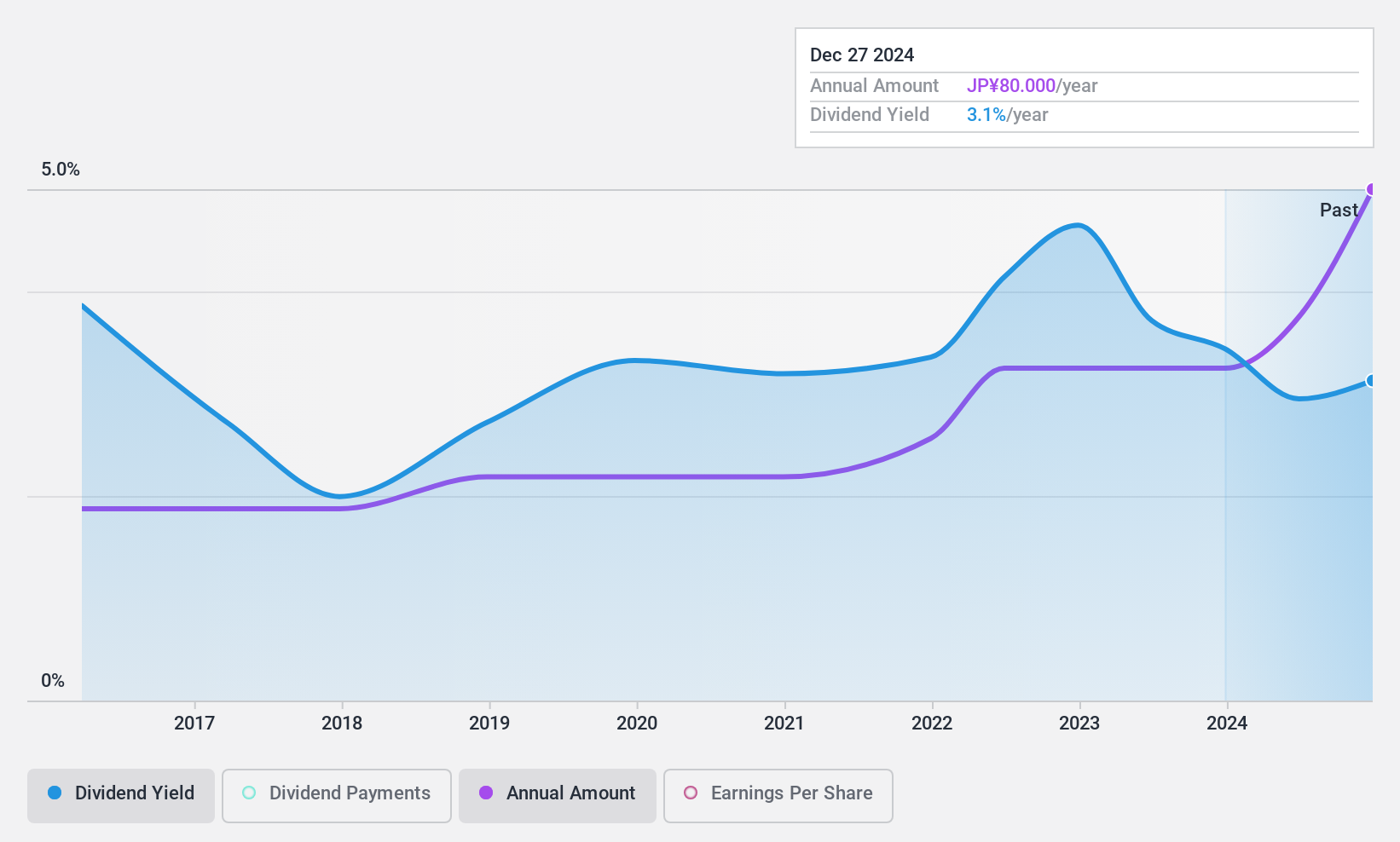

Yamabiko (TSE:6250)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yamabiko Corporation, along with its subsidiaries, manufactures and sells agricultural machinery across Japan, Europe, the United States, and other international markets with a market cap of ¥104.63 billion.

Operations: Yamabiko Corporation generates revenue through the manufacturing and sale of agricultural machinery in various regions, including Japan, Europe, the United States, and other international markets.

Dividend Yield: 3.1%

Yamabiko offers a stable dividend profile with consistent growth over the past decade, supported by a low payout ratio of 31.6%, ensuring dividends are well-covered by earnings and cash flows. The current yield of 3.14% is reliable but below the JP market's top tier. With a price-to-earnings ratio of 8.4x, it presents good value in comparison to the broader market, alongside robust recent earnings growth of 73.4%.

- Unlock comprehensive insights into our analysis of Yamabiko stock in this dividend report.

- Our valuation report here indicates Yamabiko may be overvalued.

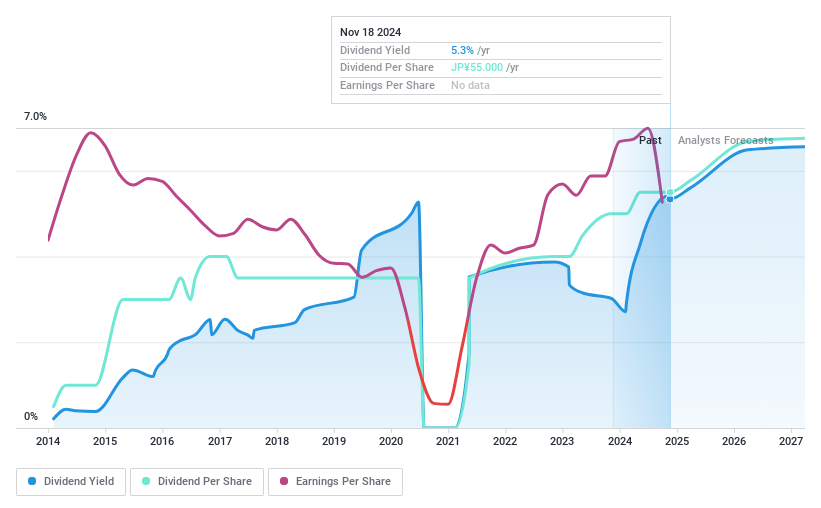

Mazda Motor (TSE:7261)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mazda Motor Corporation manufactures and sells passenger cars and commercial vehicles across Japan, the United States, North America, Europe, and other international markets with a market cap of approximately ¥649.26 billion.

Operations: Mazda Motor Corporation's revenue segments include ¥3.81 billion from Japan, ¥0.82 billion from Europe, ¥3.26 billion from North America, and ¥0.68 billion from other regions.

Dividend Yield: 5.3%

Mazda Motor's dividend yield of 5.34% ranks in the top 25% of JP market payers, supported by a low payout ratio of 25.7%, ensuring sustainability through earnings and cash flow coverage. Despite recent guidance revisions lowering net income forecasts, dividends remain stable with a JPY 30 per share annual expectation. However, its dividend history is marked by volatility and unreliability over the past decade, although it trades below estimated fair value, offering potential relative value.

- Dive into the specifics of Mazda Motor here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Mazda Motor is priced lower than what may be justified by its financials.

Make It Happen

- Get an in-depth perspective on all 1962 Top Dividend Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7261

Mazda Motor

Engages in the manufacture and sale of passenger cars and commercial vehicles in Japan, the United States, North America, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.