Can Mazda (TSE:7261) Turn Next-Gen Tech Into a Lasting Competitive Edge?

Reviewed by Sasha Jovanovic

- Mazda Motor Corporation recently unveiled two concept vehicles, the MAZDA VISION X-COUPE and MAZDA VISION X-COMPACT, showcasing innovative hybrid and AI-driven technologies, alongside the European debut of the all-new MAZDA CX-5 featuring advanced vehicle architecture and design.

- These announcements highlight Mazda's commitment to sustainable mobility and emotional connectivity, blending next-generation powertrains with smart, human-centered technologies.

- We'll explore how Mazda's integration of carbon capture technology into vehicle design could influence the company's long-term investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Mazda Motor's Investment Narrative?

If you’re considering Mazda Motor stock, the investment case really comes down to how much you believe in the company's ability to transform years of traditional engineering into a new story of innovative, sustainable mobility. The recent showcase of the MAZDA VISION X-COUPE and X-COMPACT firmly signals Mazda’s ambition to move beyond incremental updates and push into meaningful hybrid technology, in-car AI, and even carbon capture integration. These announcements may not be immediate revenue drivers or change short-term results, but they have the potential to reshape Mazda’s long-term direction and investor perception. That said, the most important short-term catalysts still seem anchored in profitability and U.S. tariff headwinds, while the main risks, limited revenue growth, low returns, high valuation multiples, and ongoing margin pressure, remain. For now, the news event reinforces Mazda’s vision but does not materially shift the immediate risk-reward tradeoff.

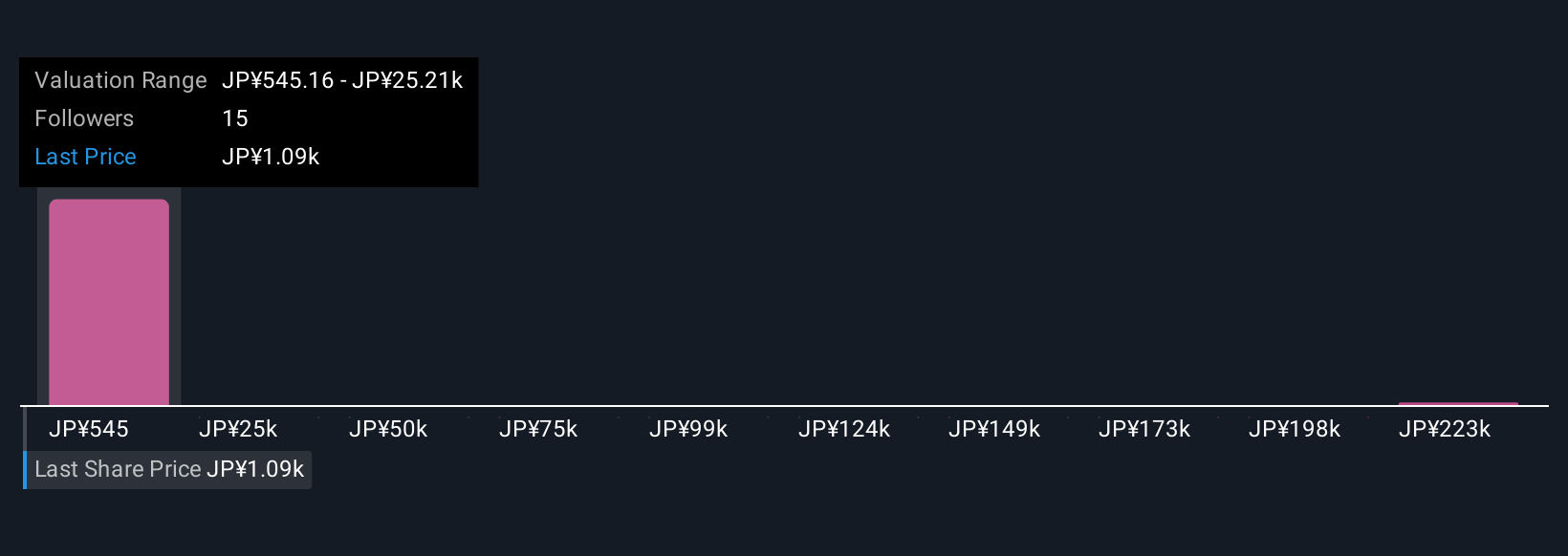

But while new tech is promising, margin pressure is an immediate concern for investors. Despite retreating, Mazda Motor's shares might still be trading 22% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 8 other fair value estimates on Mazda Motor - why the stock might be a potential multi-bagger!

Build Your Own Mazda Motor Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mazda Motor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Mazda Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mazda Motor's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7261

Mazda Motor

Engages in the manufacture and sale of passenger cars and commercial vehicles in Japan, North America, Europe, and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives