- Japan

- /

- Auto Components

- /

- TSE:7250

Pacific Industrial (TSE:7250) Margin Decline Challenges Quality-Narrative Despite Discount to Fair Value

Reviewed by Simply Wall St

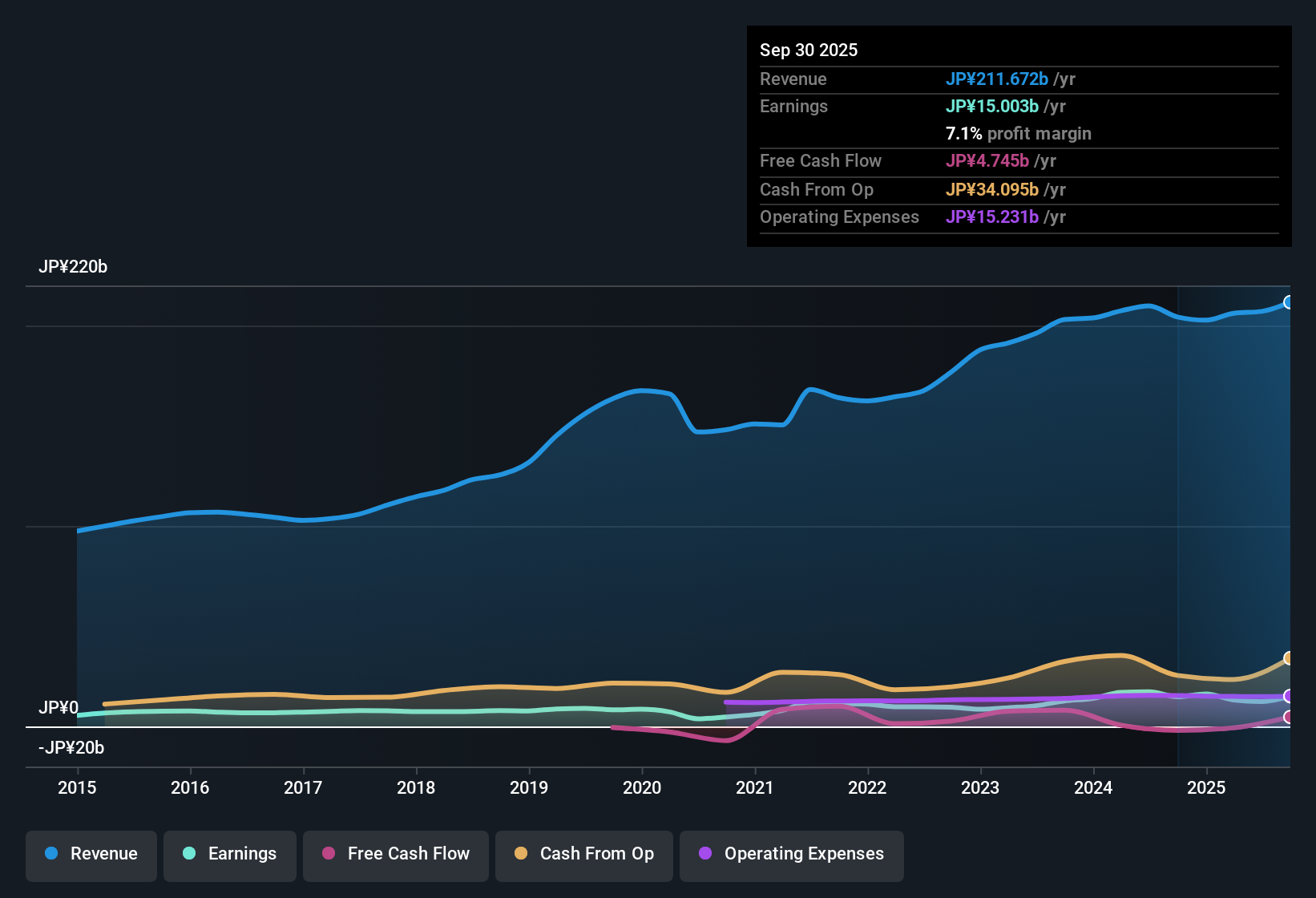

Pacific Industrial (TSE:7250) posted average annual earnings growth of 15.5% over the last five years, but its current earnings margin slipped to 6% from 8.2% a year earlier. Revenue is forecast to grow by 3.3% per year, slower than the overall Japanese market’s projected 4.5%, while earnings are expected to expand at 5.8% per year, also lagging the market’s 8% outlook. Despite the recent margin compression and negative earnings growth in the latest period, the company trades at ¥2,920 per share, well below its estimated fair value, offering a potential opportunity for value investors amid more tempered growth prospects.

See our full analysis for Pacific Industrial.Next, we will compare these numbers to the prevailing market narratives to see where the data aligns and where it might challenge expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Under Pressure While Quality Persisted

- Net profit margin dropped to 6% from 8.2% last year, highlighting a squeeze on profitability even as historical five-year earnings growth clocked in at a solid 15.5% annually.

- Despite the margin slip, the prevailing market view sees Pacific Industrial's established track record of high-quality earnings supporting confidence in continued profit growth moving forward.

- Forecasters expect profits to keep expanding at 5.8% per year, which, while not exceptional, still signals respectable durability as the sector transforms.

- This reinforces the idea that recent pressures have not erased the company's strengths, but do mean investors are balancing optimism about earnings durability against the evidence of compression.

Valuation Gap Versus Peers Grows

- Pacific Industrial trades at a price-to-earnings ratio of 13.6x, which is above its peer group average of 11.7x and the industry’s 12.2x, even as its ¥2,920 share price sits far below the DCF fair value estimate of ¥12,704.39.

- The prevailing market view weighs the valuation premium alongside the sizable discount to DCF fair value, laying out a complex scenario for investors:

- Some see the steep discount versus DCF as a compelling reason to consider the stock undervalued, especially for value-focused investors unconcerned by near-term growth lags.

- Others question whether the above-peer P/E is justified given the company’s slower expected profit expansion relative to the broader Japanese market, reflecting an ongoing push and pull between value and growth priorities.

Dividend Sustainability Faces Minor Risk

- There is a minor risk noted in the filings around dividend sustainability, though no major red flags were cited and the company’s fundamentals otherwise appear steady.

- The prevailing market view treats the modest dividend risk as a manageable concern amid the company’s consistent sector positioning and preference among investors for reliability.

- Given the company’s stable operations and ongoing profitability, the sustainability risk does not appear to be a major obstacle for most investors right now.

- If any material change in payout arises, it would likely have a greater impact on those investors primarily seeking steady income rather than capital gains.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Pacific Industrial's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Amid squeezed profit margins and slower projected growth, Pacific Industrial faces ongoing questions about whether its valuation premium is justified given its lackluster earnings momentum.

If you prefer more reliable growth and steadier performance, focus on stable growth stocks screener (2117 results) to discover companies with a strong record of consistent expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7250

Pacific Industrial

Manufactures and sells sell compressor-related products and electronic equipment in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives