Mikuni Corporation (TSE:7247) will increase its dividend from last year's comparable payment on the 1st of July to ¥15.00. Even though the dividend went up, the yield is still quite low at only 2.1%.

View our latest analysis for Mikuni

Mikuni's Distributions May Be Difficult To Sustain

If it is predictable over a long period, even low dividend yields can be attractive. Even though Mikuni is not generating a profit, it is still paying a dividend. Along with this, it is also not generating free cash flows, which raises concerns about the sustainability of the dividend.

Looking forward, earnings per share could 8.2% over the next year if the trend of the last few years can't be broken. This means the company won't be turning a profit, which could place managers in the tough spot of having to choose between suspending the dividend or putting more pressure on the balance sheet.

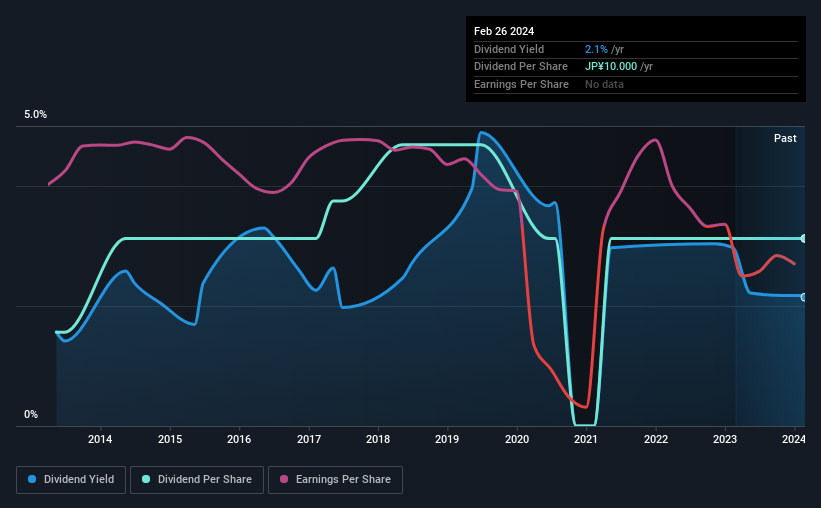

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The dividend has gone from an annual total of ¥5.00 in 2014 to the most recent total annual payment of ¥10.00. This means that it has been growing its distributions at 7.2% per annum over that time. A reasonable rate of dividend growth is good to see, but we're wary that the dividend history is not as solid as we'd like, having been cut at least once.

Dividend Growth Is Doubtful

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Over the past five years, it looks as though Mikuni's EPS has declined at around 8.2% a year. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends.

We're Not Big Fans Of Mikuni's Dividend

Overall, while the dividend being raised can be good, there are some concerns about its long term sustainability. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. Overall, the dividend is not reliable enough to make this a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 3 warning signs for Mikuni that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7247

Mikuni

Manufactures and sells automobile related products in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion