- Japan

- /

- Auto Components

- /

- TSE:7238

There May Be Underlying Issues With The Quality Of Akebono Brake Industry's (TSE:7238) Earnings

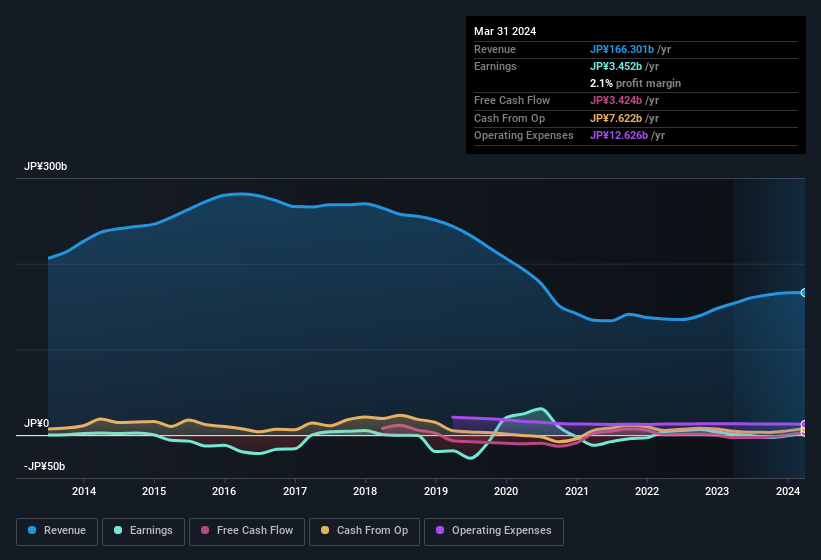

Despite announcing strong earnings, Akebono Brake Industry Co., Ltd.'s (TSE:7238) stock was sluggish. Our analysis uncovered some concerning factors that we believe the market might be paying attention to.

Check out our latest analysis for Akebono Brake Industry

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Akebono Brake Industry's profit received a boost of JP¥327m in unusual items, over the last year. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Akebono Brake Industry.

Our Take On Akebono Brake Industry's Profit Performance

Arguably, Akebono Brake Industry's statutory earnings have been distorted by unusual items boosting profit. Therefore, it seems possible to us that Akebono Brake Industry's true underlying earnings power is actually less than its statutory profit. But the happy news is that, while acknowledging we have to look beyond the statutory numbers, those numbers are still improving, with EPS growing at a very high rate over the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. In terms of investment risks, we've identified 1 warning sign with Akebono Brake Industry, and understanding this should be part of your investment process.

Today we've zoomed in on a single data point to better understand the nature of Akebono Brake Industry's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7238

Akebono Brake Industry

Manufactures and sells brakes for automobiles, industrial machinery and railway vehicles in Japan, North America, Europe, China, Thailand, and Indonesia.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives