- Japan

- /

- Auto Components

- /

- TSE:7236

T.RAD Co., Ltd. (TSE:7236) Soars 32% But It's A Story Of Risk Vs Reward

T.RAD Co., Ltd. (TSE:7236) shareholders have had their patience rewarded with a 32% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 31% in the last year.

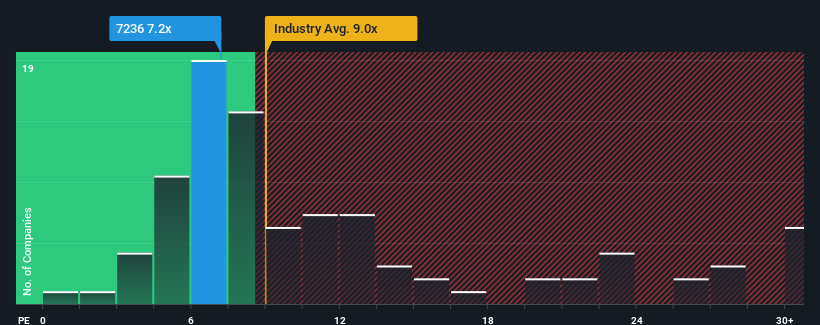

Although its price has surged higher, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 13x, you may still consider T.RAD as an attractive investment with its 7.2x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

We've discovered 2 warning signs about T.RAD. View them for free.Recent times have been quite advantageous for T.RAD as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for T.RAD

How Is T.RAD's Growth Trending?

In order to justify its P/E ratio, T.RAD would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 243%. EPS has also lifted 29% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

It's interesting to note that the rest of the market is similarly expected to grow by 9.3% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that T.RAD's P/E sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

Despite T.RAD's shares building up a head of steam, its P/E still lags most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of T.RAD revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching the company's performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 2 warning signs for T.RAD that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if T.RAD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7236

T.RAD

Engages in the research and development, manufacture, and sale of heat exchangers for automobiles, construction and industrial machines, air conditioners, generators, and others in Japan, the United States, China, rest of Asia, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives