Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Mitsubishi Motors Corporation (TSE:7211) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Mitsubishi Motors

What Is Mitsubishi Motors's Net Debt?

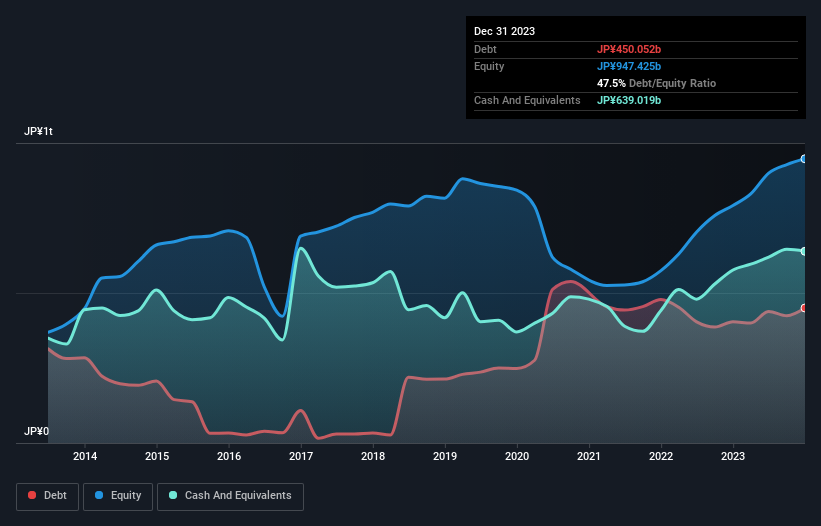

The image below, which you can click on for greater detail, shows that at December 2023 Mitsubishi Motors had debt of JP¥450.1b, up from JP¥404.1b in one year. But it also has JP¥639.0b in cash to offset that, meaning it has JP¥189.0b net cash.

How Strong Is Mitsubishi Motors' Balance Sheet?

We can see from the most recent balance sheet that Mitsubishi Motors had liabilities of JP¥1.18t falling due within a year, and liabilities of JP¥219.3b due beyond that. Offsetting these obligations, it had cash of JP¥639.0b as well as receivables valued at JP¥365.9b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by JP¥391.3b.

Mitsubishi Motors has a market capitalization of JP¥759.8b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. Despite its noteworthy liabilities, Mitsubishi Motors boasts net cash, so it's fair to say it does not have a heavy debt load!

The good news is that Mitsubishi Motors has increased its EBIT by 6.4% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Mitsubishi Motors's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Mitsubishi Motors has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Mitsubishi Motors's free cash flow amounted to 43% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Summing Up

Although Mitsubishi Motors's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of JP¥189.0b. On top of that, it increased its EBIT by 6.4% in the last twelve months. So we don't have any problem with Mitsubishi Motors's use of debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for Mitsubishi Motors you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7211

Mitsubishi Motors

Engages in the development, production, and sale of passenger vehicles, and related parts and components in Japan, Europe, North America, Oceania, the rest of Asia, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success