Mitsubishi Motors (TSE:7211) Seen Outpacing Market Expectations With Path to Profitability Challenging Dividend Narrative

Reviewed by Simply Wall St

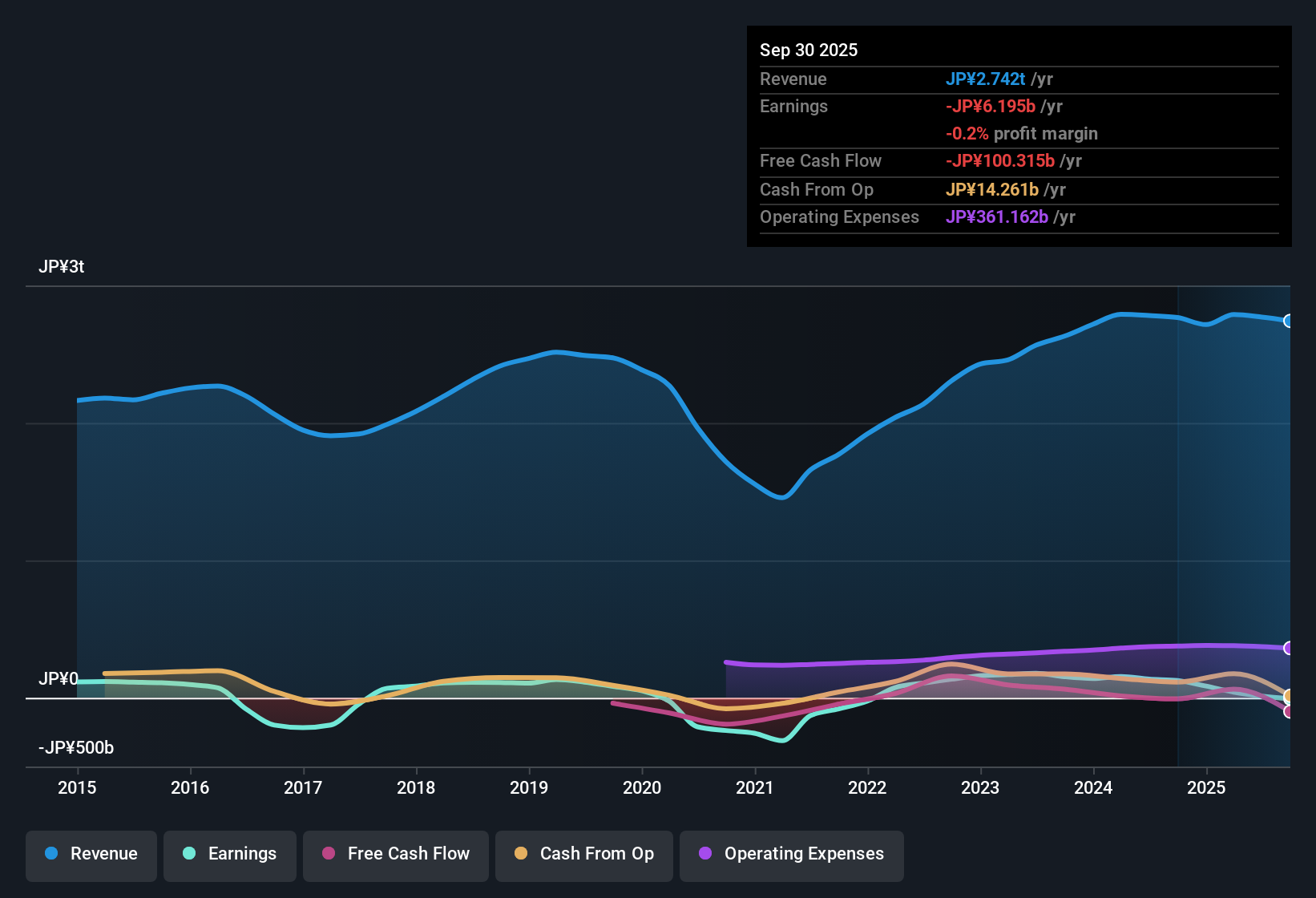

Mitsubishi Motors (TSE:7211) is expected to shift into profitability within the next three years, outpacing average market growth expectations. Losses have narrowed at an impressive rate of 46.5% per year over the past five years, and earnings are now projected to accelerate by 57.26% per year. With a solid trajectory toward positive net income and revenues set to grow at 3.3% annually, the stage is set for investors to evaluate the balance between swift profit growth and slightly lagging top-line expansion compared to the broader Japanese market.

See our full analysis for Mitsubishi Motors.The next section puts these headline numbers head-to-head with prevailing market narratives, revealing where the data confirms consensus and where it might offer a surprise.

See what the community is saying about Mitsubishi Motors

Price-to-Sales at 0.2x Signals Undervalued vs. Peers

- Mitsubishi Motors trades at a Price-to-Sales ratio of 0.2x, which is half the 0.4x average of its direct peers and well below the broader Asian Auto industry’s 0.9x.

- Analysts' consensus view highlights:

- Relative valuation supports the bullish angle that Mitsubishi is favorably priced for those prioritizing value. However, this is tempered by muted revenue growth projections of just 3.3% per year, trailing the Japanese market average of 4.4%.

- The narrow 2.3% gap between the current share price (357.5) and the analyst price target (420.83) indicates that most analysts believe the stock is fairly valued, which could potentially limit near-term upside unless growth initiatives outperform.

Consensus narrative notes that these valuation traits set the stage for a pivotal shift if future growth outpaces the cautious consensus view. 📊 Read the full Mitsubishi Motors Consensus Narrative.

Profit Margins Forecast to Climb from 0.4% to 2.1%

- Profit margins are expected to improve substantially, with forecasts showing an increase from 0.4% today to 2.1% over the next three years.

- Analysts' consensus view spotlights two crosscurrents:

- Upcoming launches of new hybrid models and a focus on emerging markets could drive both sales mix and margin expansion beyond the current guidance, supporting the consensus that strategy is addressing growth headwinds.

- However, heightened competition, especially from new Chinese automakers, and increased incentives may pressure net margins. The path to sustained profitability remains dependent on managerial execution in fast-evolving global conditions.

Dividend Sustainability Remains a Key Risk

- Dividend sustainability is identified as the company’s main risk, given the backdrop of ongoing profit reinvestment and only gradual topline growth.

- Analysts' consensus view underscores:

- While Mitsubishi offers relative value and improving profit prospects, weak momentum in cash flow, rising R&D spending, and lagging EV adoption create tension with dividend reliability and longer-term income appeal.

- As the company pivots to more capital-intensive technologies and expands its hybrid rollout, the ability to maintain current dividends comes into question. This highlights an important trade-off between near-term yield and future growth runway for investors.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Mitsubishi Motors on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the figures in a unique way? Share your take and build your narrative in just a few minutes. Do it your way

A great starting point for your Mitsubishi Motors research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Mitsubishi Motors’ modest revenue growth and uncertain dividend stability highlight risks for investors seeking consistent returns and reliable income.

If steady payouts are your priority, discover companies with a stronger track record of income reliability by starting with these 1974 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7211

Mitsubishi Motors

Engages in the development, production, and sale of passenger vehicles, and related parts and components in Japan, Europe, North America, Oceania, the rest of Asia, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives