Toyota (TSE:7203) Margin Decline Challenges Optimistic Narratives Despite Strong Five-Year Earnings Growth

Reviewed by Simply Wall St

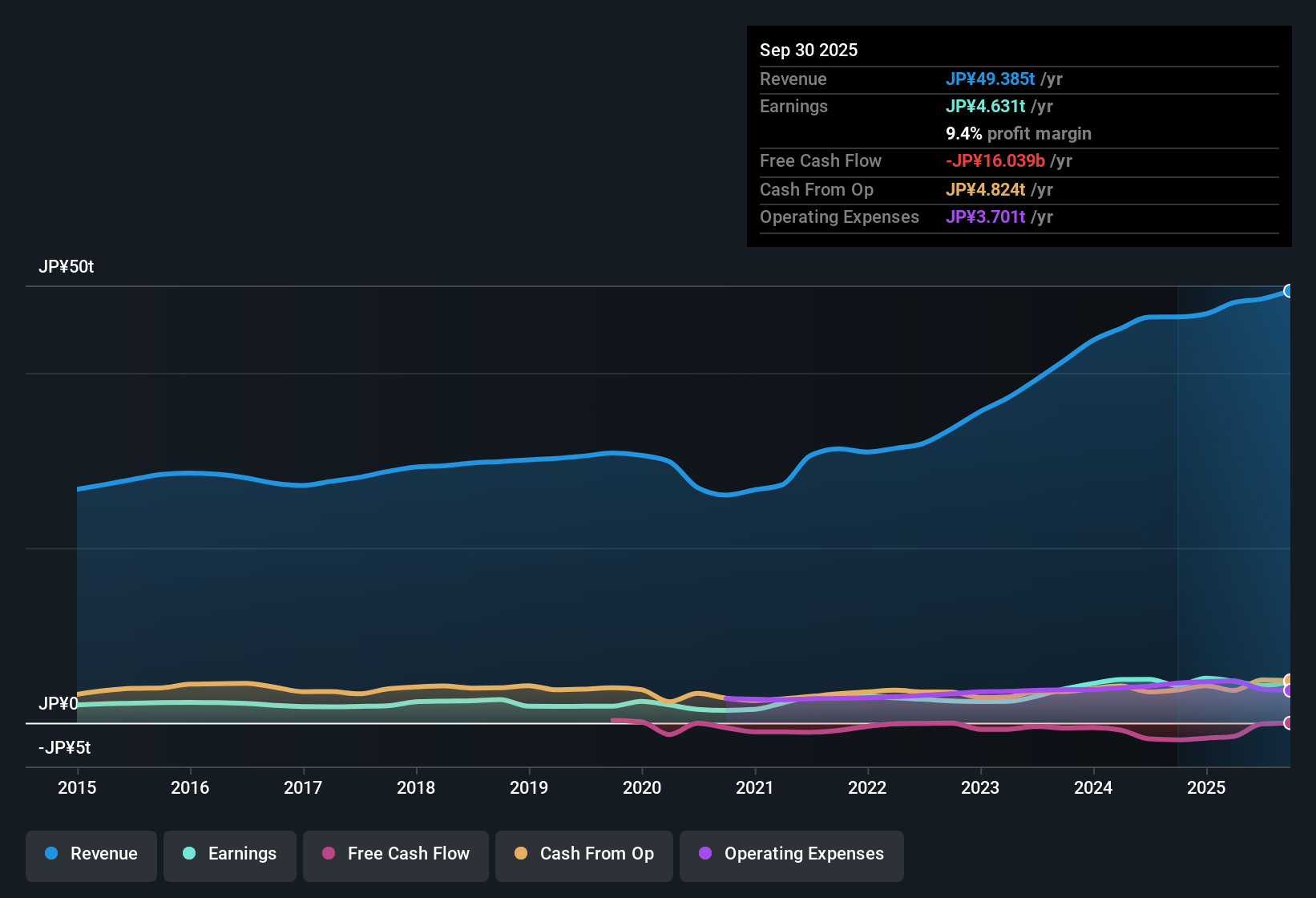

Toyota Motor (TSE:7203) posted an impressive 20.1% annual earnings growth rate over the past five years, with its latest net profit margin at 8.8%, down from 10.7% in the prior year. Looking forward, the company's earnings are forecast to grow 6.1% annually, outpacing projected revenue growth of 2.7% per year. However, both figures trail behind broader Japanese market expectations. Despite robust historical profitability, recent declines in margins and earnings growth add nuance to the overall picture for investors.

See our full analysis for Toyota Motor.Next up, we will see how these latest results measure up to the narratives shaping sentiment. Some long-held beliefs will be confirmed, while others may get a reality check.

See what the community is saying about Toyota Motor

Battery Investments Drive Long-Term Margin Play

- Toyota is investing heavily in internal battery production for both electric and hybrid vehicles, positioning itself in a market with rising electrified vehicle demand.

- According to the analysts' consensus view, these investments should bolster both revenue and margins over time.

- Efforts to optimize battery technology and streamline production could help Toyota address competitive pressures and improve profitability beyond traditional vehicle sales.

- However, the consensus notes production disruptions and currency fluctuations could still put near-term pressure on net income, even with these long-term strategic moves.

Share Price Premium vs DCF Fair Value

- At ¥3,138.00, Toyota’s current share price trades well above the DCF fair value estimate of ¥1,737.23, showing a significant valuation premium that is not justified by discounted cash flow analysis alone.

- Analysts' consensus view highlights this tension, as the market appears to value Toyota higher than underlying earnings forecasts.

- The consensus price target stands at ¥3,298.82, just 5% above the current price, suggesting limited immediate upside compared to the more conservative DCF estimate.

- This gap likely reflects optimism in Toyota’s long-term investments but also underscores the risk if execution or market conditions disappoint.

Dividend and Financial Stability Flags

- Analyst and risk ratings both flag concerns: Toyota is not in a strong financial position (IsInAGoodFinancialPosition: false), and the sustainability of its dividend is also under question (IsDividendSustainable: false).

- Analysts’ consensus view points out that while Toyota has a robust multi-year track record and continues to pursue operational efficiency,

- Financial and dividend risks add complexity to the bull case, highlighting that even with operational improvements, income-oriented investors should stay alert.

- Continued investments and production disruption risks are on watch as they could further impact both margins and dividend policy if not managed carefully.

Get a balanced perspective on how Toyota's strengths and challenges shape its outlook in the full consensus narrative. 📊 Read the full Toyota Motor Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Toyota Motor on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on Toyota's performance? Shape your own outlook by building a personal narrative in just a few minutes. Do it your way

A great starting point for your Toyota Motor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Toyota’s recent margin decline, valuation premium, and flagged financial stability issues highlight risks for investors seeking safer, more resilient balance sheets.

If you want the confidence of sturdier finances, discover solid balance sheet and fundamentals stocks screener (1979 results) that can weather market stress and offer stronger financial footing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7203

Toyota Motor

Designs, manufactures, assembles, and sells passenger vehicles, minivans and commercial vehicles, and related parts and accessories in Japan, North America, Europe, Asia, Central and South America, Oceania, Africa, and the Middle East.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives