Isuzu Motors (TSE:7202): Evaluating Valuation After Latest Share Repurchase Program Update

Reviewed by Simply Wall St

Isuzu Motors (TSE:7202) has shared an update on its share repurchase program, confirming the buyback of more than 18 million shares by October 2025. The buyback, set to continue into next year, is intended to strengthen shareholder value and refine the company’s capital approach.

See our latest analysis for Isuzu Motors.

Momentum for Isuzu Motors has been under some pressure this year, with the share price edging down about 11% year-to-date. However, its long-term total shareholder return still stands out, delivering over 24% across three years and an impressive 144% over five. The company’s latest buyback activity appears to be supporting confidence, particularly given the steady performance and recent improvements in profitability.

If Isuzu’s recent moves have you interested in broader industry opportunities, this is a great moment to explore See the full list for free.

Given these recent buybacks and steady fundamentals, investors might wonder: Is Isuzu Motors currently trading below its true worth, or has the market already factored in its future growth prospects fully? Is there a genuine buying opportunity here?

Most Popular Narrative: 12% Undervalued

Isuzu Motors is trading at ¥1,900.5, nearly 12% below the narrative’s fair value of ¥2,164. Analysts see a modest but credible upside as company fundamentals and capital allocation strategies remain in focus.

Isuzu's strategy to leverage its midterm management plan, ISUZU Transformation IX, and focus on becoming a commercial mobility solutions company by 2030 could lead to innovative products and services. This shift may also improve net margins through a diversified product lineup.

Curious which aggressive growth targets underlie this call? The narrative hinges on a bold multi-year leap in profits and a recalibrated future earnings multiple. Only by exploring the full perspective will you see the assumptions driving this valuation.

Result: Fair Value of ¥2,164 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising material costs and yen appreciation could limit future profitability. It is worth watching how Isuzu navigates these potential headwinds.

Find out about the key risks to this Isuzu Motors narrative.

Another View: What If the Numbers Don’t Fully Agree?

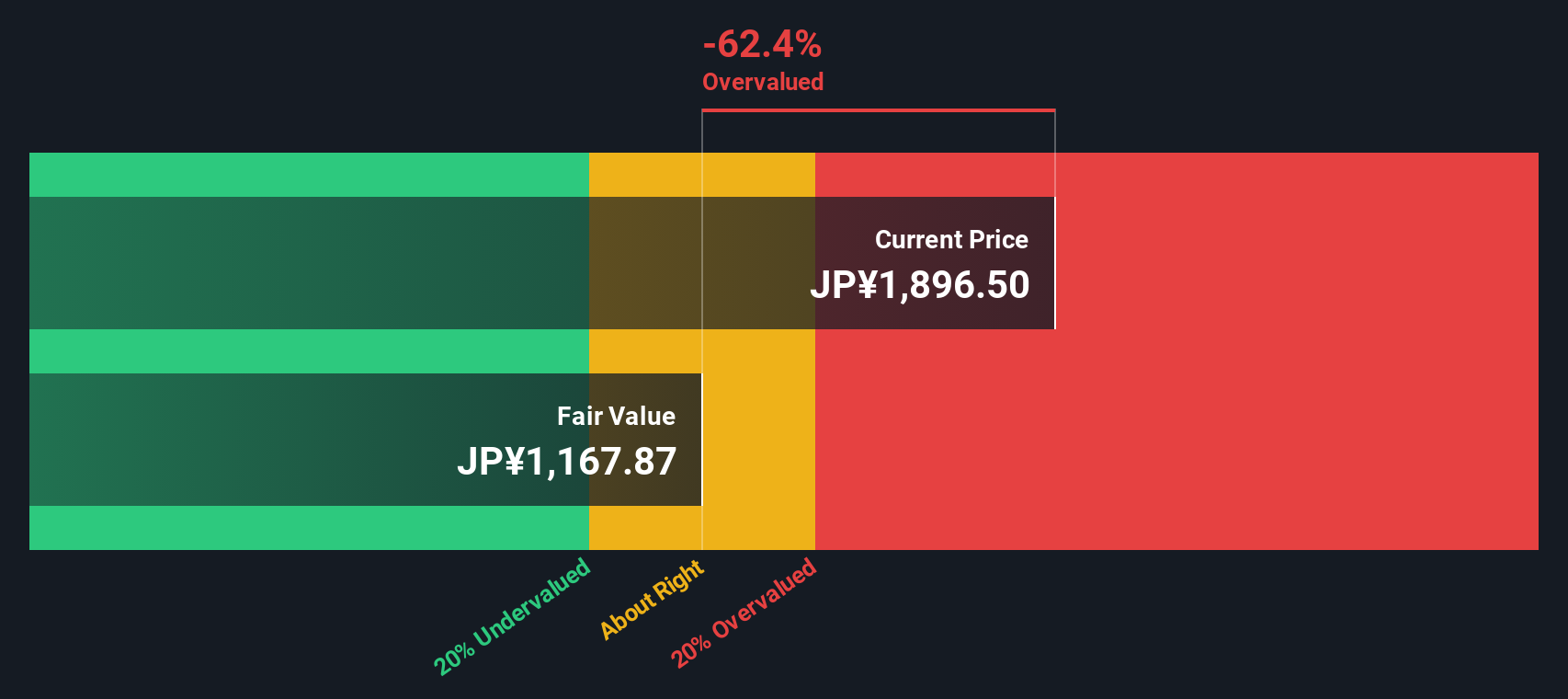

While analyst price targets suggest Isuzu Motors is undervalued, our SWS DCF model indicates the shares actually trade above their intrinsic fair value. This difference raises a crucial question: can momentum and earnings growth justify today’s price, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Isuzu Motors for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Isuzu Motors Narrative

If you have your own perspective on Isuzu Motors or want to dive deeper into the numbers, it only takes a few minutes to shape a narrative of your own. Do it your way

A great starting point for your Isuzu Motors research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take the lead and grow your portfolio with stocks handpicked for unique opportunities. The best investors act before everyone else catches on.

- Unlock potential with these 17 dividend stocks with yields > 3%, which consistently offer attractive yields beyond the market average.

- Spot tomorrow’s winners by starting with these 3597 penny stocks with strong financials, featuring up-and-coming companies demonstrating strong financials.

- Seize bargains by targeting these 848 undervalued stocks based on cash flows, as some experts believe these may be trading well below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7202

Isuzu Motors

Manufactures and sells commercial vehicles, light commercial vehicles, and diesel engines and components worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives