- Japan

- /

- Auto Components

- /

- TSE:6995

Tokai Rika (TSE:6995): Assessing Valuation After Upgraded Earnings Outlook and Dividend Boost

Reviewed by Simply Wall St

Tokai Rika (TSE:6995) captured investor attention after the company raised its full-year earnings guidance. The company reported higher projections for sales and profits, along with an increase in its upcoming dividend distribution.

See our latest analysis for Tokai Rika.

The upbeat guidance and dividend hike come after a steady run for Tokai Rika’s stock. The company’s 12% share price return over the past month and 29% gain year-to-date suggest momentum is building, supported by a robust 42% total shareholder return over the last year.

If Tokai Rika’s positive run has you thinking about where the next opportunities might be, take a look at other automaker stocks with our curated list in See the full list for free.

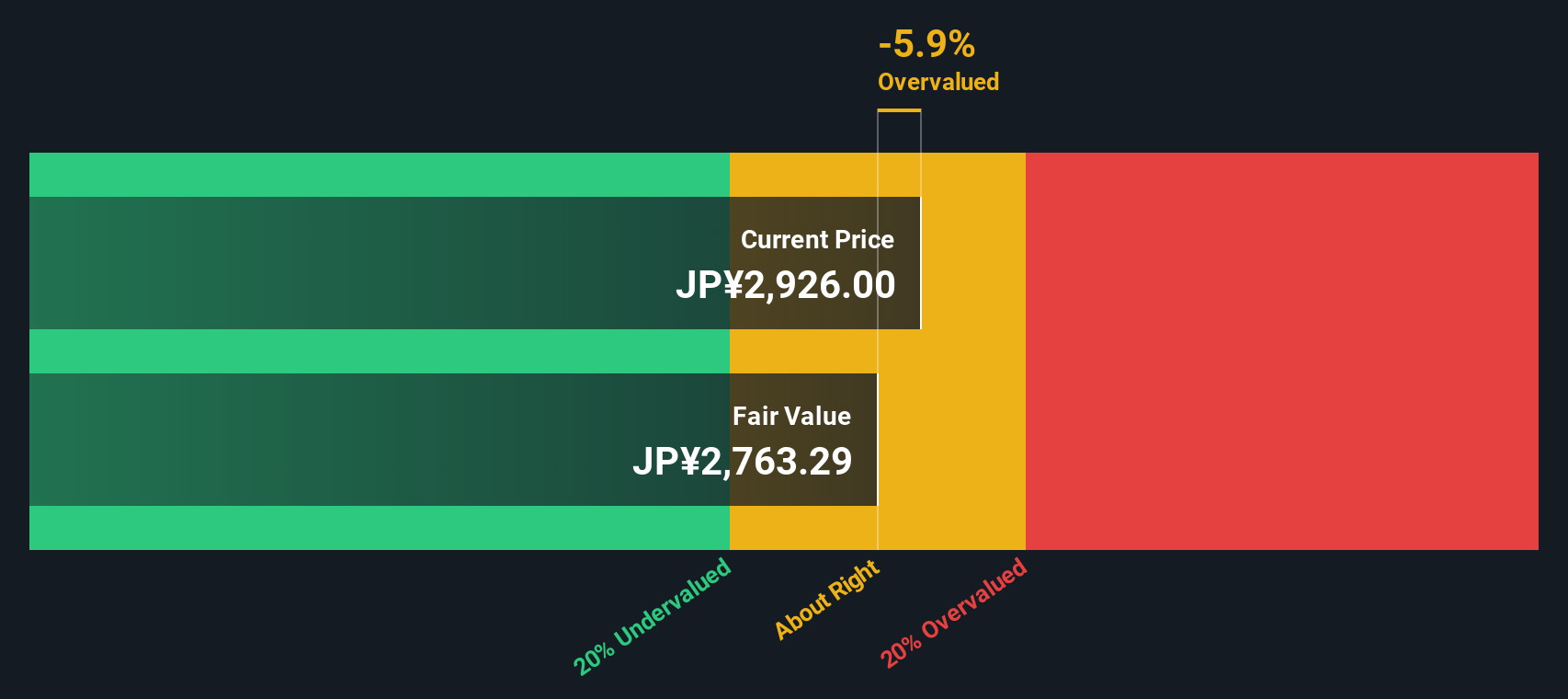

With Tokai Rika’s guidance freshly upgraded and the stock riding a year of strong gains, the key question now is whether shares remain attractively valued or if the market has already priced in the company’s improving outlook.

Price-to-Earnings of 6.9x: Is it justified?

Tokai Rika is trading at a price-to-earnings (P/E) ratio of just 6.9x. This indicates that shares are valued at a significant discount compared to both its industry and peers.

The P/E ratio is a widely used valuation tool that measures how much investors are willing to pay for each ¥1 of earnings. For industrial companies like Tokai Rika, a lower P/E can indicate skepticism about future profit growth or may highlight that the market is overlooking strong recent performance.

Tokai Rika’s P/E stands far below the peer group average of 22.2x for Japanese auto component companies, as well as the broader industry average of 10.6x. The current ratio is also below its estimated fair P/E of 8.1x. This suggests potential room for the market to re-rate the shares upward if profit momentum holds.

Explore the SWS fair ratio for Tokai Rika

Result: Price-to-Earnings of 6.9x (UNDERVALUED)

However, persistent slowing in annual net income growth and the current share price trading above analyst targets could temper the optimism surrounding Tokai Rika’s outlook.

Find out about the key risks to this Tokai Rika narrative.

Another View: What Does Our DCF Model Say?

Switching gears from looking at price-to-earnings, the SWS DCF model takes a different approach by estimating the value of future cash flows. According to this method, Tokai Rika is trading about 7% below its calculated fair value. This suggests the stock could be undervalued using this lens. Does this alternate perspective challenge the market’s current reading or confirm an overlooked opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokai Rika for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokai Rika Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own perspective in just a few minutes with Do it your way.

A great starting point for your Tokai Rika research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your strategy to a single stock? Set yourself up for smarter possibilities by using these powerful tools to find fresh opportunities and stay ahead of trends.

- Unlock the potential of market-beating cash flow with these 863 undervalued stocks based on cash flows for stocks currently priced below their true worth.

- Capitalize on technological breakthroughs by choosing these 24 AI penny stocks focused on artificial intelligence innovation and fast-paced digital growth.

- Boost your passive income with these 16 dividend stocks with yields > 3% delivering impressive yields above 3% and robust financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokai Rika might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6995

Tokai Rika

Manufactures and sells automotive parts in Japan, North America, Asia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives