- Japan

- /

- Auto Components

- /

- TSE:6902

DENSO (TSE:6902): Assessing Valuation After Earnings Guidance Cut and Updated Profit Outlook

Reviewed by Simply Wall St

DENSO (TSE:6902) has just revised its full-year earnings guidance for the fiscal year ending March 2026. This update follows second quarter results as well as changes to quality provisions and currency assumptions.

See our latest analysis for DENSO.

DENSO’s decision to lower earnings guidance comes after a year of moderate share price movement. Its 1-year share price return dipped 4.02%, even as the company maintained its dividend. Over the long run, shareholders have still seen impressive gains, with a 20% total return in just three years and nearly 84% over five years. The recent slip likely signals some recalibration of expectations given near-term profit challenges, though long-term sentiment appears steady.

Given the shifting dynamics in auto manufacturing, it’s worth taking a broader look at the sector, so why not discover See the full list for free.

With DENSO trading at a discount to analyst price targets and still delivering solid long-term returns, the key question remains: is there hidden value for investors, or are these profit headwinds already fully reflected in the price?

Price-to-Earnings of 15.8x: Is it justified?

DENSO’s stock trades at a price-to-earnings (P/E) ratio of 15.8x, placing it above both its peer group’s 15.1x average and the broader Japanese auto components industry’s average of 10.7x. Despite this premium, its last close price of ¥2,111 is still trading at a 20.9% discount to an internal fair value estimate. This raises the question of whether current expectations are already priced in or if upside remains.

The price-to-earnings ratio measures what investors are willing to pay for every yen of earnings and is especially relevant for well-established manufacturers like DENSO, where profit stability and scale are key strengths. However, a higher P/E can also signal expectations for superior earnings growth or a perceived competitive advantage.

Currently, DENSO’s P/E is not only above peers but also below a “fair” P/E ratio of 17.2x derived from profitability and growth models. This suggests the market might not be fully pricing in the company’s forecasted profit resilience, especially given its high-quality earnings record and strong growth history.

Compared to sector averages, DENSO’s valuation carries a premium. However, the fair P/E implies there may still be room for a higher valuation if the company continues to deliver consistent earnings growth and sector leadership.

Explore the SWS fair ratio for DENSO

Result: Price-to-Earnings of 15.8x (ABOUT RIGHT)

However, weaker near-term profit growth and continued pressure on automotive margins could dampen upside. This makes DENSO’s valuation sensitive to further sector shifts.

Find out about the key risks to this DENSO narrative.

Another View: What Does the DCF Model Say?

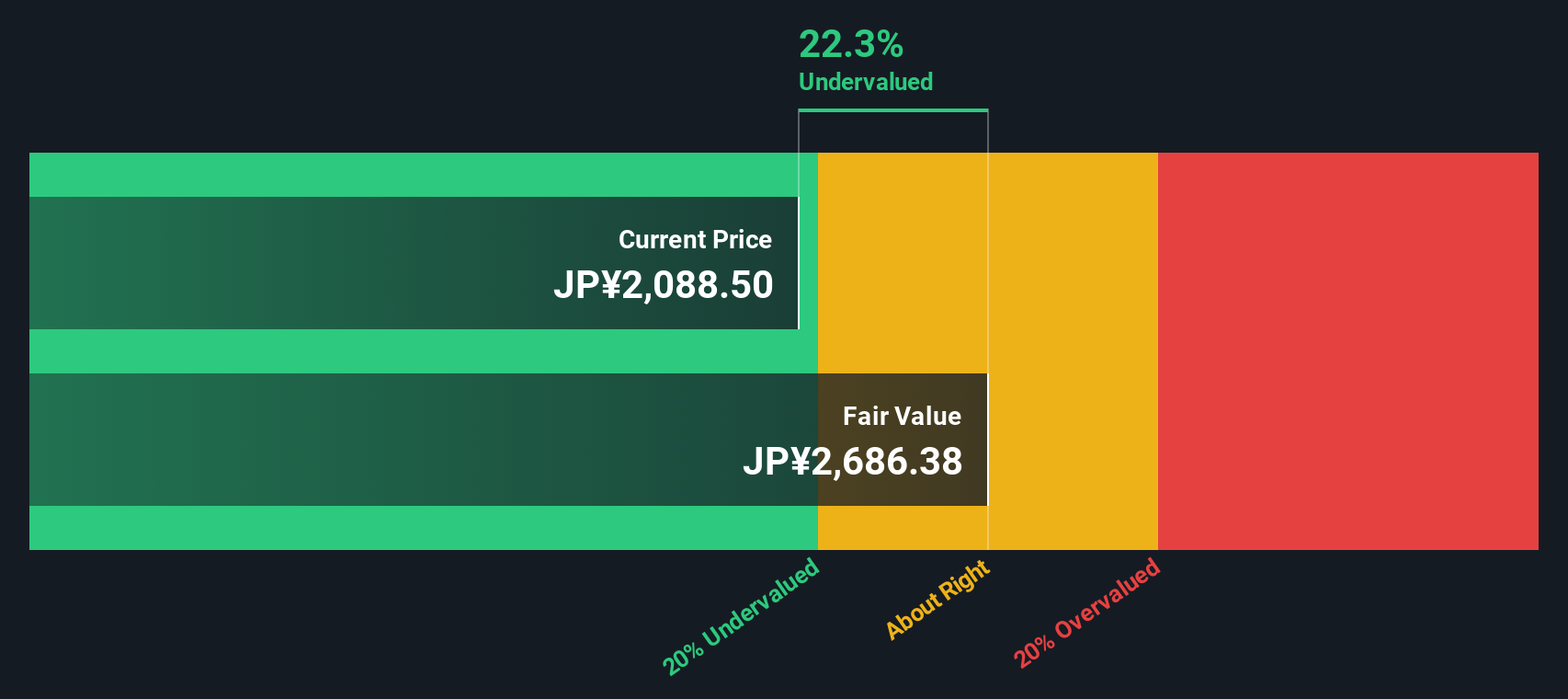

While DENSO’s stock trades at a premium to industry averages, the SWS DCF model offers a different perspective. According to this cash flow-based approach, DENSO shares are undervalued by nearly 21% against an estimated fair value of ¥2,670.38. Could the market be missing longer-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DENSO for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 857 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DENSO Narrative

If you have a different perspective or enjoy taking a hands-on approach to analysis, you can easily build your own narrative in just minutes. Do it your way.

A great starting point for your DENSO research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by. Take control of your portfolio by tapping into investment themes you might not have considered yet using the Simply Wall Street Screener.

- Unlock the potential of high-growth healthcare by checking out these 32 healthcare AI stocks, which focuses on AI-driven breakthroughs and medical innovation.

- Capture steady cash flows and robust payouts when you scan these 15 dividend stocks with yields > 3% featuring reliable companies with yields above 3%.

- Position yourself early in technology’s next frontier by surveying these 27 quantum computing stocks to find businesses pioneering quantum computing advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6902

DENSO

Engages in the manufacture and sale of automotive parts in Japan, Rest of Asia, North America, Europe, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives