- Japan

- /

- Auto Components

- /

- TSE:6473

JTEKT (TSE:6473) Valuation in Focus After Strong Share Price Rally

Reviewed by Simply Wall St

JTEKT (TSE:6473) has shown steady performance lately, with its stock gaining almost 22% over the past week and a remarkable 32% so far this year. The latest numbers offer some interesting signals for investors considering the company’s growth trajectory.

See our latest analysis for JTEKT.

JTEKT’s share price has picked up strong momentum this year, with a 31.7% gain year-to-date and boosted further by a 19.5% surge over the past three months. The one-year total shareholder return sits at 59%, indicating that recent enthusiasm is building on a solid foundation of longer-term outperformance.

If this kind of momentum has you searching for more opportunities, now is the perfect moment to broaden your investing horizons and explore See the full list for free.

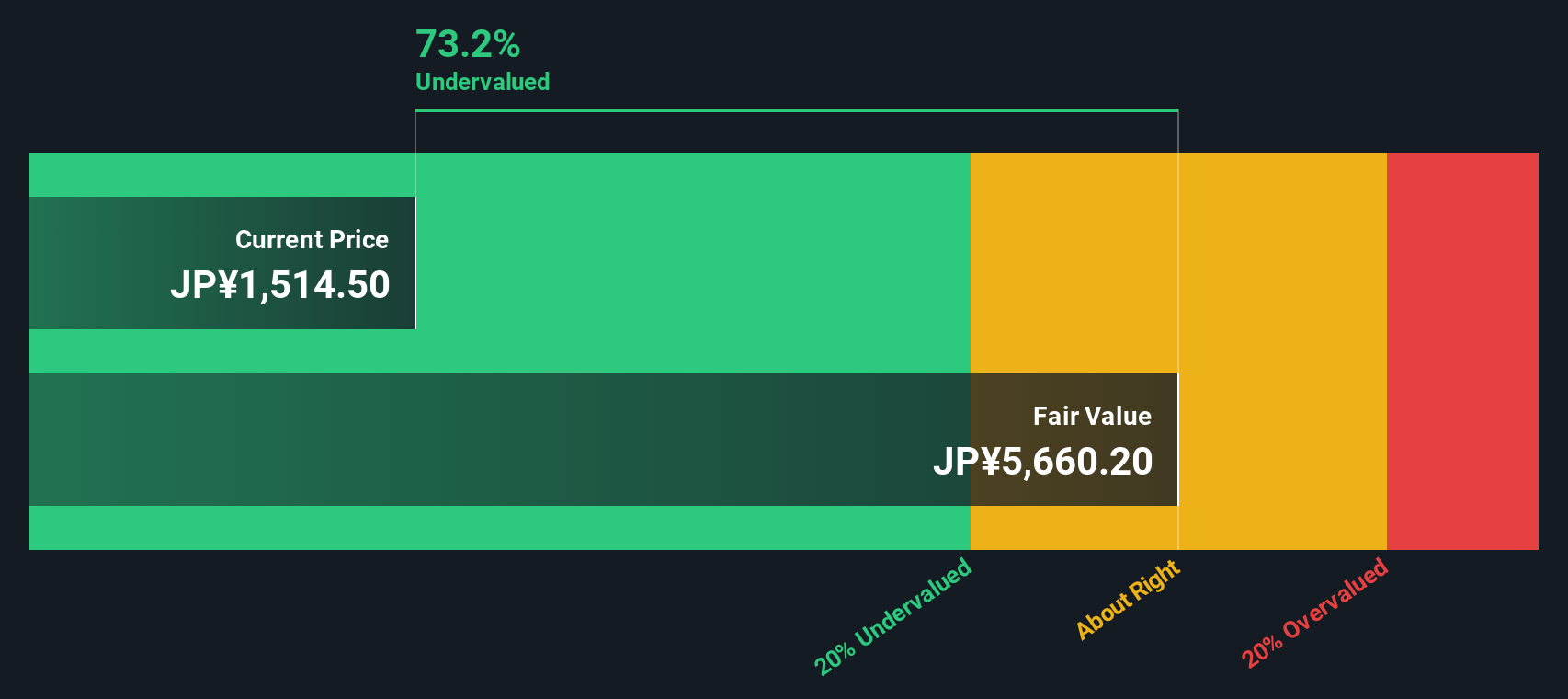

Given the recent surge, investors may wonder whether JTEKT’s shares remain undervalued or if the current price already reflects expectations for future growth. Is there still a buying opportunity, or has the market priced it all in?

Price-to-Earnings of 51.8x: Is it justified?

JTEKT’s shares currently trade at a price-to-earnings (P/E) ratio of 51.8x, noticeably higher than both industry peers and broader market benchmarks. Compared to its last close at ¥1,531.5, this signals a premium placed on future earnings.

The P/E ratio measures how much investors are willing to pay for each ¥1 of earnings. In the case of JTEKT, this figure is important for benchmark comparisons in the auto components sector, where consistent profitability and growth prospects matter.

Despite the high valuation, JTEKT’s earnings recently suffered a large decline and profit margins are low. A high P/E ratio can imply that investors expect a turnaround or significant growth ahead. However, the company’s lack of robust recent profit growth means current optimism may be running ahead of the underlying financial performance.

When placed next to the Japanese Auto Components industry average of 11.4x and peer group average of 15.2x, JTEKT’s price-to-earnings multiple appears particularly steep. Even the estimated fair P/E ratio for JTEKT is 35.7x, which is still far below the current market level. This suggests there may be a substantial disconnect between price and fundamentals.

Explore the SWS fair ratio for JTEKT

Result: Price-to-Earnings of 51.8x (OVERVALUED)

However, weaker-than-expected earnings growth or changing market sentiment could quickly dampen the premium that is currently being placed on JTEKT’s shares.

Find out about the key risks to this JTEKT narrative.

Another View: SWS DCF Model Suggests Deep Undervaluation

While the current price-to-earnings ratio presents JTEKT as expensive, our SWS DCF model provides a contrasting perspective. The model estimates JTEKT's fair value at ¥5,067.21, which is significantly higher than its current share price. According to this method, the stock appears deeply undervalued. Which valuation should investors trust to guide their next move?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out JTEKT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own JTEKT Narrative

If you want to form your own conclusions instead of relying solely on these perspectives, try building your personalized thesis in just a few minutes. Do it your way

A great starting point for your JTEKT research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Let your next move be a smart one. Expand your horizons and seize opportunities beyond JTEKT. Don’t let another market winner pass you by when tailored screener tools can put you ahead of the curve in minutes.

- Target stocks with market-beating income potential by reviewing these 17 dividend stocks with yields > 3% yielding over 3% for reliable cash flow and steady returns.

- Unlock emerging tech potential and find your edge by checking out these 27 AI penny stocks with rapid AI growth stories and transformative business models.

- Catch tomorrow's breakthrough stories at an early stage as you scan these 3571 penny stocks with strong financials showing strong financial fundamentals and promising momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6473

JTEKT

Manufactures and sells steering systems, driveline components, bearings, machine tools, electronic control devices, and home accessory equipment.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives