- Japan

- /

- Auto Components

- /

- TSE:6473

JTEKT (TSE:6473): Evaluating Valuation After Strong One-Month Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for JTEKT.

JTEKT’s momentum has been impressive lately, with a 10.1% one-month share price return adding to the year-to-date rise. As the market’s focus shifts from short-term volatility to longer-term growth potential, solid 1-year total shareholder returns of 57.7% highlight how well the stock has rewarded patient holders.

If you’re curious what other manufacturers might be making moves this year, take this chance to discover See the full list for free.

But with shares reaching new heights, the key question becomes whether JTEKT is currently undervalued or if the market is already pricing in all the anticipated growth ahead. This could potentially leave little room for further upside.

Price-to-Earnings of 26.3x: Is it justified?

At a price-to-earnings (PE) ratio of 26.3x, JTEKT trades at a noticeable premium to both its industry peers and the broader auto components sector, despite the recent rally in its share price to ¥1,621.

The price-to-earnings ratio is a benchmark commonly used to gauge how much investors are willing to pay for a company’s earnings. For manufacturers like JTEKT, it essentially reflects the market’s expectations for profit growth, stability, and overall company quality within the sector.

This premium PE likely hints at exuberant expectations for future profit growth or a perceived edge in earnings quality. However, when measured against the sector backdrop, JTEKT stands out as being significantly more expensive. Its PE ratio of 26.3x is well above the JP Auto Components industry average of 10.9x and the peer group average of 11.7x. Importantly, the market could adjust closer to its estimated “fair” PE of 26.4x if actual growth matches optimism.

Explore the SWS fair ratio for JTEKT

Result: Price-to-Earnings of 26.3x (OVERVALUED)

However, slowing annual revenue growth and a lofty valuation could make JTEKT vulnerable if profit momentum falters or if macro conditions worsen.

Find out about the key risks to this JTEKT narrative.

Another View: Deep Value from Cash Flows?

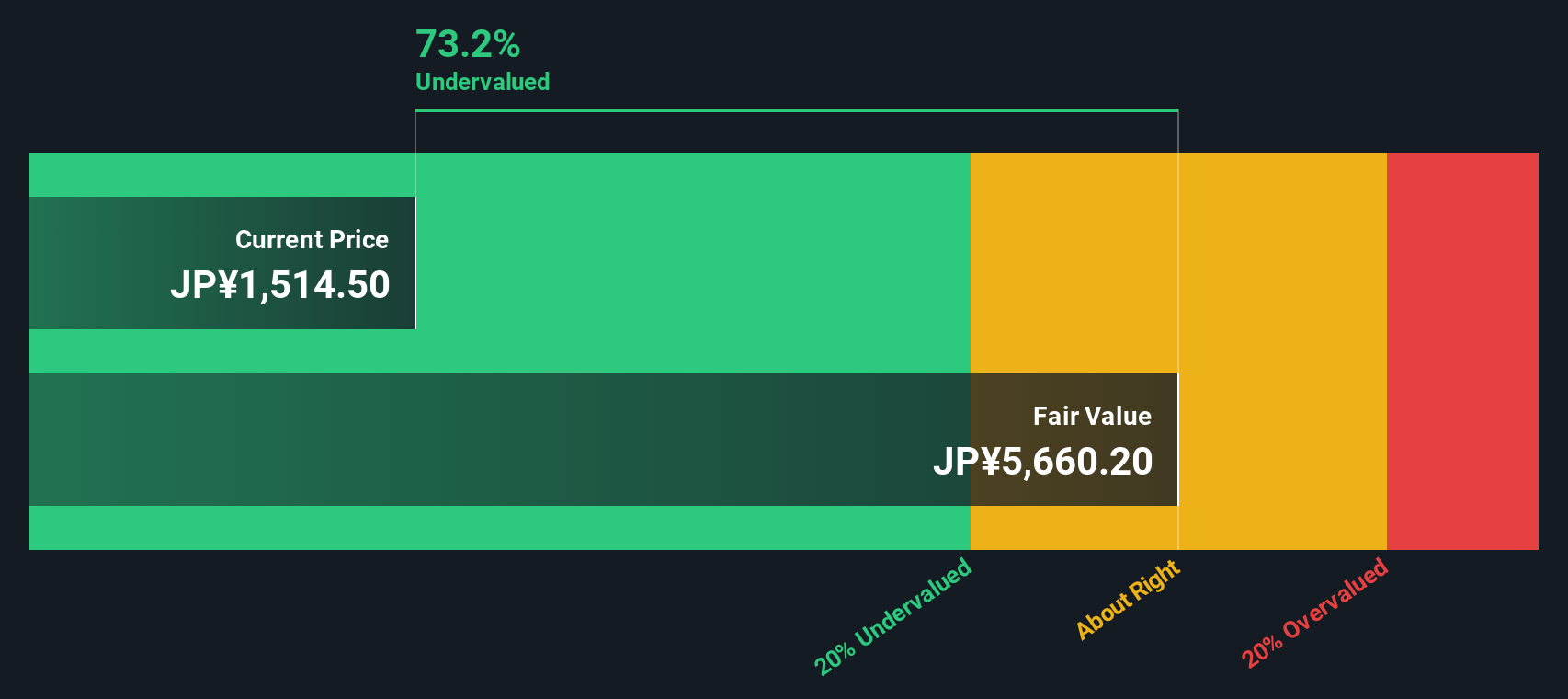

Switching perspectives, our DCF model points to a radically different scenario for JTEKT. According to this approach, shares are trading nearly 60% below their estimated fair value, which identifies them as undervalued despite the high price-to-earnings ratio we discussed earlier. Could the market be overlooking something in its focus on earnings multiples?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out JTEKT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own JTEKT Narrative

Keep in mind, if our analysis doesn’t match your perspective or you want to dive deeper into the numbers yourself, you’re free to shape your own view in just a few minutes. Do it your way

A great starting point for your JTEKT research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. There are exciting stocks across sectors waiting to be found. Take action with these strategies and level up your portfolio now:

- Boost your income by targeting companies with solid yields using these 16 dividend stocks with yields > 3%. Focus on those that deliver consistent dividends above 3%.

- Spot tomorrow’s technological leaders as you scan these 24 AI penny stocks that harness AI innovations across industries for market-beating potential.

- Position yourself ahead of the curve by tapping into these 27 quantum computing stocks, which highlights companies at the forefront of quantum computing breakthroughs and disruptive tech trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6473

JTEKT

Manufactures and sells steering systems, driveline components, bearings, machine tools, electronic control devices, and home accessory equipment.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives