- Japan

- /

- Auto Components

- /

- TSE:5992

The Market Lifts Chuo Spring Co.,Ltd. (TSE:5992) Shares 26% But It Can Do More

Chuo Spring Co.,Ltd. (TSE:5992) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 82% in the last year.

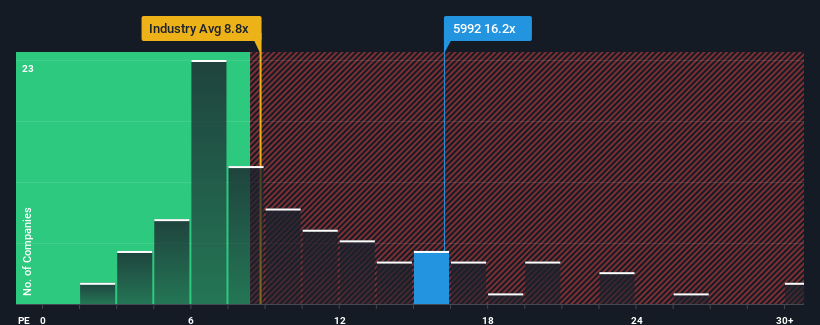

In spite of the firm bounce in price, there still wouldn't be many who think Chuo SpringLtd's price-to-earnings (or "P/E") ratio of 16.2x is worth a mention when the median P/E in Japan is similar at about 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Chuo SpringLtd certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Chuo SpringLtd

Is There Some Growth For Chuo SpringLtd?

Chuo SpringLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered an exceptional 310% gain to the company's bottom line. Pleasingly, EPS has also lifted 58% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 9.7% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Chuo SpringLtd's P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Chuo SpringLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Chuo SpringLtd currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Chuo SpringLtd (of which 1 is a bit concerning!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5992

Chuo SpringLtd

Engages in the manufacture and sale of springs, control cables, construction materials and equipment, and automotive accessories in Japan, North America, China, and Asia The company offers chassis springs, such as coil springs, stabilizers, leaf springs, torsion bars, and ODDS, an on demand disconnectable stabilizer; and precision springs, including precision coil springs, valve springs, heat resistant springs, power back door springs, spiral spring, wire springs, knitted mesh spring, and assembly products.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives