- Japan

- /

- Auto Components

- /

- TSE:5852

Revenues Tell The Story For Ahresty Corporation (TSE:5852) As Its Stock Soars 26%

Ahresty Corporation (TSE:5852) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 43%.

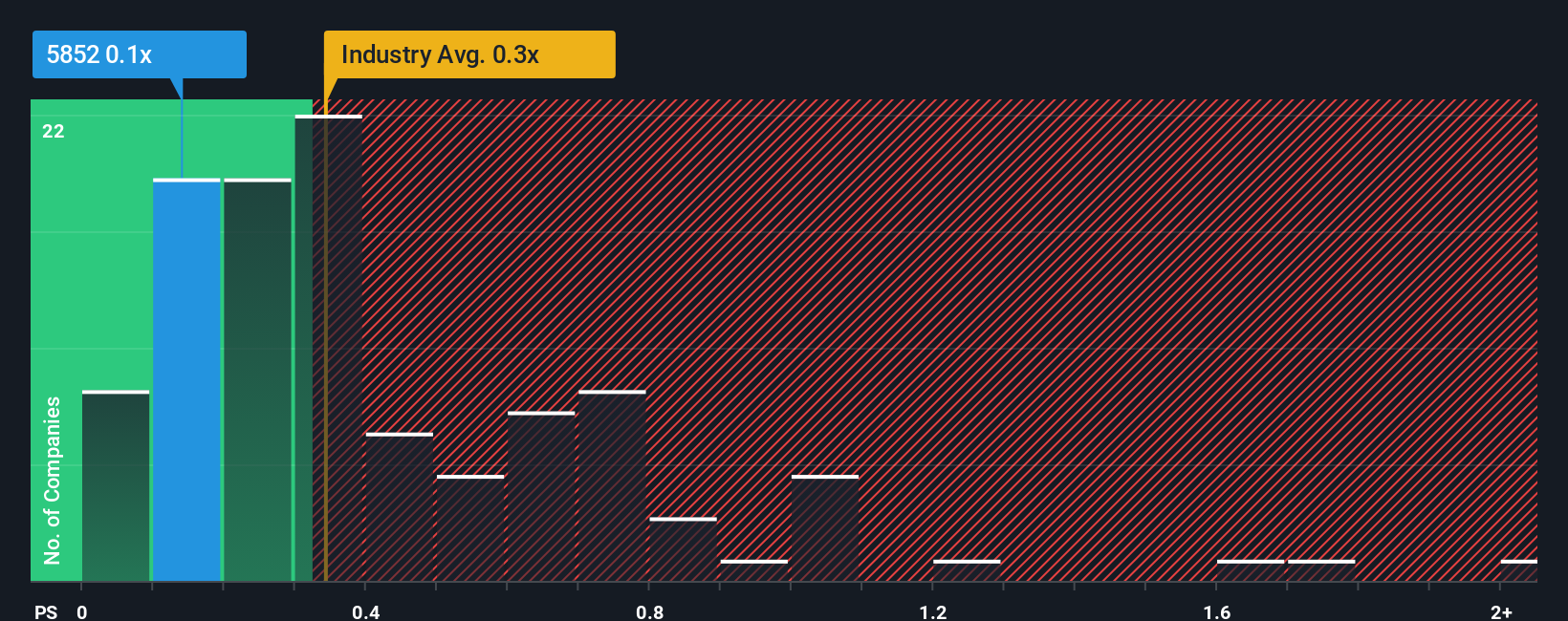

Although its price has surged higher, there still wouldn't be many who think Ahresty's price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in Japan's Auto Components industry is similar at about 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Ahresty

What Does Ahresty's P/S Mean For Shareholders?

Recent times have been advantageous for Ahresty as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ahresty.Is There Some Revenue Growth Forecasted For Ahresty?

In order to justify its P/S ratio, Ahresty would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.5%. This was backed up an excellent period prior to see revenue up by 37% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 0.8% during the coming year according to the sole analyst following the company. With the industry predicted to deliver 1.1% growth , the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Ahresty's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Ahresty's P/S

Ahresty's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Ahresty's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Auto Components industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 1 warning sign for Ahresty that you should be aware of.

If you're unsure about the strength of Ahresty's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5852

Ahresty

Engages in the aluminum die casting, aluminum, and proprietary products businesses in Japan, North America, and Asia.

Good value with adequate balance sheet.

Market Insights

Community Narratives