- Japan

- /

- Auto Components

- /

- TSE:5802

Will Sumitomo Electric Industries (TSE:5802) Q2 Earnings Settle Questions About Its Long-Term Strategy?

Reviewed by Sasha Jovanovic

- Sumitomo Electric Industries is set to release its Q2 2026 earnings on November 13, 2025, attracting attention in the lead-up to the announcement.

- Investor interest often heightens ahead of earnings releases, as market participants look for fresh financial signals and guidance.

- We'll explore how anticipation around Sumitomo Electric Industries' upcoming earnings announcement shapes its investment narrative and expectations.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Sumitomo Electric Industries' Investment Narrative?

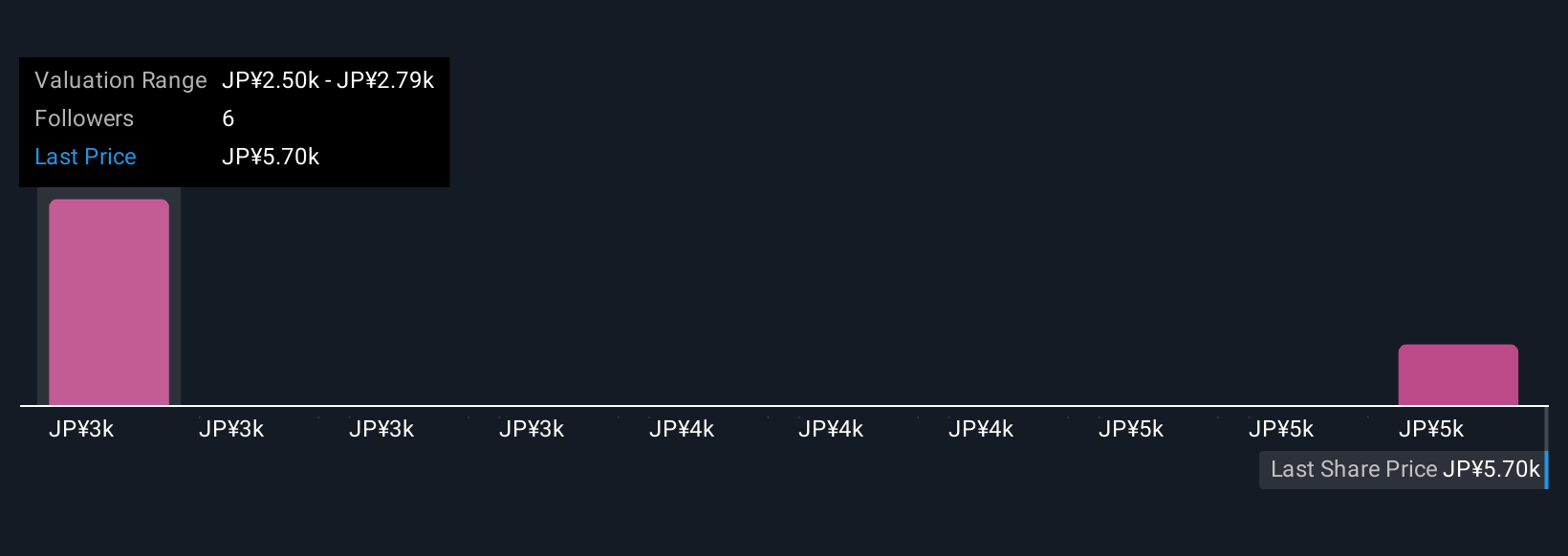

To be a shareholder in Sumitomo Electric Industries right now, you would need to buy into its broad story of steady revenue growth, a solid history of profit improvements, and regular dividend increases, recently highlighted by a boost in both interim and projected full-year payouts. The most important short-term catalysts revolve around guidance upgrades and new partnerships in optical technologies, like the recent collaboration with Point2 Technology. The upcoming Q2 2026 earnings call may influence these drivers if actual results differ from the upbeat guidance issued last month, though given the limited price reaction ahead of this release and the company's prior upward revisions, the immediate impact could be muted. However, significant risks persist in valuation, as Sumitomo Electric trades at a premium to both sector averages and consensus price targets, and recent share price volatility adds to the uncertainty. For now, the company's investment narrative hinges on whether improved guidance and dividend growth can continue to outweigh risks of overvaluation and moderate growth expectations.

In contrast, it's essential to pay attention to the premium valuation, which remains a key consideration.

Exploring Other Perspectives

Explore 2 other fair value estimates on Sumitomo Electric Industries - why the stock might be worth as much as ¥5359!

Build Your Own Sumitomo Electric Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sumitomo Electric Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sumitomo Electric Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sumitomo Electric Industries' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5802

Sumitomo Electric Industries

Manufactures and sells electric wires and cables worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives