- Japan

- /

- Auto Components

- /

- TSE:5802

Sumitomo Electric (TSE:5802) Margin Gains Defy Slowing Growth, Challenge Valuation Concerns

Reviewed by Simply Wall St

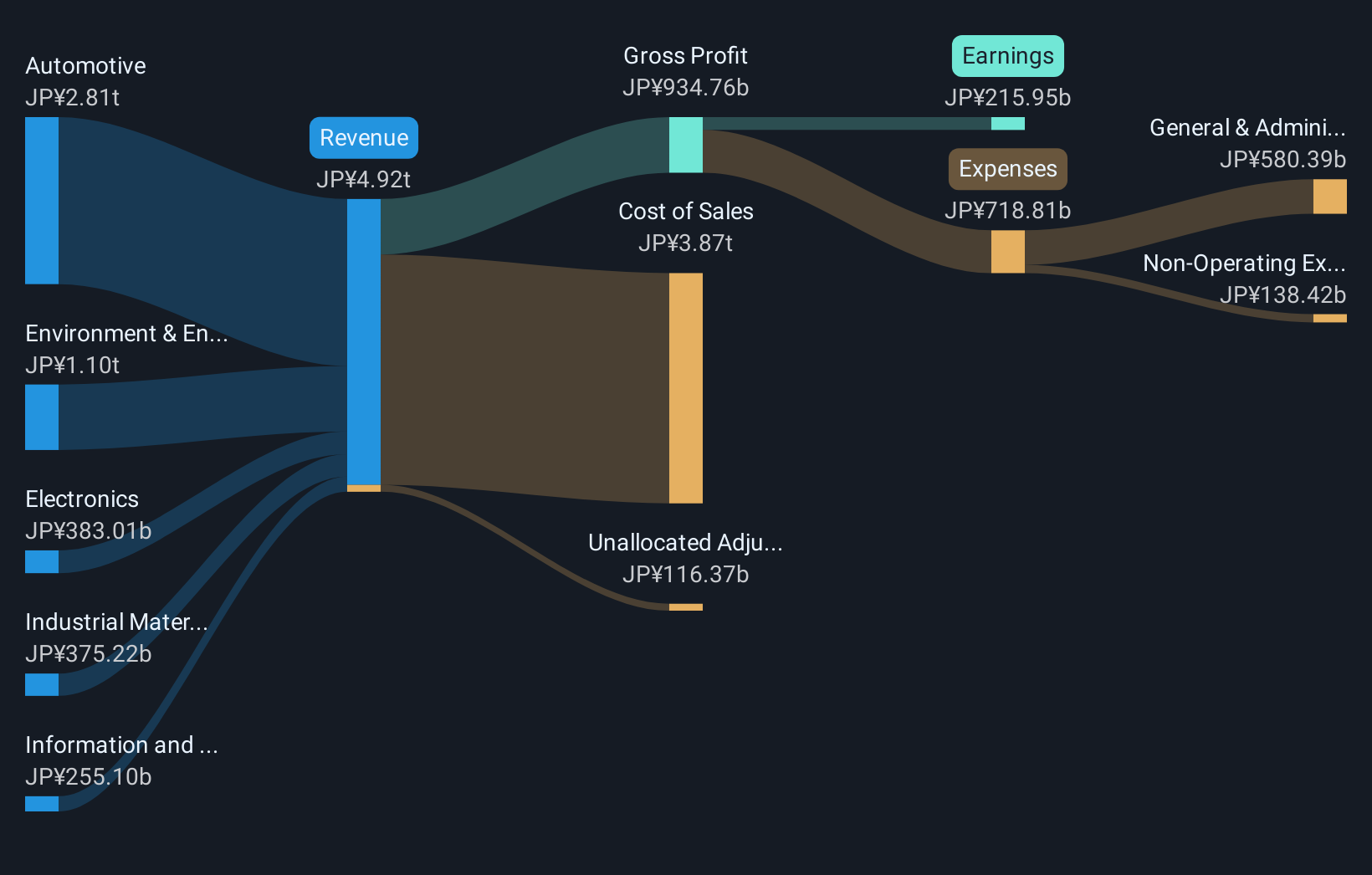

Sumitomo Electric Industries (TSE:5802) posted net profit margins of 4.5% for the latest period, up from last year’s 4.3%, as earnings grew by 8.6%. Analyst forecasts now see annual earnings growth holding at 6.78%, while revenue is expected to rise by 1.4% per year. After years of strong growth, averaging an impressive 26.8% per year over the last five years, investors are watching to see how a recent slowdown in momentum and valuation above fair value shape expectations for the next chapter.

See our full analysis for Sumitomo Electric Industries.Next, we’ll see how these headline results measure up to the dominant narratives in the market and the Simply Wall St community.

See what the community is saying about Sumitomo Electric Industries

Margin Expansion Defies Industry Slowdown

- Net profit margin rose to 4.5%, an improvement from 4.3% a year earlier, even as recent earnings growth of 8.6% lagged the five-year annual average of 26.8%.

- Prevailing market view points to ongoing profitability strength

- What is notable is that margin gains come in spite of moderate revenue growth forecasts at 1.4% per year, which is below sector averages and indicates the core business remains resilient.

- Analysts forecast profits to increase at 6.78% annually, supporting the view that margins can be maintained, provided that cost controls and product mix continue to evolve in line with recent performance.

Dividend Sustainability Emerges as Key Risk

- Dividend sustainability is highlighted as the primary risk, making future payout decisions a focal point as growth moderates and the cost of capital environment shifts.

- Prevailing market view highlights the tension between profit growth and sustainable income

- While profits and revenues show a solid multi-year growth record, slower projected growth may pressure management to balance rewarding shareholders with long-term investment needs.

- This tension could become more pronounced if dividend expectations rise faster than profit growth, especially with profitability trends showing a clear but slowing trajectory.

Shares Priced Above DCF Fair Value and Peers

- Current share price of ¥5,650 is trading at a premium to DCF fair value of ¥5,087.76 and the company sports a price-to-earnings ratio of 20.4x, well above the peer average of 13.8x and the Japanese auto components sector at 11.6x.

- Prevailing market view signals that investors are asked to pay a premium for perceived stability

- What is surprising is that this premium comes even as revenue growth is projected at just 1.4% per year, suggesting investors expect the company to outperform either on margin or future innovation.

- The gap between the current price and both peer multiples and intrinsic value presents a challenge for further upside unless growth surprises or market risk appetite changes.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sumitomo Electric Industries on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Thinking about the results from another angle? Share your outlook, add your voice, and craft your own interpretation in just a few minutes. Do it your way

A great starting point for your Sumitomo Electric Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Sumitomo Electric Industries’ premium valuation and softening revenue growth may limit future upside unless new catalysts or surprises emerge.

For investors seeking better value and stronger upside prospects, consider these 840 undervalued stocks based on cash flows where companies trade below their intrinsic worth with more room to run if market conditions shift.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5802

Sumitomo Electric Industries

Manufactures and sells electric wires and cables worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives