- Japan

- /

- Auto Components

- /

- TSE:5334

A Look at Niterra (TSE:5334) Valuation Following Share Buyback and Dividend Hike

Reviewed by Simply Wall St

Niterra (TSE:5334) has just approved a share repurchase plan, set to buy back up to 7.2 million shares. This represents about 4% of its outstanding shares. This move comes alongside an upward revision of its interim dividend.

See our latest analysis for Niterra.

Niterra’s confidence shows in more than just boardroom decisions. The company’s shares have rallied lately, with a 29% share price return in the past 90 days and a remarkable 43.75% total shareholder return over the last year. Moves like the buyback and dividend hike appear to have resonated with investors, reflecting both positive business momentum and belief in the company’s longer-term prospects.

If you're looking beyond Niterra for your next idea, now is an opportune time to broaden your search with fast growing stocks with high insider ownership.

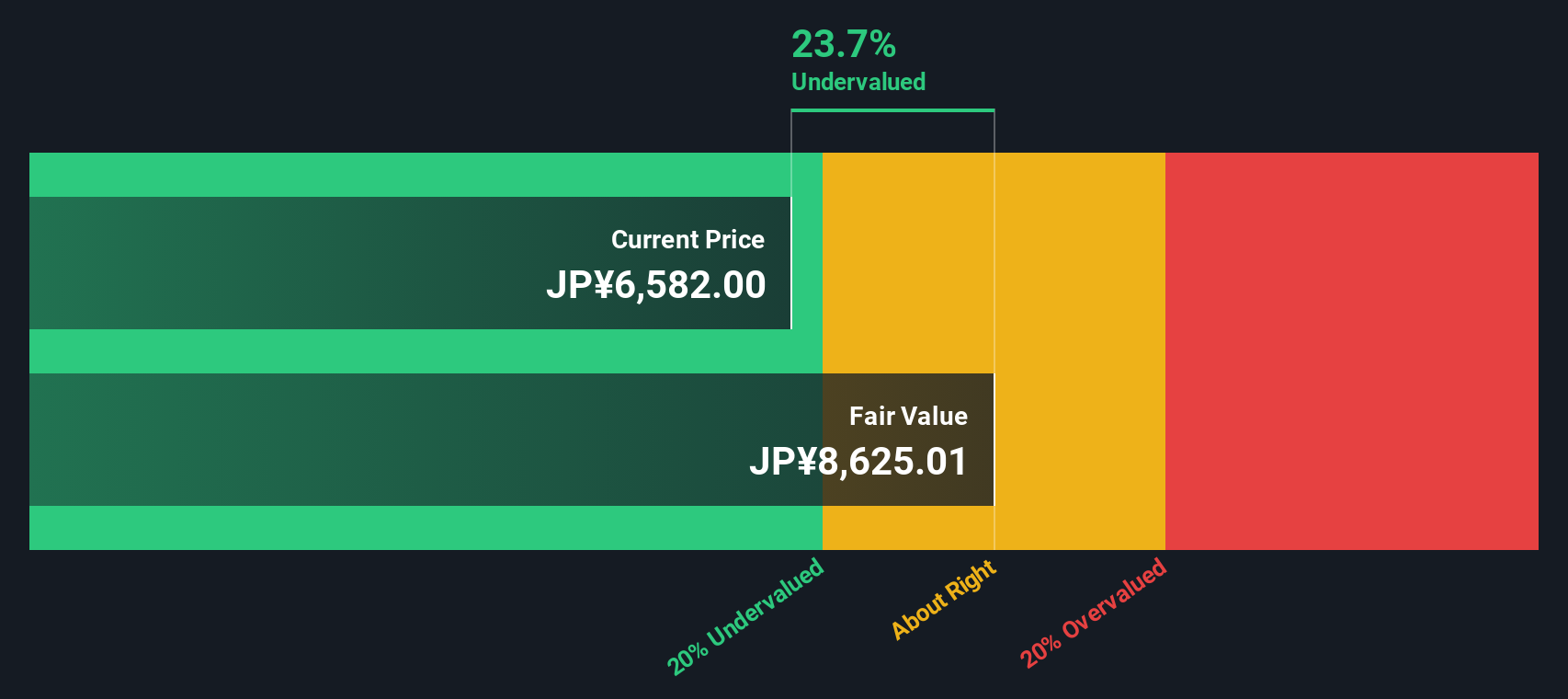

With the stock trading near 12-month highs, the real question is whether Niterra’s recent strategic moves signal an undervalued opportunity for investors or if the company’s future growth is already fully reflected in the share price.

Price-to-Earnings of 13.1x: Is it justified?

Niterra’s shares currently trade at a price-to-earnings ratio of 13.1x, putting it above the average for its industry peers and raising the question of whether investors are paying a premium for the stock’s growth profile.

The price-to-earnings (P/E) ratio is a widely used metric that compares a company’s market value to its earnings. It helps investors gauge if a stock is fairly valued against others in the sector. In the case of Niterra, this ratio suggests that the market expects either stronger future earnings or values its profitability more highly than the average auto components firm in Japan.

Niterra’s P/E of 13.1x is higher than the JP Auto Components industry average of 11.6x. This signals that the market assigns a premium for its past earnings pace or outlook. However, when compared to the estimated fair P/E ratio of 13.7x, Niterra’s valuation appears much more reasonable and could potentially move higher if its earnings continue to outperform expectations or investor sentiment remains robust.

Explore the SWS fair ratio for Niterra

Result: Price-to-Earnings of 13.1x (ABOUT RIGHT)

However, risks remain, such as a potential pullback if earnings momentum slows or if shares correct after rising significantly above formal analyst targets.

Find out about the key risks to this Niterra narrative.

Another View: Discounted Cash Flow Tells a Different Story

Looking at Niterra through the lens of our DCF model, the picture shifts. The SWS DCF model suggests the stock trades at about 32% below its estimated fair value. Does this signal a real bargain that the market has yet to recognize, or are investors overlooking risks beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Niterra for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Niterra Narrative

If you want to draw your own conclusions or dig deeper into the details, you can craft a personal view using our tools in under three minutes. Why not Do it your way.

A great starting point for your Niterra research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t hold back your portfolio with just one stock. Some of the most exciting opportunities go beyond the obvious. This is your chance to find smart, future-focused stocks right now.

- Unlock the power of digital transformation with these 26 AI penny stocks as companies harness advancements in machine learning, automation, and data-driven innovation.

- Benefit from steady income streams when you tap into these 22 dividend stocks with yields > 3% featuring businesses offering attractive yields and consistent shareholder returns above the market average.

- Accelerate your search for tomorrow’s undervalued winners by scanning these 840 undervalued stocks based on cash flows and spot companies trading with room to grow based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Niterra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5334

Niterra

Manufactures and sells spark plugs and related products for internal-combustion engines and technical ceramics in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives