- Japan

- /

- Auto Components

- /

- TSE:5110

Does Sumitomo Rubber’s Current Price Reflect Its Value After Recent 4.3% Pullback?

Reviewed by Simply Wall St

If you have been keeping an eye on Sumitomo Rubber Industries, you are probably wondering whether it's time to jump in, stay the course, or lock in some profits. The stock has recently given investors plenty to talk about. After notching a solid 124.2% gain over the last five years and an impressive 67.0% rise in the past three, this tire powerhouse has shown it’s capable of delivering long-term growth. Even more recently, the stock is up 13.7% over the past year, with a steadier 1.6% return year-to-date.

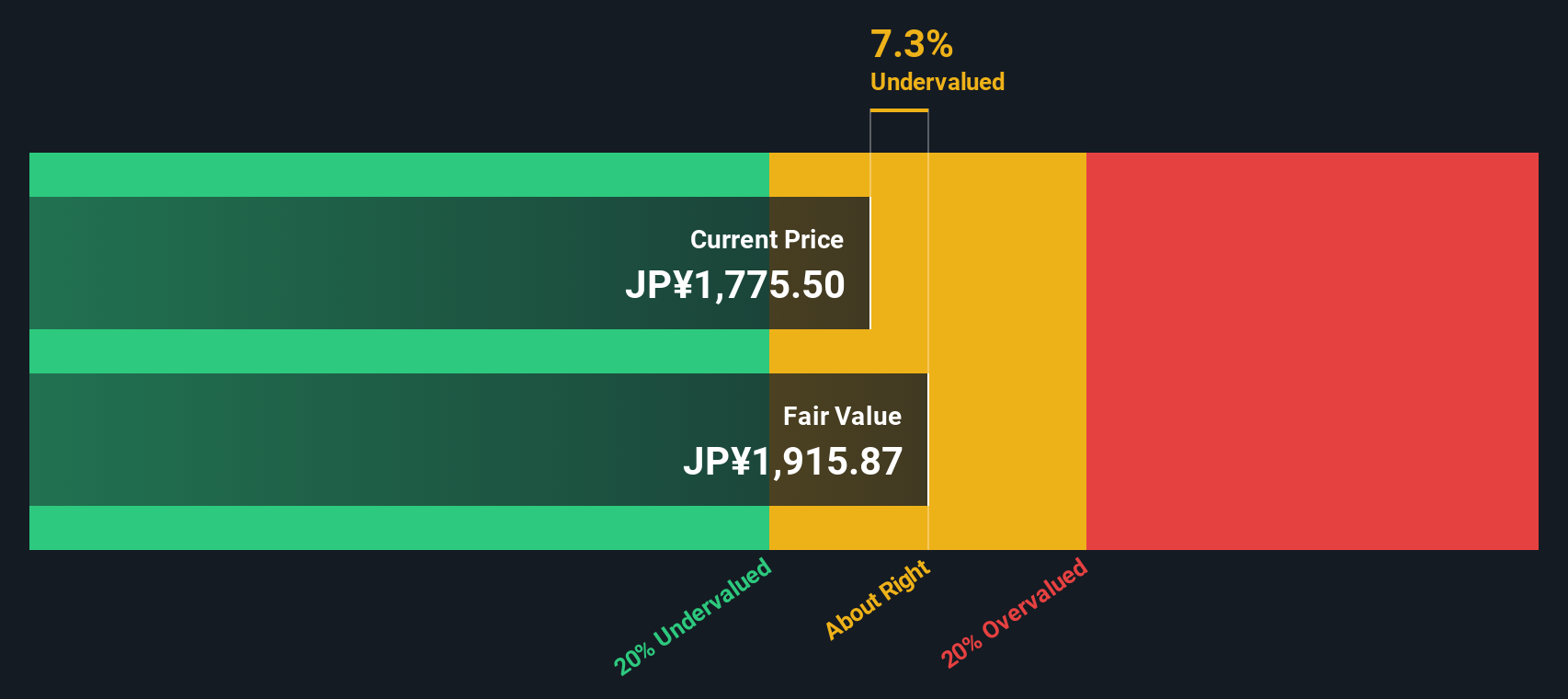

Of course, it’s not all uphill. The last week saw a dip of 4.3%, showing that markets are anything but predictable, especially when shifting sentiment about global manufacturing and consumer demand keeps everyone on their toes. But rather than letting short-term moves shake your confidence, the bigger question is whether Sumitomo Rubber Industries is undervalued, overvalued, or fairly priced at the current level of 1779.5 per share.

Valuation plays a huge role in any investment decision, so it pays to be methodical. Sumitomo Rubber Industries gets a valuation score of 3 out of 6, meaning it checks the box for being undervalued in half the key areas typically used by analysts. But before making up your mind, let’s break down these valuation methods. Stick around, because at the end I’ll share a smarter, more holistic way to judge Sumitomo’s worth beyond the usual metrics.

Why Sumitomo Rubber Industries is lagging behind its peersApproach 1: Sumitomo Rubber Industries Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by forecasting its future cash flows and discounting those amounts back to present value. For Sumitomo Rubber Industries, this approach uses a 2 Stage Free Cash Flow to Equity model, relying on analyst projections for the first five years and then extending forecasts for another five years, as extrapolated by Simply Wall St.

Currently, Sumitomo Rubber Industries reports Last Twelve Months Free Cash Flow (FCF) of ¥6.3 Billion. Analysts expect FCF to grow substantially, projecting figures as high as ¥53.0 Billion by 2029. Simply Wall St also extrapolates these cash flows over the following years, reflecting both analyst consensus and reasoned estimates of future company performance in the sector.

Based on this model, the estimated fair value of the stock is ¥1,893 per share, compared to the current share price of ¥1,779.5. This suggests a 6.0% intrinsic discount, indicating the shares are very close to fair value with a slight undervaluation.

Result: ABOUT RIGHT

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Sumitomo Rubber Industries.

Approach 2: Sumitomo Rubber Industries Price vs Sales

When it comes to valuing profitable companies in sectors like auto components, the Price-to-Sales (P/S) ratio is a favorite among analysts. This metric compares a company’s stock price to its revenues, which is particularly helpful when profit margins may be variable yet revenues remain reliably reported. Companies with consistent sales and solid market standing often attract more attention using this multiple.

It's important to note that growth expectations and risk both factor into what is considered a “normal” or “fair” P/S ratio. Fast-growing or safer businesses often command higher multiples, while more mature or riskier players trade at a discount. Comparing these ratios to benchmarks provides crucial context.

Currently, Sumitomo Rubber Industries trades at a P/S ratio of 0.39x. This is well below the peer average of 0.95x and also just above the auto components industry average of 0.36x. However, benchmarks tell only part of the story.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. This figure, calculated at 0.65x for Sumitomo Rubber Industries, considers a blend of company-specific factors including earnings growth, industry trends, profit margins, market capitalization, and associated risks. By taking these broader characteristics into account, the Fair Ratio delivers a more customized and often more accurate valuation target than relying strictly on peers or sector averages.

Comparing the actual P/S of 0.39x to the Fair Ratio of 0.65x, the stock is trading notably below its fair value range, suggesting it might be undervalued at the current share price.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Sumitomo Rubber Industries Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple, story-driven approach that lets you share your perspective on a company by connecting its real-world story with your own forecasts for fair value, future revenue, earnings, and profit margins. Narratives bridge the gap between what a company does and what you think it is worth, linking your personal view of its future to a concrete fair value estimate.

On Simply Wall St’s Community page, Narratives are an easy and accessible tool used by millions of investors. They help you decide when to buy or sell by comparing your Fair Value to the current Price. Narratives automatically update as new developments or earnings are released, keeping your outlook as current as possible. For Sumitomo Rubber Industries, one investor might build a bullish Narrative with aggressive growth estimates, resulting in a fair value well above the current price. Another investor may take a cautious view with lower expectations and a conservative fair value. Narratives empower investors to make decisions based on both the numbers and their belief in the business’s story.

Do you think there's more to the story for Sumitomo Rubber Industries? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5110

Sumitomo Rubber Industries

Provides tires, sports, and industrial and other products in Japan and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives