- Japan

- /

- Auto Components

- /

- TSE:5108

Bridgestone (TSE:5108) Valuation in Focus Following CEO Transition Announcement

Reviewed by Simply Wall St

Bridgestone (TSE:5108) has announced a significant leadership change, with Yasuhiro Morita set to take over as Global CEO and Representative Executive Officer at the start of 2026. Investors often watch such transitions closely because new leadership can influence future strategy and performance.

See our latest analysis for Bridgestone.

Bridgestone’s recent leadership announcement comes after a period of strong momentum, with its 1-year total shareholder return at 29.4% and share price gains of 27.7% year-to-date. The combination of steady progress and a well-timed CEO transition has brought renewed attention to the stock’s long-term growth potential and resilience.

If major milestones like this leadership change have you thinking bigger, consider expanding your search and discover See the full list for free.

The leadership transition arrives at a time when shareholders are asking whether Bridgestone’s strong run leaves room for the stock to climb further, or if the market already reflects next year’s growth potential.

Most Popular Narrative: 5.2% Undervalued

The narrative’s fair value estimate for Bridgestone suggests the stock is trading moderately below its projected worth. This assessment is shaped by a combination of evolving growth drivers and changing market assumptions.

Bridgestone is focusing on restructuring and rebuilding its European and Latin American operations, particularly aiming to improve profitability by optimizing production and distribution. This effort should positively impact net margins as efficiency improves by 2026.

Curious which bold strategic moves underpin the valuation? The key assumptions driving this price target include ambitious margin goals, efficiency upgrades, and a fresh push for revenue growth. Want to see the forecast that could catch the market off guard?

Result: Fair Value of ¥7,223 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing pressure from low-priced imports in Latin America and restructuring costs in Europe could limit Bridgestone's ability to lift margins as planned.

Find out about the key risks to this Bridgestone narrative.

Another View: Market Multiples Tell a Different Story

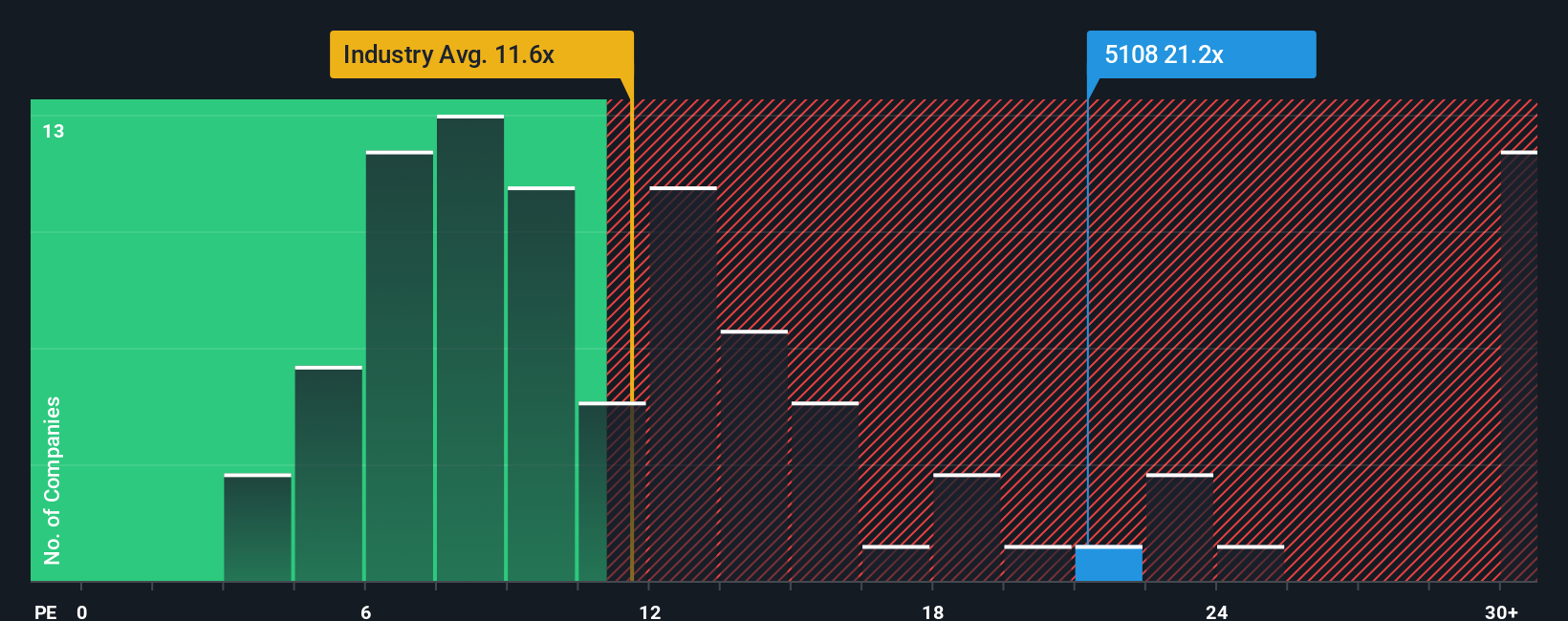

While the fair value estimate suggests Bridgestone is undervalued, a look at the price-to-earnings ratio paints a more cautious picture. Bridgestone trades at 22.4 times earnings, which is notably higher than both its industry average of 11.9x and its fair ratio of 19.9x. This premium could signal that investors expect faster growth and strong execution, or it may reflect increased valuation risk if results fall short. Does this gap present an opportunity or a warning?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bridgestone Narrative

If you want to take your own approach or dig deeper into the numbers, you can build a personal narrative in just a few minutes. Do it your way

A great starting point for your Bridgestone research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock even more opportunities by targeting stocks that fit your goals. Don’t miss your chance to get ahead. These screens can reveal tomorrow’s top performers today.

- Supercharge your search for standout yields by uncovering companies with strong payouts and stability using these 19 dividend stocks with yields > 3%.

- Jump on groundbreaking innovation by targeting trailblazers at the intersection of healthcare and artificial intelligence through these 34 healthcare AI stocks.

- Act now to find compelling values in the market with help from these 875 undervalued stocks based on cash flows, highlighting stocks projected to be trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bridgestone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5108

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives