- Italy

- /

- Gas Utilities

- /

- BIT:SRG

Snam (BIT:SRG) Valuation in Focus After Dividend Hike and Strong Nine-Month Results

Reviewed by Simply Wall St

Snam (BIT:SRG) just announced a 4% increase in its 2025 interim dividend, with payment set for January 2026. The company also posted higher sales and net income for the past nine months.

See our latest analysis for Snam.

Snam’s recent interim dividend boost and solid nine-month results come on the back of impressive momentum. The company’s share price has climbed nearly 30% year-to-date, while its 1-year total shareholder return sits just shy of 40%. This sustained performance suggests that investors are responding both to improved fundamentals and to management’s steady hand on growth and payouts.

If you’re eyeing companies with similar potential, it might be the perfect moment to broaden your outlook and discover fast growing stocks with high insider ownership

But with shares already up nearly 30% this year and recent results beating expectations, is there still a buying opportunity here, or is the market already pricing in Snam’s future growth?

Most Popular Narrative: 4% Overvalued

Snam’s last close at €5.65 sits just above the widely followed narrative fair value of €5.42, hinting at a slightly expensive market stance. The latest narrative brings together forward-looking growth assumptions and sector-wide transformation themes and sets the stage for evolving expectations.

Regulatory and investment momentum behind green hydrogen, biomethane, and carbon capture & storage (CCS), demonstrated by Snam's pipeline of hydrogen-ready projects, advancing CCS in Ravenna, and new regulatory frameworks, will unlock incremental revenue streams and drive higher long-term EBITDA margins.

Curious what ambitious growth bets are baked into this price? The key drivers play out through bold revenue upgrades, shifting margins, and a future earnings multiple that rivals top-tier sectors. See which strategies and forward estimates have analysts betting on Snam’s evolving value story.

Result: Fair Value of €5.42 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Europe's energy transition could dampen long-term gas demand, or stricter regulations could erode Snam's profitability, questioning the current bullish outlook.

Find out about the key risks to this Snam narrative.

Another View: Is the Market Missing Something?

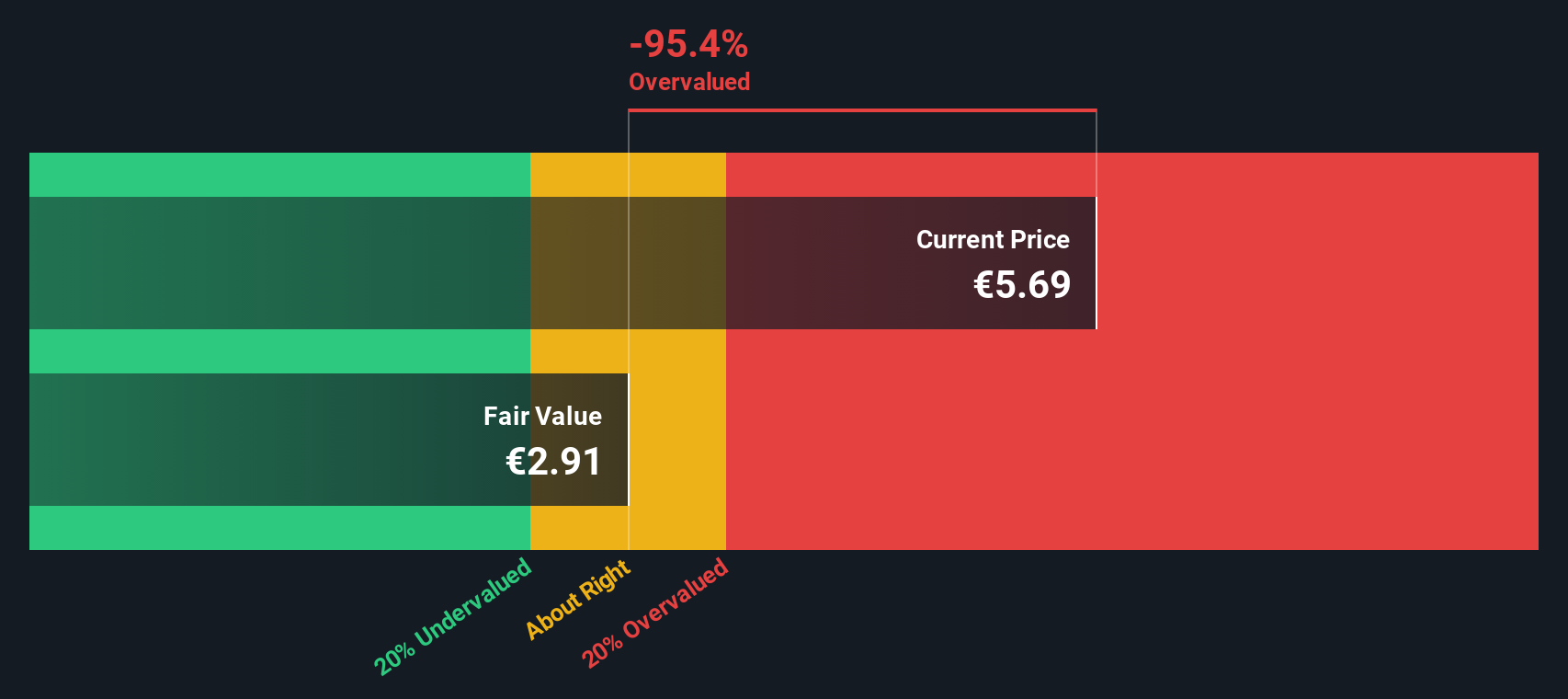

While the popular narrative sees Snam as slightly overvalued, our DCF model tells a different story. The model suggests the stock is trading well above its fair value of €2.91. This significant gap challenges the idea that Snam’s future growth is enough to support its current price. Could there be more risk looming than most expect?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Snam Narrative

If you see things differently or want to dig deeper into the numbers, you can build your own perspective in just a few minutes with Do it your way

A great starting point for your Snam research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Position yourself ahead of the crowd by tapping into fresh opportunities beyond Snam. There’s always another angle, trend, or game-changing stock just waiting to be found.

- Find growth where others miss it and explore these 883 undervalued stocks based on cash flows with strong cash flow potential and attractive valuations.

- Catch market momentum early by focusing on these 3589 penny stocks with strong financials with the potential to deliver significant returns during the next breakout.

- Enhance your strategy with access to these 27 AI penny stocks built to leverage the AI revolution across transformative industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:SRG

Snam

Engages in the operation of natural gas transport and storage infrastructure.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives