- Italy

- /

- Other Utilities

- /

- BIT:IRE

Does Iren's Strong 2024 Rally Reflect Its True Value After Latest Earnings Report?

Reviewed by Simply Wall St

If you have been weighing your options with Iren stock lately, you are certainly not alone. The past year has been quite eventful for this utility player, with its share price moving up a strong 36.9% over the last twelve months. Even just so far this year, Iren has climbed over 33%, giving shareholders reason to smile. While a quick glance at the last week and month shows smaller increases of 2.2% and 1.4% respectively, the bigger story may be the impressive 114.1% gain over three years. Such momentum suggests not just optimism in Iren’s prospects, but perhaps a shift in how the market perceives its risks and rewards.

Part of what’s fueling interest right now is wider market attention on utilities’ role in the energy transition, as well as some sector trends that favor companies with strong regional portfolios and stable cash flows. While there is always day-to-day news flow, these larger forces seem to have positioned Iren as one of the more resilient options on the market, helping to sustain its growth.

Of course, price performance alone does not tell the full story. When thinking about whether Iren is still a good buy, the real question is how its current valuation stacks up against the fundamentals. After running through six different valuation checks, Iren scores a 3 out of 6 for being undervalued, which is better than average but not a runaway bargain.

So how does Iren measure up by different valuation methods, and is there a smarter way to judge if the stock is actually undervalued? Let’s break down the valuation approaches, and at the end, I will share one perspective that could be even more telling for investors.

Iren delivered 36.9% returns over the last year. See how this stacks up to the rest of the Integrated Utilities industry.Approach 1: Iren Discounted Cash Flow (DCF) Analysis

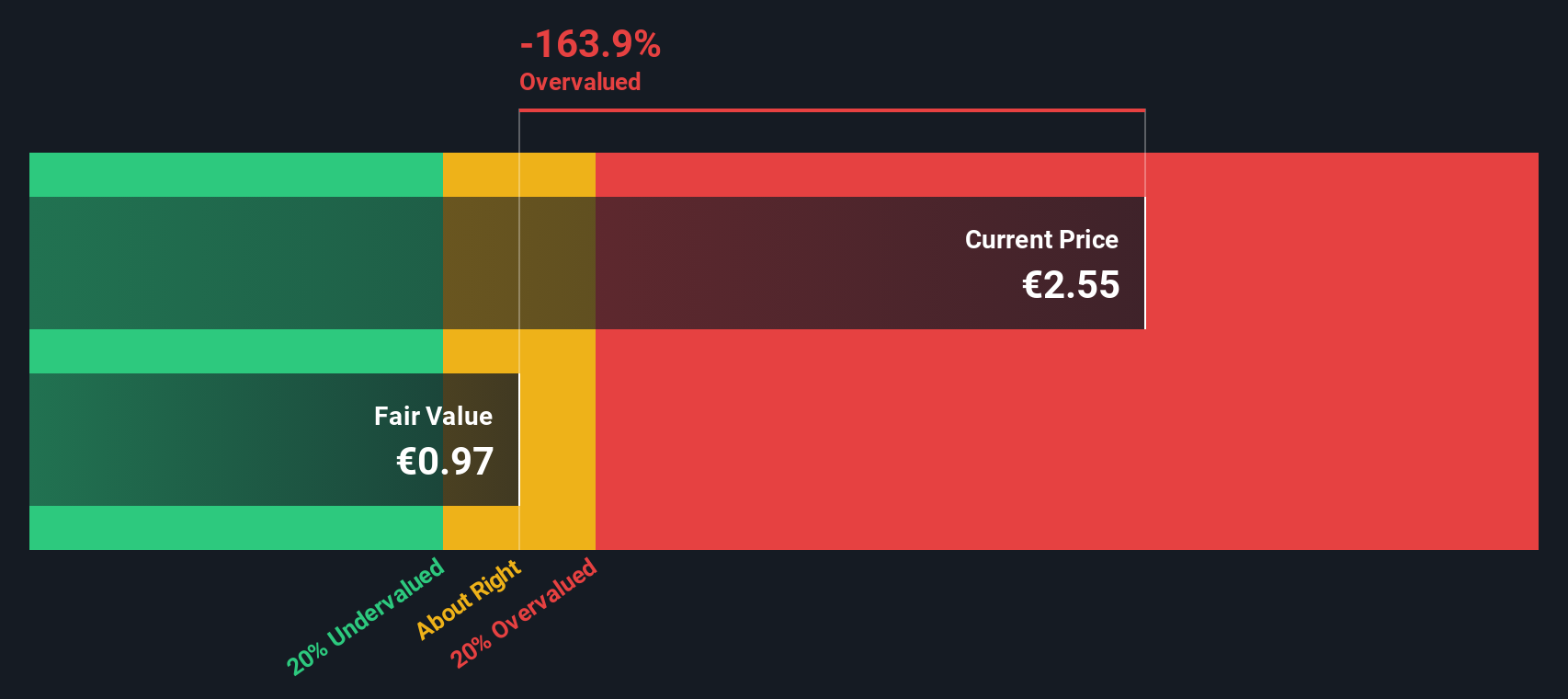

The Discounted Cash Flow (DCF) model offers a forward-looking way to value a business by estimating all future cash flows and discounting them back to today's value. In Iren's case, this relies on projected Free Cash Flow, which currently stands at €222.3 million. Analysts estimate FCF will rise to around €124 million by 2027. From there, projections are extrapolated, with estimates for 2035 suggesting FCF could reach just over €96.5 million. These later years involve more modeling assumptions than analyst forecasts.

DCF models like this provide an intrinsic value based on the sum of all projected cash flows. For Iren, the estimated fair value per share is €1.07. However, when compared to the company's current share price, this implies a discount of 144.4%. This suggests the market price is significantly higher than the DCF model indicates is justified by fundamentals.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Iren.

Approach 2: Iren Price vs Earnings (PE)

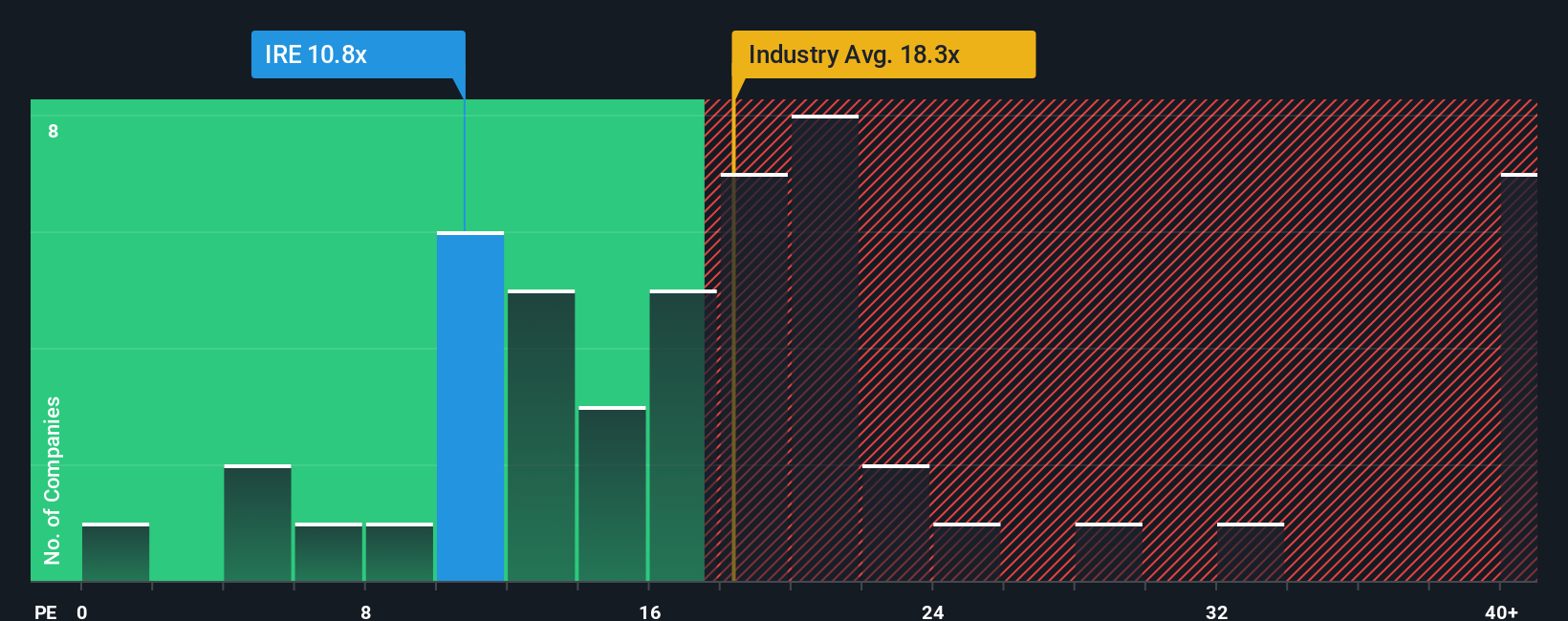

The Price-to-Earnings (PE) ratio is a widely respected way to value profitable companies like Iren, since it puts a company’s market price in direct relation to the earnings it actually generates. For established businesses in stable industries, the PE ratio helps investors compare stocks on a like-for-like basis, taking into account profitability, size, and financial stability.

However, growth expectations and risk play a big part in what counts as a “fair” PE. A company with strong growth prospects or lower risk will often justify a higher PE, while slower growth or greater uncertainty tends to pull the ratio lower. Iren’s current PE stands at 11.0x, noticeably below both its peer average of 12.95x and the broader Integrated Utilities industry average of 17.83x.

Simply Wall St adds an extra layer with the “Fair Ratio,” a proprietary metric that projects what an appropriate PE for Iren should be. This metric factors in its outlook, earnings quality, profit margins, sector, and even its market cap. This tailored approach is often more insightful than a simple peer or industry comparison, since those can ignore company-specific strength or risks. For Iren, the Fair Ratio is 13.76x. Since this is reasonably close to the current PE, the share price appears well-aligned with what investors could expect given the company’s earnings and potential.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Iren Narrative

Earlier we mentioned there is an even better way to understand a company’s true value; let’s introduce you to Narratives. A Narrative is your story behind the numbers. It’s how you combine your assumptions about Iren’s prospects (such as future revenue, earnings, and margins) with your perspective on what makes the company unique, then link these ideas directly to a financial forecast and fair value.

On Simply Wall St’s Community page, millions of investors use Narratives as an intuitive tool to map their view of a stock and instantly see if today’s price matches their expectations, helping them decide whether to buy, hold, or sell. Narratives stand out because they update dynamically as new information, such as fresh earnings reports or news, becomes available. This makes your analysis as adaptive as the market itself.

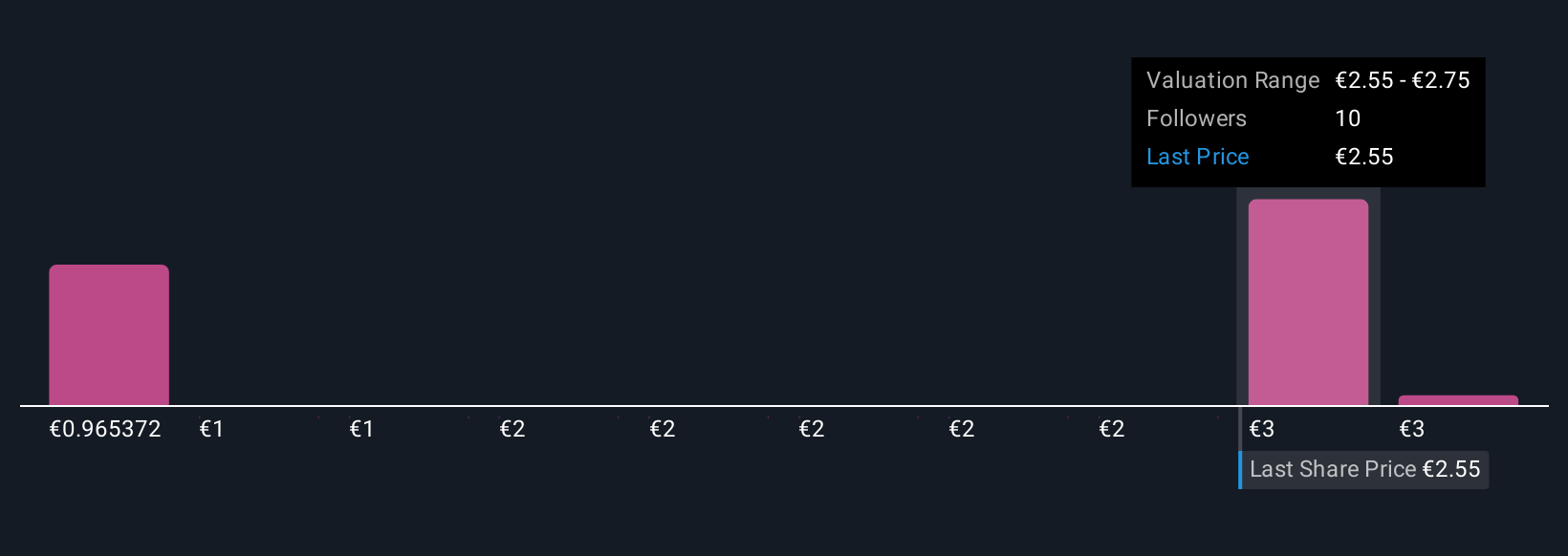

For Iren, some investors build Narratives rooted in strong infrastructure investments and renewables, arriving at a fair value above €2.90 per share, while others forecast more competitive pressures or regulatory challenges, painting a cautious story and setting fair value around €2.00. Your Narrative lets you confidently act on your own insight, which can be a smarter way to invest than simply following the crowd.

Do you think there's more to the story for Iren? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:IRE

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Community Narratives