- Italy

- /

- Other Utilities

- /

- BIT:HER

Will Hera's (BIT:HER) Strong Earnings Shift the Investment Narrative for the Utility Leader?

Reviewed by Sasha Jovanovic

- Hera S.p.A. has announced its earnings for the nine months ended September 30, 2025, reporting sales of €9.37 billion and net income of €294.7 million, both higher than a year earlier.

- This improvement in both revenue and net profit highlights Hera's ability to grow its core business even as the broader industry faces operational headwinds.

- With Hera delivering increased net income and sales, we’ll explore how this earnings performance may update its broader investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Hera Investment Narrative Recap

To invest confidently in Hera S.p.A., you need to believe in its ability to maintain steady profitability and defend its strong position in regulated networks, even as sector conditions get tougher. The most recent results show higher sales and net income, but with pressure from customer churn and a competitive retail energy market, this news has only a limited effect on the biggest near-term catalysts or risks, neither appears fundamentally altered following this update. The key focus remains on Hera’s organic growth and customer retention initiatives.

One recent announcement that stands out is Hera’s ongoing merger and acquisition activity, such as its purchase of Ambiente Energia. This ties directly to growth drivers, as M&A is a central tactic for expanding Hera’s waste management and recycling operations, which offer higher margins and align closely with the push toward more stable recurring revenue. Investors should weigh how well such transactions deliver actual synergy benefits relative to the competitive and capital-intensive environment.

On the other hand, with rising capital intensity across networks and increased operational spending, what could happen if...

Read the full narrative on Hera (it's free!)

Hera's outlook projects €13.7 billion in revenue and €508.9 million in earnings by 2028. This is based on analysts expecting a 1.0% yearly revenue decline and a modest €3.5 million increase in earnings from current earnings of €505.4 million.

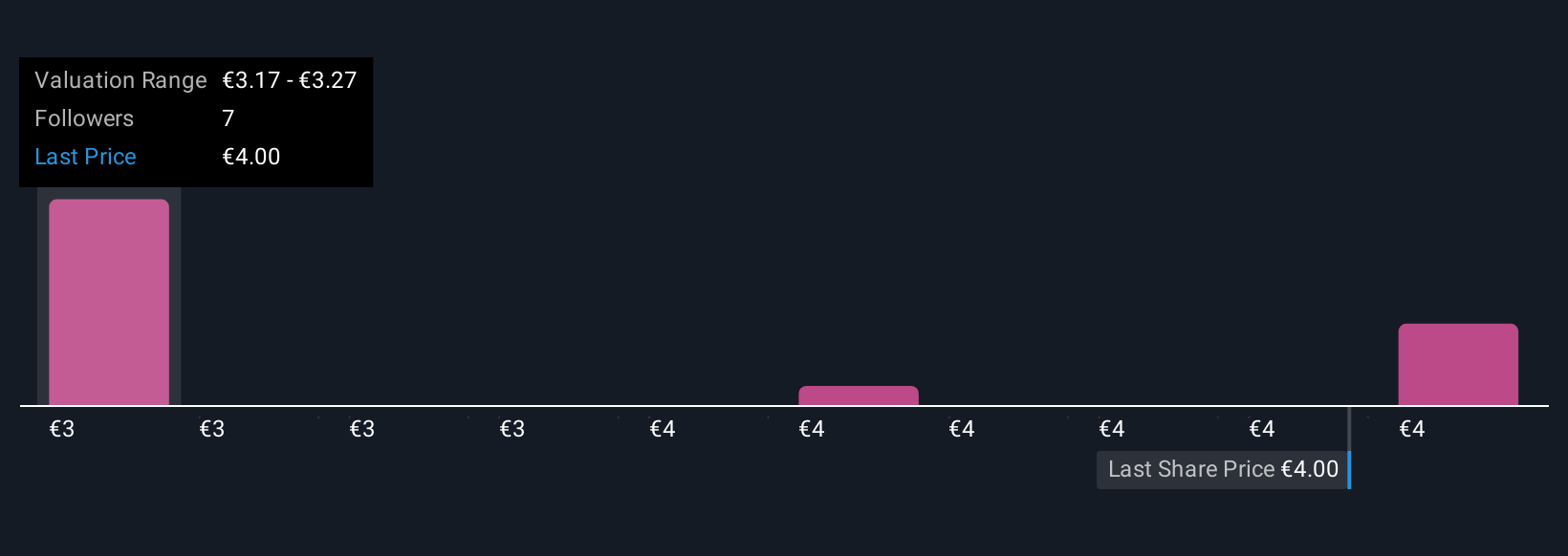

Uncover how Hera's forecasts yield a €4.12 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range widely from €3.53 to €4.13 across three unique viewpoints. Given Hera’s customer base slipped slightly last quarter, you may want to explore several perspectives on how this could impact both valuation and longer term returns.

Explore 3 other fair value estimates on Hera - why the stock might be worth as much as €4.12!

Build Your Own Hera Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hera research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hera research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hera's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:HER

Hera

A multi-utility company, engages in the waste management, water services, and energy businesses in Italy.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives