- Italy

- /

- Electric Utilities

- /

- BIT:ENEL

Should Higher Sales but Lower Profits Amid Grid Spending Matter to Enel (BIT:ENEL) Investors?

Reviewed by Sasha Jovanovic

- On November 13, 2025, Enel SpA reported earnings for the nine months ended September 30, 2025, with sales rising to €59.70 billion while net income slipped to €5.24 billion compared to the previous year.

- These results came as Enel continues strengthening its electricity infrastructure to address a rise in extreme weather events in Italy, highlighting the growing operational and infrastructure risks facing the company.

- Let's explore how Enel's increased focus on grid resilience amid more frequent extreme weather could reshape its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Enel Investment Narrative Recap

To be an Enel shareholder, you need confidence in the company's ability to translate major investments in power grid resilience and renewables into steady earnings and dividend growth, even as weather-related risks mount. The recent earnings update, with higher sales but softer net income, doesn’t materially change the current short-term catalyst: Enel’s push to modernize and protect its Italian and Spanish electricity networks. The most pressing risk remains the operational strain and costs brought by increasingly frequent extreme weather events in its core regions.

Among recent developments, Enel’s continued collaboration with the European Investment Bank to fund solar projects in Colombia provides a concrete example of how its strategy addresses both growth and resilience. These projects, designed to avoid exchange rate risks and supply clean energy, support Enel’s broader shift toward renewables, a key driver for revenue expansion amid an accelerating global energy transition and heightened climate-related pressures.

Yet, despite all the progress, investors should be aware that the increasing frequency and cost of extreme weather events could still...

Read the full narrative on Enel (it's free!)

Enel's narrative projects €88.5 billion revenue and €7.1 billion earnings by 2028. This requires 4.4% yearly revenue growth and a €1.1 billion earnings increase from €6.0 billion today.

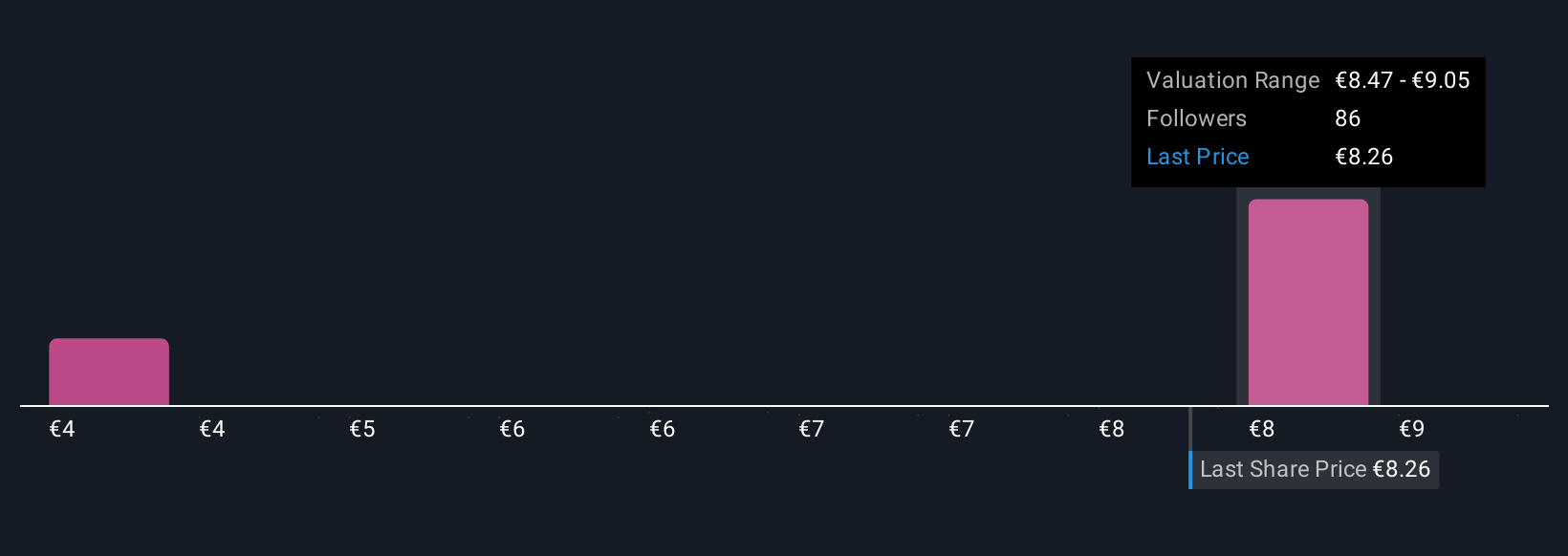

Uncover how Enel's forecasts yield a €8.49 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Thirteen members of the Simply Wall St Community estimate Enel's fair value between €3.91 and €9.63. While many focus on earnings potential from renewables, the growing operational risks from severe weather remain top of mind and can impact future returns, see how your view compares to others in the community.

Explore 13 other fair value estimates on Enel - why the stock might be worth less than half the current price!

Build Your Own Enel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enel research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Enel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enel's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENEL

Enel

Operates as an integrated operator in electricity and gas industries worldwide.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives