- Norway

- /

- Construction

- /

- OB:VEI

Three European Hidden Gems Backed By Strong Fundamentals

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index recently ended a two-week losing streak, buoyed by hopes of increased government spending despite concerns over upcoming U.S. tariffs, investors are keenly observing the mixed performance across major European stock indexes. In this environment of cautious optimism and economic uncertainty, identifying stocks with strong fundamentals becomes crucial for investors looking to navigate these turbulent waters effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 6.15% | 4.62% | 14.67% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Prim | 10.72% | 10.36% | 0.14% | ★★★★☆☆ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 410.88% | 4.14% | 7.22% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Acinque (BIT:AC5)

Simply Wall St Value Rating: ★★★★★☆

Overview: Acinque S.p.A. operates as a multi-utility company in Italy with a market cap of €424.29 million.

Operations: Acinque generates revenue primarily through its multi-utility services in Italy. The company's market capitalization stands at €424.29 million.

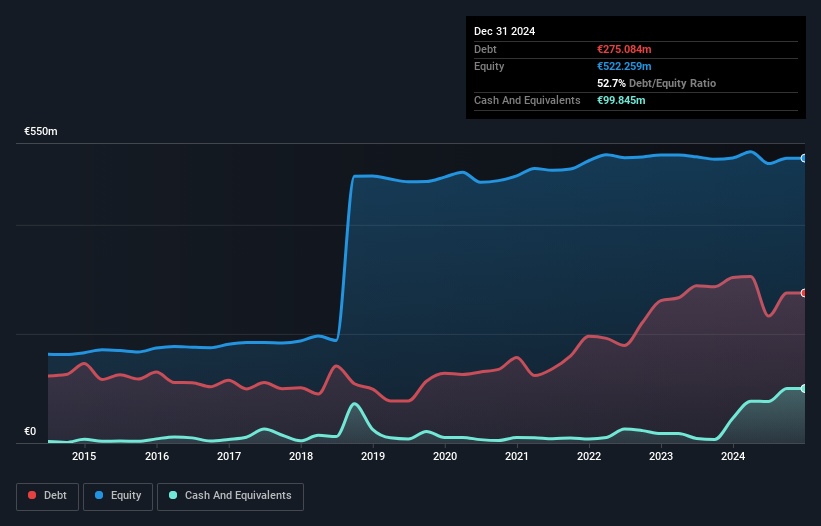

Acinque, a promising player in the gas utilities sector, has shown impressive earnings growth of 96.6% over the past year, outpacing the industry average of 4.1%. Despite this strong performance, its earnings have seen a decline of 4.9% annually over five years. The company's net debt to equity ratio stands at a satisfactory 33.6%, indicating prudent financial management amidst an increase from 26.2% to 52.7% in overall debt to equity over five years. Recent financials reveal net income surged to €21 million from €10 million last year, highlighting potential for robust future growth despite sales and revenue dips.

- Delve into the full analysis health report here for a deeper understanding of Acinque.

Examine Acinque's past performance report to understand how it has performed in the past.

NRJ Group (ENXTPA:NRG)

Simply Wall St Value Rating: ★★★★★★

Overview: NRJ Group SA is a private media company that functions as a publisher, producer, and broadcaster in France and internationally, with a market capitalization of approximately €541.79 million.

Operations: NRJ Group generates revenue primarily from its Radio segment (€243.01 million), followed by Television (€78.63 million) and Circulation (€77.62 million). The company's net profit margin is a key financial metric to consider when evaluating its profitability.

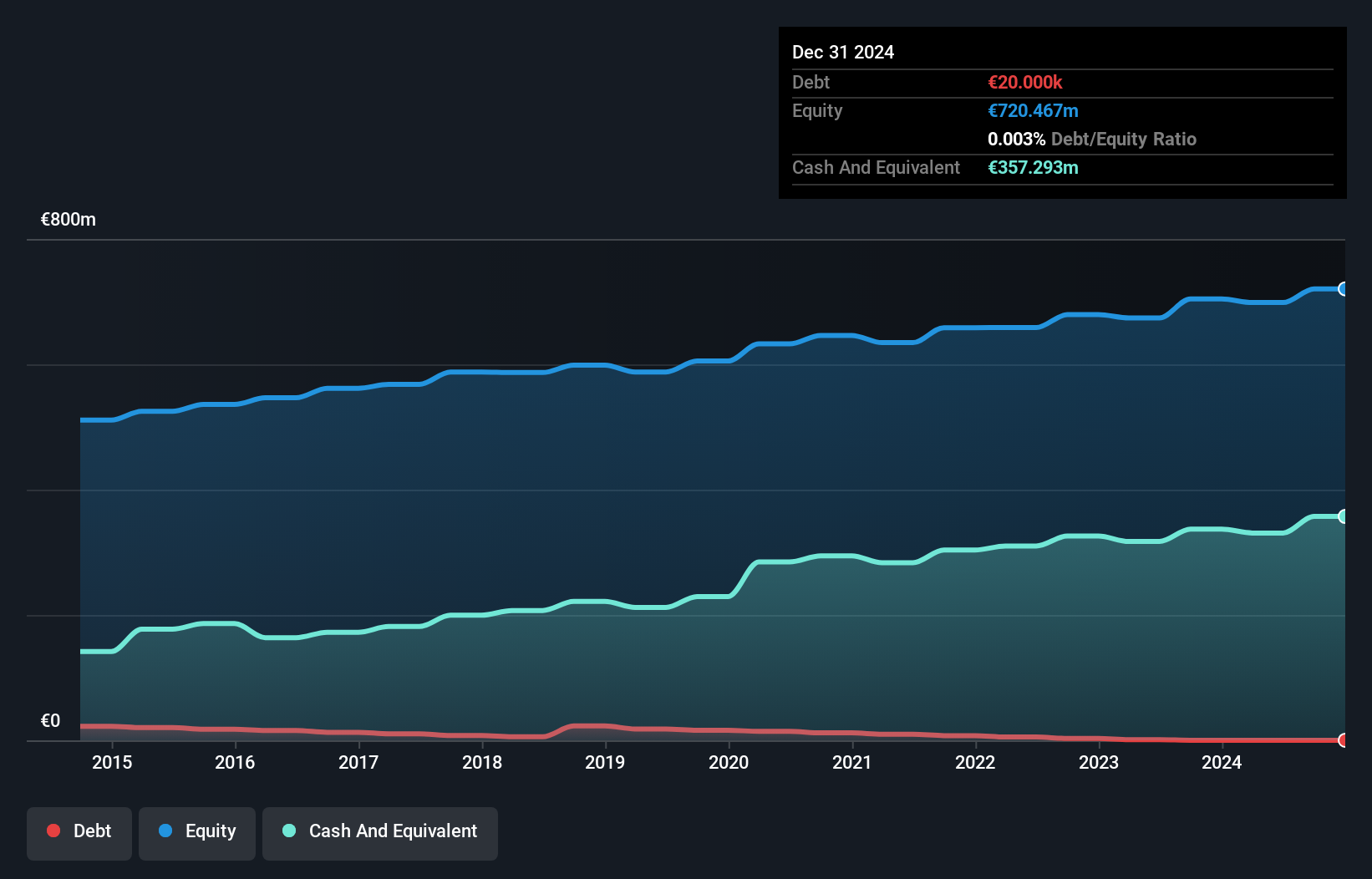

NRJ Group, a notable player in the media sector, has demonstrated impressive earnings growth of 37% over the past year, outpacing the industry's 26%. The company's debt to equity ratio has impressively dropped from 3.1% to zero over five years, indicating strong financial management. Trading at nearly 35% below its estimated fair value suggests potential for investors seeking undervalued opportunities. Despite forecasts of a 2.9% annual decline in earnings over the next three years, NRJ's high-quality earnings and positive free cash flow position it well within its industry context as a resilient entity with robust fundamentals.

- Take a closer look at NRJ Group's potential here in our health report.

Evaluate NRJ Group's historical performance by accessing our past performance report.

Veidekke (OB:VEI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Veidekke ASA is a construction and property development company operating in Norway, Sweden, and Denmark with a market capitalization of NOK 20.12 billion.

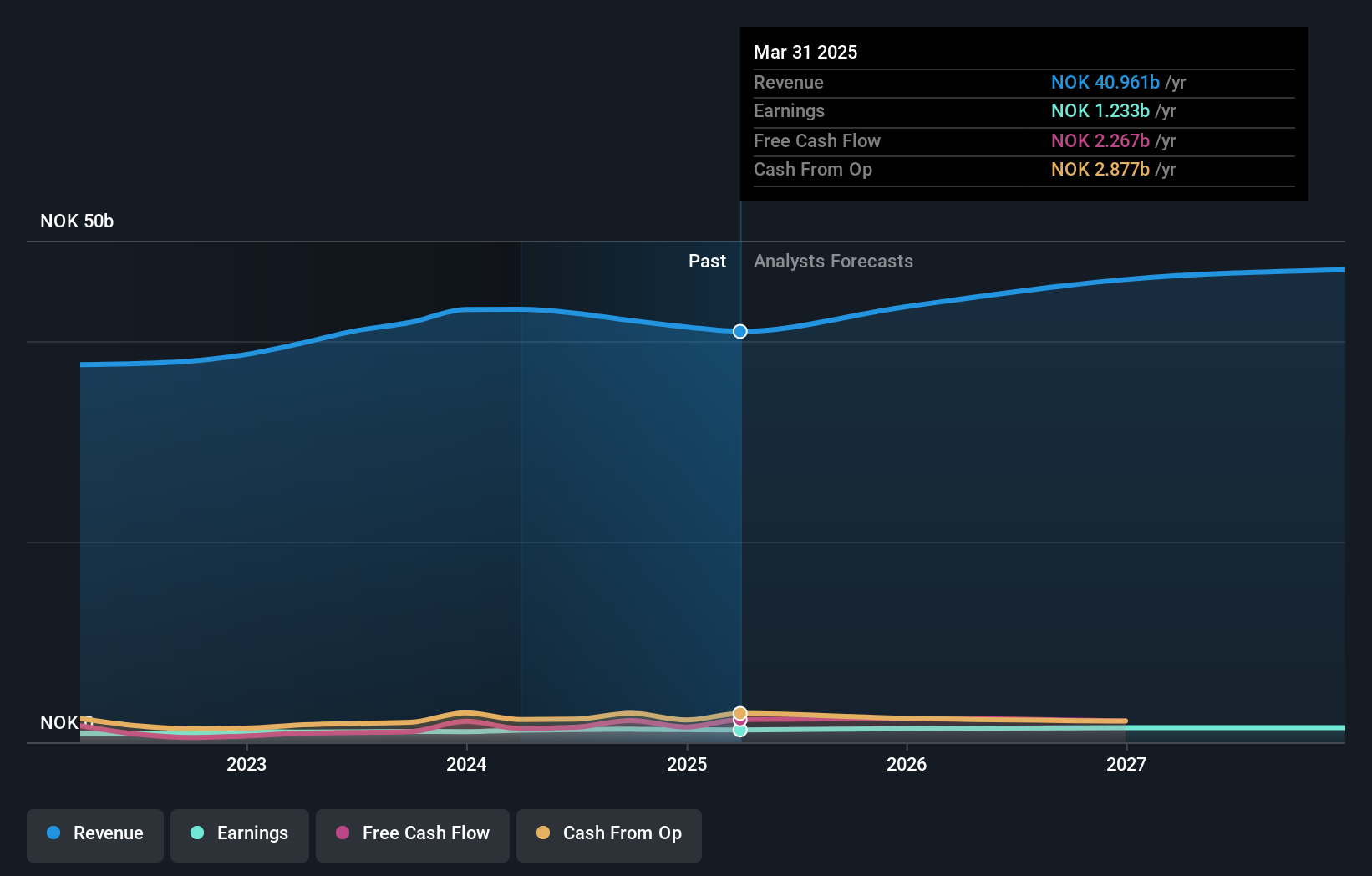

Operations: Veidekke generates revenue primarily from its Construction Norway segment (NOK 14.91 billion) and Infrastructure Norway segment (NOK 9.96 billion), with significant contributions from Construction Sweden excluding infrastructure (NOK 7.75 billion) and Infrastructure Sweden (NOK 6.17 billion). The company faces group eliminations amounting to NOK -838 million, impacting total revenue figures.

Veidekke, a notable player in the construction sector, has demonstrated robust financial health with its debt-to-equity ratio significantly reduced from 79% to 19.2% over five years. Trading at 20.5% below its estimated fair value, it presents an attractive opportunity for investors seeking undervalued stocks. The company reported earnings growth of 18.3% annually over the past five years and maintains a positive free cash flow position, reinforcing its financial stability. Recent projects include a NOK 155 million contract for apartment rehabilitation in Oslo and a SEK 843 million road project in Sweden, enhancing its order book and future revenue prospects.

- Click to explore a detailed breakdown of our findings in Veidekke's health report.

Gain insights into Veidekke's past trends and performance with our Past report.

Make It Happen

- Gain an insight into the universe of 347 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:VEI

Veidekke

Operates as a construction and property development company in Norway, Sweden, and Denmark.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026