- Italy

- /

- Gas Utilities

- /

- BIT:AC5

Exploring Three Undiscovered European Gems with Solid Foundations

Reviewed by Simply Wall St

As European markets experience a positive uptick, with the pan-European STOXX Europe 600 Index rising amid expectations of U.S. interest rate cuts, investors are keenly observing opportunities in small-cap stocks that could benefit from these broader economic trends. In this environment, identifying stocks with solid foundations—those demonstrating resilience and potential for growth—becomes crucial for navigating the evolving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Sparta | NA | -9.54% | -15.40% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Acinque (BIT:AC5)

Simply Wall St Value Rating: ★★★★★☆

Overview: Acinque S.p.A. is a multi-utility company operating in Italy with a market capitalization of €434.16 million.

Operations: Acinque S.p.A. generates its revenue through various utility services in Italy, with a focus on energy and water supply. The company's financial structure includes costs related to service delivery and infrastructure maintenance. Net profit margin trends are a key aspect of its financial performance analysis.

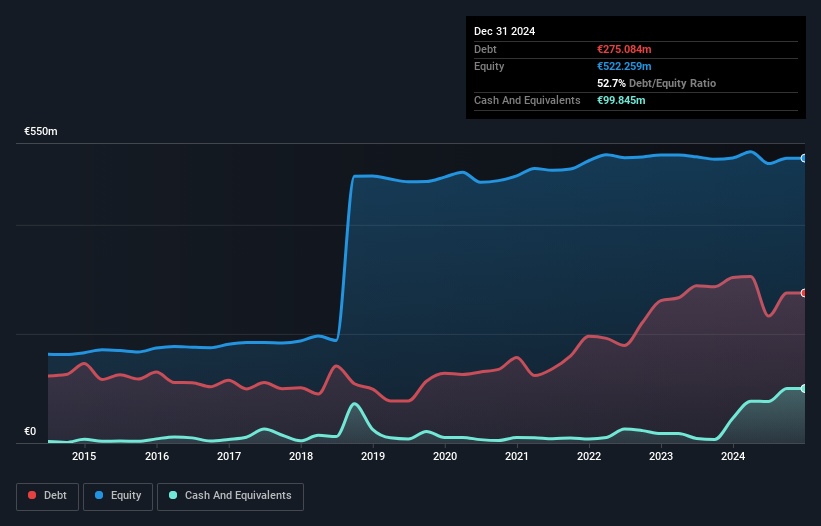

Acinque, a noteworthy player in the European market, has shown impressive growth with earnings surging 95.7% over the past year, outpacing its industry peers. Despite a challenging five-year period where earnings dipped by 9.1% annually, recent figures indicate a turnaround with sales reaching €318.36 million and net income at €15.45 million for the first half of 2025. The company's net debt to equity ratio stands at a satisfactory 32.7%, and interest payments are well covered by EBIT at 5.6 times coverage, highlighting solid financial health amidst its small cap nature.

- Navigate through the intricacies of Acinque with our comprehensive health report here.

Understand Acinque's track record by examining our Past report.

EPC Groupe (ENXTPA:EXPL)

Simply Wall St Value Rating: ★★★★★★

Overview: EPC Groupe is involved in the manufacture, storage, and distribution of explosives across Europe, Africa, Asia Pacific, and the Americas with a market cap of €423.46 million.

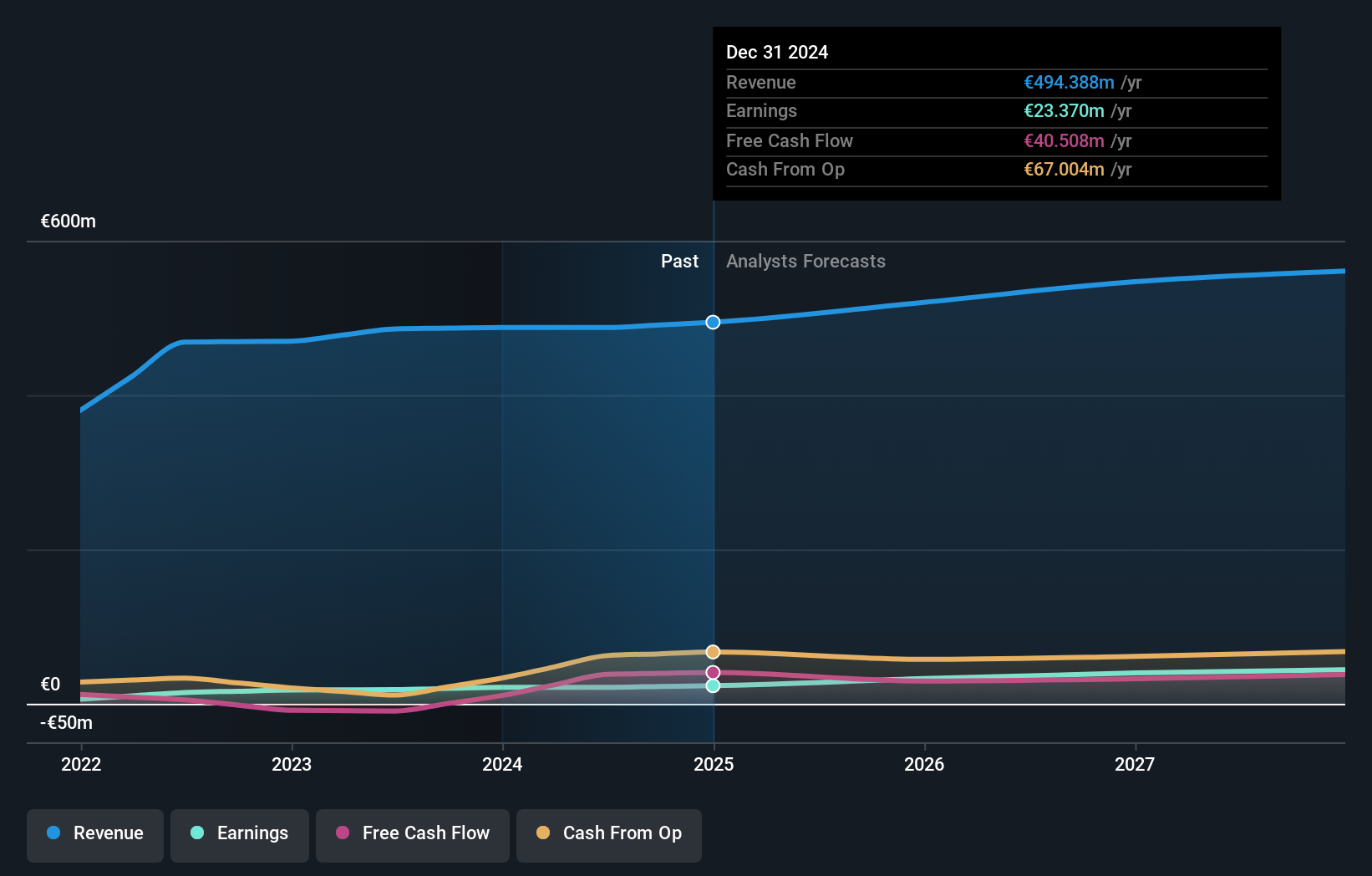

Operations: EPC Groupe generates revenue primarily from its Specialty Chemicals segment, amounting to €494.39 million. The company's operations span multiple regions, contributing to its financial performance.

EPC Groupe, a relatively small player in the chemicals sector, has shown robust financial health with earnings growing at 59.8% annually over the past five years. Despite not outpacing industry growth last year, its net debt to equity ratio of 27.7% is satisfactory and indicates prudent financial management. The company seems undervalued, trading at 37.3% below estimated fair value, which might appeal to value-focused investors. With interest payments well covered by EBIT (3.5x), EPC's high-quality earnings position it as a solid contender for those seeking stability and potential upside in the European market landscape.

- Dive into the specifics of EPC Groupe here with our thorough health report.

Evaluate EPC Groupe's historical performance by accessing our past performance report.

Huuuge (WSE:HUG)

Simply Wall St Value Rating: ★★★★★★

Overview: Huuuge, Inc. is a developer and publisher of free-to-play mobile games with operations spanning North America, Europe, the Asia Pacific, and other international markets, holding a market cap of PLN1.22 billion.

Operations: Huuuge generates revenue primarily from its online mobile games segment, which amounted to $246.24 million. The company's market cap stands at PLN1.22 billion.

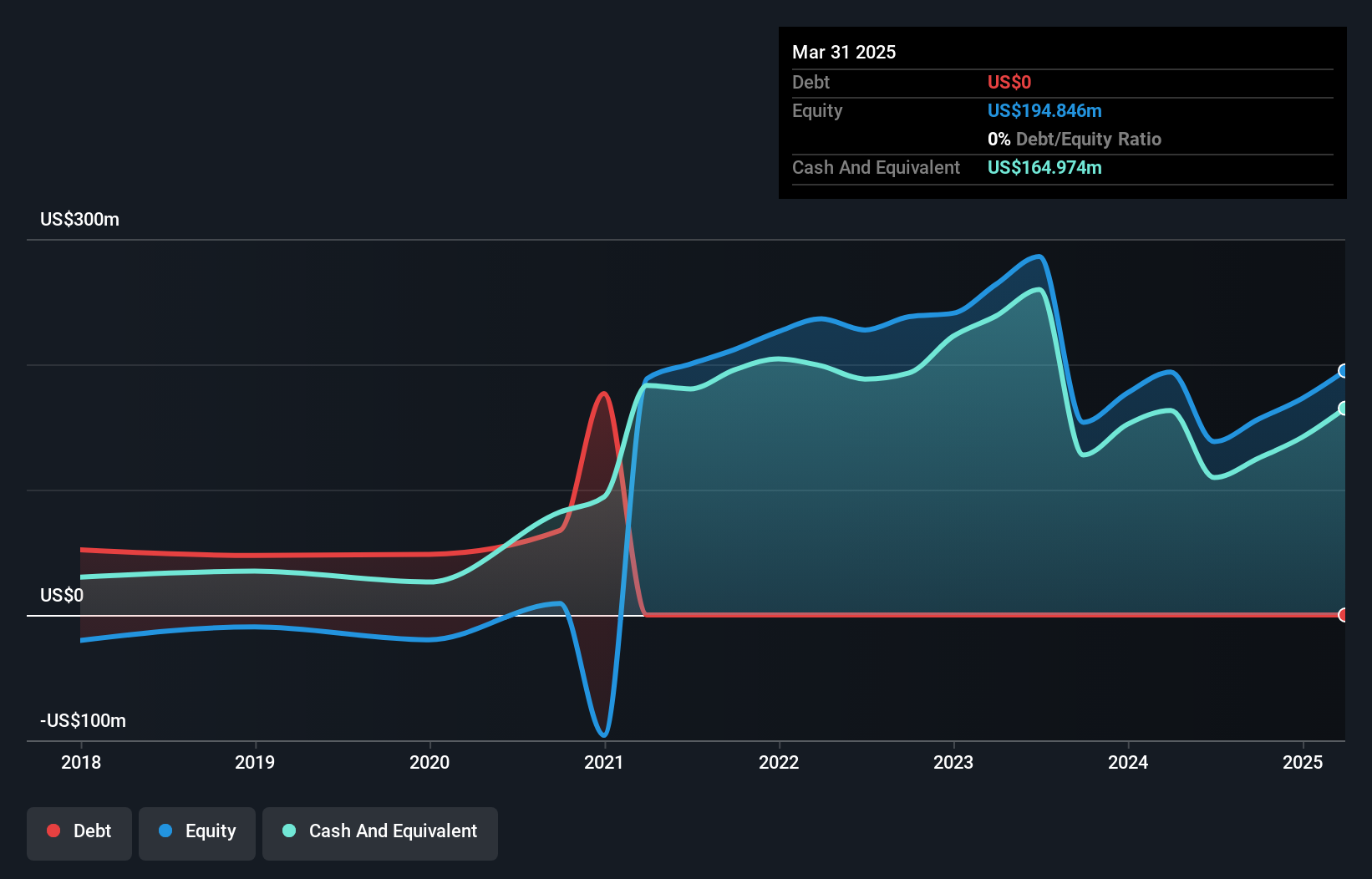

Huuuge, a unique player in the gaming sector, operates debt-free with no worries about interest payments. Despite its negative earnings growth of 10.1% last year, which lags behind the entertainment industry average of 4.1%, it boasts high-quality past earnings. The company seems to have improved its financial health over recent years, as evidenced by a levered free cash flow increase from US$11.91 million in 2019 to US$70.26 million by September 2025. Trading at an appealing value—18.2% below estimated fair value—Huuuge appears well-positioned against peers despite forecasted earnings declines averaging 16.9% annually over the next three years.

- Delve into the full analysis health report here for a deeper understanding of Huuuge.

Review our historical performance report to gain insights into Huuuge's's past performance.

Where To Now?

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 332 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:AC5

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives