- Italy

- /

- Infrastructure

- /

- BIT:ENAV

Is ENAV Stock Still Attractive After Recent 6.6% Year-to-Date Rally?

Reviewed by Simply Wall St

If you have been keeping an eye on ENAV and wondering whether now is the right moment to make a move, you are not alone. The company's performance has been quietly impressive, with shares up 6.6% year-to-date and delivering a solid 19.2% gain over the past year. Few stocks can boast a 57.0% total return over five years, and ENAV’s upward trajectory suggests it has managed to earn investor confidence amid evolving industry conditions.

What is driving these moves? Market sentiment around infrastructure investments and air traffic management is definitely playing a role, with global travel slowly returning to normal and long-term modernization projects continuing apace. ENAV’s role at the heart of Italy’s air navigation system puts it in a unique position to benefit as travel activity picks up and the demand for efficient flight management technology grows.

But you are here for the numbers, and when it comes to valuation, ENAV stands out from the crowd in a particular way. Out of six commonly used valuation checks, the company is considered undervalued in just one. It is a mixed picture, and it means we need to dig deeper to understand what might justify this market optimism.

So, how do these valuation approaches stack up for ENAV, and what should you really be focusing on? Let’s break down the numbers and see which methods matter most. Stay tuned, because at the end, I’ll share a smarter lens you can use to judge the stock’s potential.

ENAV scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: ENAV Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This method helps investors judge whether a stock price reflects its true, long-term earning potential.

For ENAV, the current Free Cash Flow stands at €193.5 Million. Analyst estimates cover the next five years, with future projections indicating a Free Cash Flow of €177 Million by 2029. Beyond 2029, Simply Wall St extrapolates cash flow forecasts out to 2035, showing a generally steady trend as the company matures.

According to this two-stage Free Cash Flow to Equity model, the resulting estimated intrinsic value of ENAV shares is €3.13. This is compared with the current trading price and suggests ENAV is trading at a 40.6% premium over its fair value based on forecasted cash flows.

In simple terms, the DCF analysis suggests the stock’s market price is significantly above what these cash flow projections would support.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for ENAV.

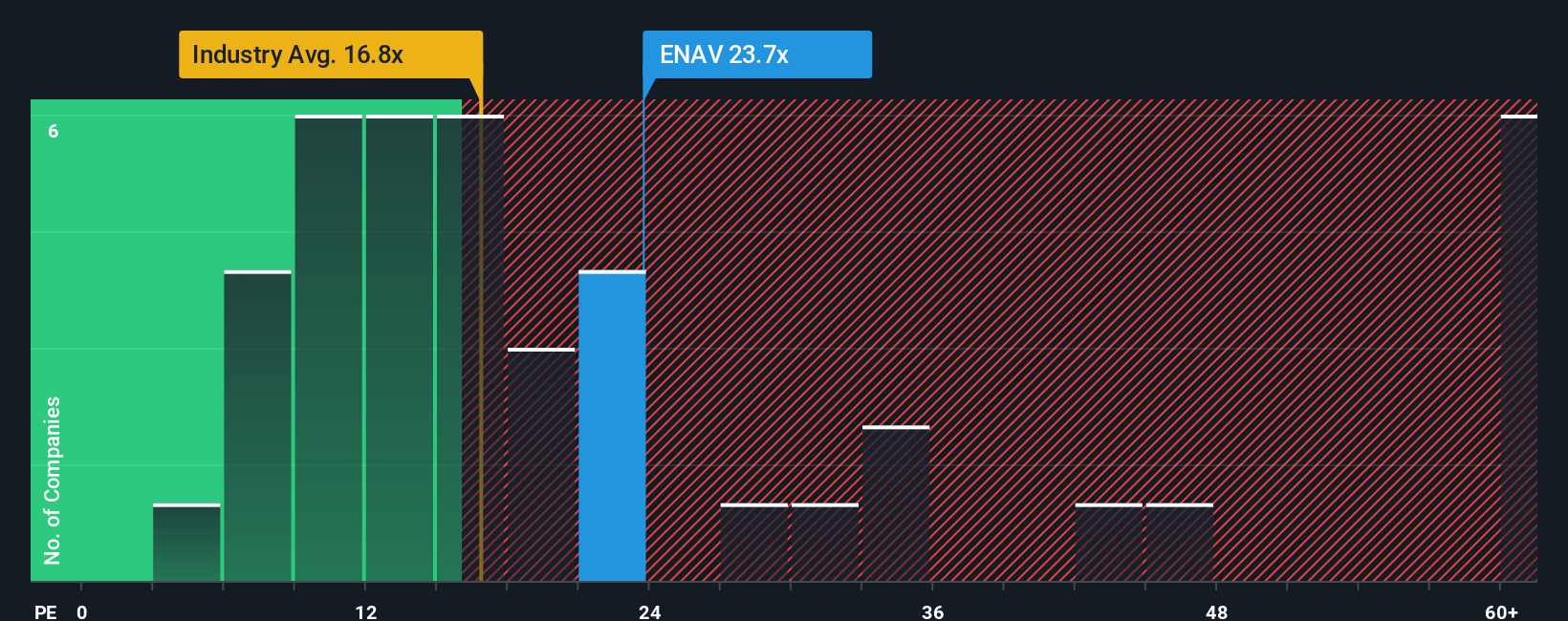

Approach 2: ENAV Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used by investors to value established, profitable companies like ENAV. It provides a simple way to gauge how the market values each euro of the company’s earnings, making it a popular yardstick for stock comparisons within the same sector.

Typically, what constitutes a "fair" PE ratio depends on expectations for growth and the riskiness of future earnings. Companies with higher anticipated growth or lower risk generally deserve a higher PE multiple, while those facing uncertainty or slower growth warrant a lower one.

Today, ENAV trades at a PE ratio of 21.7x. For comparison, the average for its industry is 15.1x, and its peers are priced even higher at 29.9x. While this puts ENAV above the industry average, it remains below many comparable companies.

Instead of relying solely on broad benchmarks, the "Fair Ratio" developed by Simply Wall St incorporates more specific variables such as ENAV’s earnings growth prospects, margins, risk factors, and company size. This makes it a more tailored and practical estimate of a company’s warranted multiple compared to simple peer or industry averages.

ENAV’s Fair Ratio is calculated to be 19.9x. Since its current PE is only slightly above this, the stock appears to be priced just about right according to this balanced view.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your ENAV Narrative

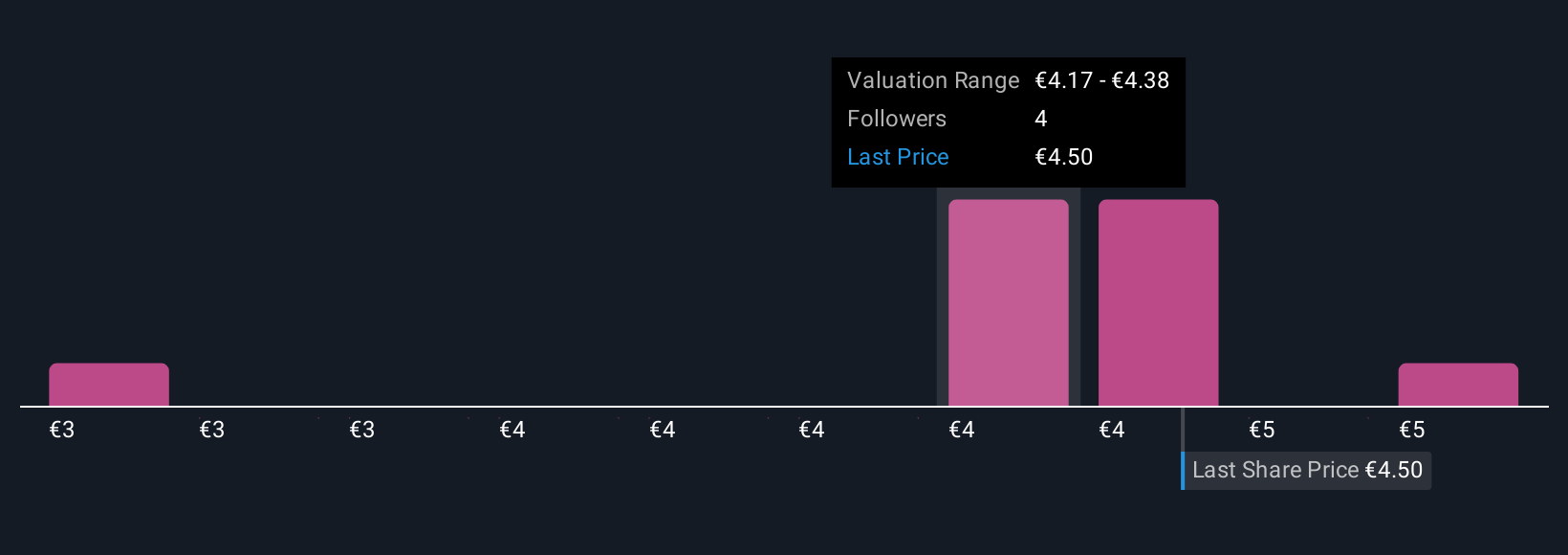

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or point of view about a company, combining your financial forecasts and fair value assumptions with your outlook on its future revenue, earnings, and margins.

Narratives let you connect the story you believe about ENAV with numbers, so you can see how your expectations translate to a fair value, right alongside the current share price. On Simply Wall St's Community page, millions of investors already use Narratives to bring their investment thinking to life, and you can create or explore them with just a few clicks.

This approach helps you decide when to buy or sell by making your assumptions and upside or downside crystal clear, and ensures your view stays up to date as new news or earnings reports are published. For example, looking at ENAV, some investors see robust air traffic recovery driving a fair value of €4.90 per share, while others, concerned about regulatory risks, see a more conservative value of €3.60.

Do you think there's more to the story for ENAV? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ENAV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENAV

ENAV

Provides air traffic control and management, and other air navigation services in Italy, the rest of Europe, and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives